Growing up in an upper-class family with immigrant parents, I’ve been fortunate enough to get to know successful people from all walks of life that came from nothing and rose to the top.

Out of this bunch, there are always going to be bad apples including entitled selfish kids that haven’t worked a day in their lives. Yet just because someone was born into wealth, doesn’t mean you can’t learn something from them, especially if their parents were the ones who manifested the fortune.

My family migrated from Poland in the early 80s. They worked their way up with 1 suitcase, went to college in the states and eventually landed top jobs on Wall Street and in tech. No one handed them their roles on a silver platter. They created their luck, wealth and opportunity by outworking 99% of people doing what no one else did which included investing at the peak of the market and downturn of the dot-com bubble and in 08 and 09 when everyone else was selling, invested in themselves, learned 3+ languages to stand out, saved 80%+ of their income, showed up no matter, prioritized networking, and slowly but surely learned what it takes to become well-off in the wealthiest country.

Everyone has their own definition of what it means to be wealthy. Prestige and praise is killing us. As Americans we focus on the glitz and the glamour instead of on impact and value. I find many people despise the wealthy simply due to the challenges they’ve overcome while the rest have been beaten down by them. You could hate me simply for growing up with this lifestyle or soon find out once you get to know me, that I choose to work as hard as my parents starting at age 13 and I’m the most down to earth frugal 20 yr old college student. No one knows the full story so if you have nothing nice to say, don’t say it. Anyone can accomplish anything especially since 90% of millionaires+ are self-made. No special IQ or talent needed. Just consistency and focus which most procrastinators can’t handle.

Yes, you can be angry at the ultra-wealthy as I partially am, for not paying their fair share in taxes but just because they’re in the top 1% doesn’t make them bad guys. They can spend their fortune however they like, although it’s recommended to follow Mackenzie Scott’s footsteps donating a couple billion each month to noble causes.

I believe success is created when opportunity meets luck. You can’t time nor predict it so the best chances at growing luck is by becoming more comfortable with change, something immigrants have become accustomed to as part of their blood.

I know countless families who came from the Netherlands to Africa with nothing who are better off than Americans who’ve lived here for generations. Immigrants have this unique unwavering commitment and dedication. They are able to endure a heck of a lot. No wonder why a majority of small businesses in this country were founded by immigrants.

Happiness Scale

Believe it or not, after a certain income, $75k, your happiness starts to plateau.

Why?

Because humans adapt quick and our needs always change. We ride a hedonic treadmill. We buy that Rolex and are elated, then eventually get used to it and want that Lambo, etc. We aren’t even made to stay in the same house for over 8 years! That explains why most people loose not earn more cash flow on their house overtime. We will never have everything and with the ubiquity of the media, we feel compelled to have more and more everyday with never enough.

Yet the real gems in life are the ones that are free. Family, health, true peace, happiness, fulfillment and mental sanity. Surprisingly, the rich value the simple things more than anything because they’ve witnessed in their glory days earning their first six-figure paycheck what money can really provide. It can heal or destroy you. Literally. After you consult with your $1k per hour therapist or follow that green juice cleanse for $500 a day, money cannot reverse your health all that much.

The hard work starts within.

Before we get into what my 4 pals invest in, let’s understand the tricks of the trade and how they actually got there. Your life is a sum of habits and after all, if you want to be rich, might as well follow in their footsteps.

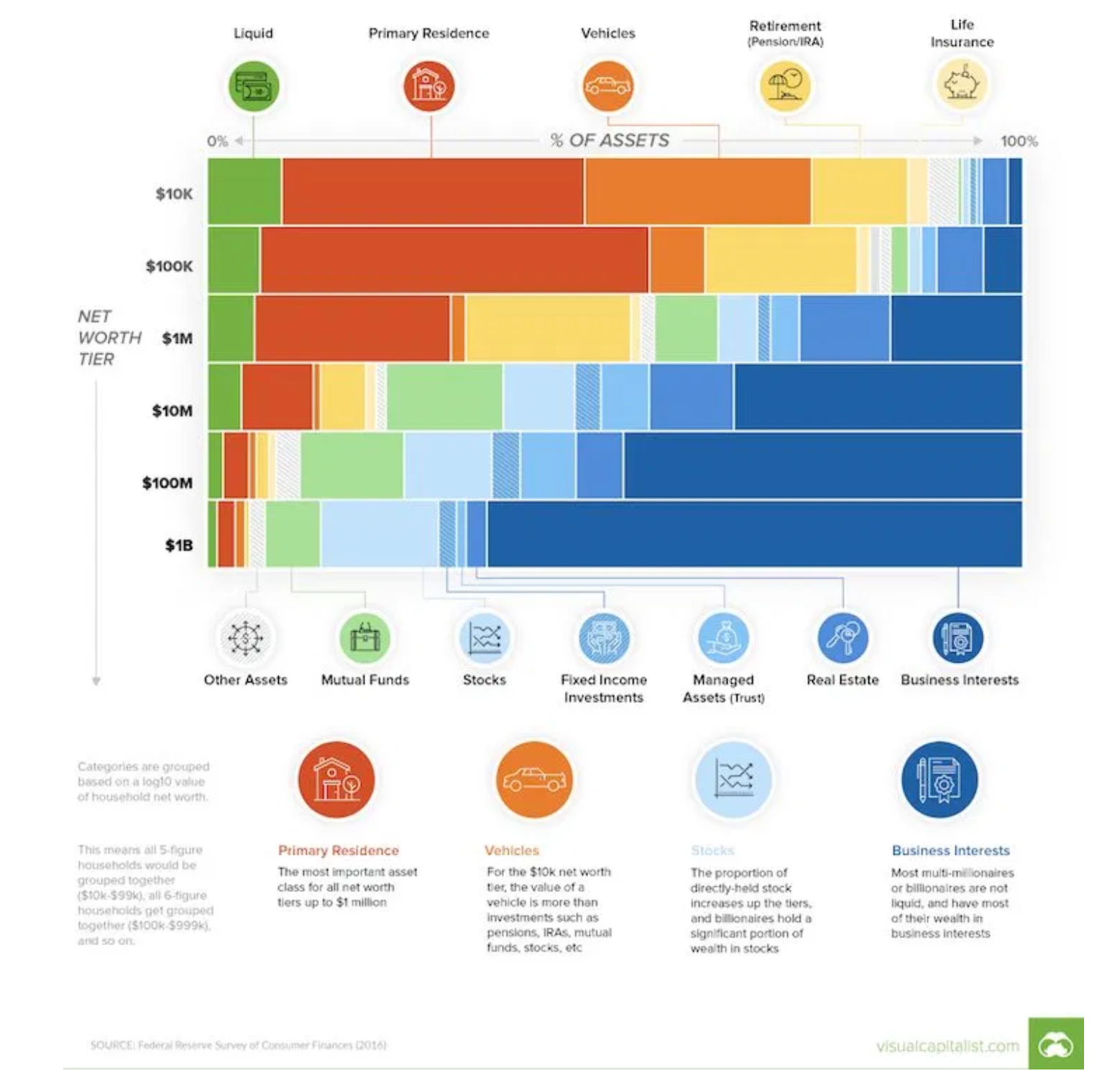

Net Worth Composition By Wealth

Your net worth composition will most likely change the wealthier you get which typically tends to appreciate overtime. You’re much less likelier to be worth more as a 20 year old than as a 60 year old due to the staggering time difference. More time = more money since time = money.

Baby boomers (56–74 yrs) hoard and are worth the most at $59.4 trillion ahead of the Silent Generation & Older at $18.8 trillion, Generation X at $38.6 trillion and last but not least, Millennials at $5.0 trillion who’ve endured the most hardship growing up during the Dot-com crash, Great Recession of ’08 and dealt with enduring the real world out of college in 2020. They’ve had the worst luck due to their age, took on too much risk and the world didn’t work out in their favor since birth. Luckily, life moves on and there’s no pay-wall for this superb financial literacy content.

Your net worth composition should look nothing like it did 20, 30 years ago. You should be reallocating conservatively every few years to keep check with your finances. Check out how often you should reallocate and why it’s over-suggested.

For a view on how wealth compounds overtime, take a look at how the red (primary residence) quickly shrinks the wealthier you get while blue (business interests) quickly grows. No wonder the richest billionaires didn’t pay any taxes! Their stake in their primary residence is little to none and majority of their income is from investment to passive income sources. The key to wealth isn’t working for someone because then there’s a ceiling and burden of taxes. Rather, creating something of your own through intellectual property or by taking a significant share/equity stake in your husband’s ex-business, cough cough Amazon will put you on the ultimate path to no financial insecurity again. Unless you spend it of course…

Learning From The Greats

Over the years, I’ve become quite curious on how my neighbors to colleagues and older friends have amassed a great fortune. They are the most humble down to earth people on the world but when it comes to asking them about the markets, their stock holdings, properties, licenses, and the work they do, you know they are worth a lot.

One of my friends’ grandfather built one of the great consumer staple product brands in the world. Hint hint, the products were used throughout the pandemic and now there’s an excess in supply of them. You would assume my friend (age 22) doesn’t have to work a day in his life with this massive fortune yet it’s the complete opposite.

He has to carry on the family legacy, follow in his family’s footsteps dating back generations, go to the same school as his great great grandfather, get stellar grades, play a certain sport in college and essentially become a replica of his father to make sure the business doesn’t die down on his shoulders.

What a stressor coming from one of the richest grandkids in America! The grass isn’t always greener on the other side after all!

As a result, for all the kids out there, start paying attention to what you do have, not what you don’t have!

I hope my friend helps you realize how grateful you should be. I wouldn’t want all that stress since birth! Lower expectations = always higher results!

Along with my friend, I asked 3 of my closest colleagues/neighbors what their portfolios are up to and how they are investing during this strange frothy time.

For some background, I haven’t snooped around at their financial statements nor tax returns. I’ve gathered these net worth estimations from what they’ve built, online research about their companies/holdings and compared it what their primary residence could be worth today on handy dandy Zillow.

Before we get into their strategies which I know you are dying to read about and FYI are more boring than you may think, let’s identify the composition of a high net worth client’s portfolio and what these folks focus on.

Primary Residence

The wealthier you get, the less stake your primary residence has in your overall net worth. That might not be the case for real estate as a whole though. It’s typically the second largest asset class behind investments for most millionaires and counting.

It’s no use just owning 1 property when you can own several, rent them out and earn passive residual income. Most of my colleagues that reside in New York rent luxury and buy utility. Since they are moving constantly, meeting new clients, setting up different shops and networking across the globe, they have no time for the upkeep, renovation, brokerages, closing fees and all the hassle of a tangible physical home.

Although renting is -100% return and 99% of millionaires + don’t rent their primary residence, it’s not a bad move if you believe you won’t stay in the same place for more than 5 years. With a majority of American’s net worth tied up in their primary residence for capital appreciation and a sizable equity stake, it makes sense as its a great inflation hedge and real estate lags the stock market, but when you hit the six figure mark, the primary residence doesn’t take up a large percentage of net worth. As a result, it is roughly 10–30% of the top 10%’s net worth.

Life Insurance

Those who got evicted, lost their jobs, had high exposure and risk to Covid working minimum wage as essential warehouse and caregivers struggled the most during the pandemic to keep ends meet because of their lack of preparation and focus beforehand.

The skill that you must master to beat out your competition and live like no on else is to prepare for the worst, hope for the best. Having grown up in an immigrant family learning about my parent’s past experience moving to the states and having to save diligently and take calculated risks, they’ve become risk averse and it has helped them the most.

Surprisingly, the higher net worth you have, the more you save. Cash is your friend, especially in an emergency because what typically happens during a recession is that when 1 income source flops, the rest follow.

You have to be realistically pessimistic and know what to expect in the future. It can’t always go your way and no job is irreplaceable so set up that emergency savings account with 6–12 moths of emergency cash in it, read here what that entails and as much as you don’t want to think about it, plan your after-life wishes and death to help your beneficiaries out. No one has a crystal ball but we all have our resources in the present to help us.

Life insurance is one of the designated asset classes of the rich for a reason (look above). It’s the most vital source of financial security. Life insurance is a contract between an insurer and insurance company to provide death benefits to your family when you pass. Immediately when you start having kids, have dependents and get married sharing an income, it’s imperative to set up a life insurance benefit.

Yes, you must pay a premium and coverage every month but at the end of your life, you’ll get that all back and more since it’s invested. The healthier and younger you are, the cheaper it is. Once you start smoking and ailments, your costs incrementally go up as the insurance company predicts you will live shorter and they will get their money back faster.

Vehicles

Vehicles are pure money down the drain and those who look rich, typically aren’t. That’s why a majority of the top 10%+ are harder to spot these days. They are the most down to earth Silicon Valley entrepreneurs WFHomers wearing hoodies driving Hondas. The only way to really tell how much someone is worth is by where they live.

They have no one to impress except themselves. Living the stealth wealth frugal minimalist lifestyle will set yourself apart in many ways and save your relationships to bank account. People won’t think you’re so entitled and narcissistic either. Vehicles are a true net worth killer and hassle although for some reason Americans are obsessed with the desire for prestige. 80%+ of car owners cannot even afford their car full in cash. That entails a majority of us on the road have gone into debt to simply impress people. Shame on you.

I would suggest never to spend more than 5–10% of your net worth on a car or you’re toast especially as it already depreciates the moment you drive it off the lot.

Retirement (401k, IRA, Roth IRA, SEP IRA, Pension)

Retirement is the most expensive and stressful period of your life. Since the wealthy know that history repeats itself and recessions happen every 8–10 years, they not only plan for the worst and hope for the best, they make it mandatory to sit down and comfortably discuss finances as a family and their future. Worst case scenarios and plans must come up which include the discussion on life insurance and an annuity. They plan for old age and are proud of it.

If you work for an employer, set up your qualified retirement plan ASAP. This includes a 401k or pension (IRA) ASAP and do a dollar for dollar match. Working for a company offers immense benefits from PTO, mat/paternity leave to sabbaticals and most importantly, a qualified retirement plan where a portion of your earnings gets directly invested into your retirement account and you cannot touch it until you hit 59 1/2.

There are contribution limits but contribute as much as you can because inflation is only going up and should be invested not spent. These are tax-deferred accounts where contributions can tax deducted but withdrawals after age 59 ½ are regularly taxed at the income tax rate.

Your retirement plan has to be a sizable amount of your net worth. No wonder the rich also save a lot. They don’t spend much because their earnings get directly reinvested back into the market and never touch it compared to the lower to middle class where a majority of their income is taxed at the regressive rate, then eventually allocated to retirement and by that time, they need to spend it on necessities. To break out of that cycle of barely breaking even, set up various income sources, a Roth IRA to take advantage of compounding and let your money grow for you in the market to alternatives.

Securities (stocks, fixed income)

Surprisingly, mutual funds have the largest weighting for those with a $10m+ net worth level. Mutual funds are actively traded funds with high fees, possible lock-up period specifically when dealing with hedge funds, require larger contributions-min threshold, are less liquid and riskier but tend to generate higher returns with more risk exposure. High net-worth clients are prime targets for hedge funds as accredited investors yet they are also relatively risk adverse especially as they frequently consider the unknown future and have at least 70% of their net worth invested passively in index funds to ETFs, rarely in individual socks.

From cyclicals to growth stocks have only increased overtime as the indexes always go up overtime. The rich not only invest in boring stocks but also lucrative stock options and convertible bonds to convert into issued shares of stock.

Fixed Income are debt securities such as bonds and loans that don’t offer stellar returns compared to stocks since they are less volatile and have set matures but are often the most secure investments. Nothing beats the security of US Government bonds and treasury securities that the Fed has been buying through their quantitative easing policies to pump stimulus into the economy If you’re looking to hedge inflation, get into TIPS, commodities (although the wealthy tend to oppose forwards and futures for the most part) and gold as an inflation hedge.

Real Estate

Portfolio and passive income make up a majority of high net worth clients assets according to various brokerages and my own sources. However, real estate drops as wealth increases as the rich dive into more speculative alternative investments as they’re all allured by scarcity.

Alternative investments include artwork, real estate, crypto, crowdfunding (not having to deal with tenants to physical real estate) and farmland which coincidentally Bill Gates is the largest independent land owner of in the U.S. . After a net worth of 10m+, real estate isn’t as attractive since it requires upfront costs, a lot of time spent with tenants, and pure hassle.

Business Interests

The largest category for the top 10%+ is the meat of their wealth. This includes franchises, S-corps, C-corps, partnerships, sole proprietorships, you name it that the wealthy spend most of their time on since their business is their baby after all!

Any business that is loosing or gaining money already offers massive tax breaks as you can deduct your expenses on your income, earn passive income through, generate royalties and get a lot of perks that working for an employer can’t provide.

If you don’t have the guts or time, which is never a legit excuse to start a business, working for a hot lucky startup for a consecutive period of time can possible give you an opportunity to become an executive and earn a juicy compensation package down the road.

To be worth $10m or more you have to usually own something and provide value to people through that service.

If you weren’t able to land the coveted seat of an executive, you can also take advantage of stock ownership and options at your company. There can only be so many executives so the chances are relatively slim, roughly 5–10% to be exact. With stock options, you can sell your stock after the company goes public or acquired and they can be worth a lot! You don’t have to build the next Amazon you can simply build the new Boiled Not Fried which you can realistically live off of earning $200k a year with only 5 hours per week doing something you love!

What The Rich Spend On

One of the best ways to get rich is to figure out what rich people are doing with their money. It’s not copying, it’s learning.

Without further or due, let’s see what my pals are up to:

Family Friend #1 (Net Worth ~$70M, 54): “I’ve been focusing on investing in emerging markets. The U.S. seems overheated and I can’t wrap my head around most valuations. ADS have been on my mind as they’ve yielded steady returns and act as an inflation hedge. I finally paid off all mortgages on the 5 commercial properties which relives the massive debt burden on my shoulders. At this stage, I’m serious about enjoying life again. Looking forward to taking the kids to a national park close to Fourth of July when business becomes more stable again.”

Colleague #2 (Net Worth ~$40M, 37): “Finally was able to snag a great deal on a property by the beach in Greenwich. My wife and I can enjoy ourselves a bit more now after being stuck on Park Ave for the past 15 months. I’m looking into illiquid assets uncorrelated to the market which should generate decent cash flow. Nothing crazy for now.”

Former Neighbor #3 (Family Net Worth ~$700–1b+, my friend’s inheritance ~ $300m, 22): “Yale’ endowment strategy including uncorrelated physical assets and alternatives seems appealing considering it had returned an average 9% per year between June 2006 -2016 so fingers crossed it will continue on this run. Private equity and VC has been on my mind for quite some time now. I’m always looking to add as much diversification as possible.”

Family Friend #4 (Net Worth ~$90M, 72):

“Considering I spent more than expected on renovations for all six properties, I’m sitting low on more cash than usual. I know I’ll need to reallocate eventually — most likely into fixed-income in the next few weeks to adjust for the Fed’s possible tapering and market’s response. Sticking with real estate for the long term. I don’t see any possible housing bubble in sight. I need to make tax-conscious investment choices with almost half of my net worth invested in tangible assets at this point.”

The Rich Are Free

The biggest takeaway I got from my generous network was that they are all trying to enjoy the fruits of their living and make sure that none of their eggs are in 1 basket. They are optimistic about the future but always reasonable and extremely frugal despite their enormous wealth.

If I went to lunch at McDonalds wth all these folks, you wouldn’t be able to notice which one was wealthier because they have an incredibly high amount of self-esteem, humbleness, positivity and aren’t selfish one bit.

They don’t pay attention to their image, they focus on what value and impact they can provide through their businesses, how to make people feel good and have a lasting impression. Yes, first impressions matter and you don’t want to be dressed like a skateboarder, but living under your means not attempting to impress anyone will hep you in life big time.

Properties, alternative investments, hedges such as crypto to gold and just enjoying normal life is on their mind. What’s interesting is that they never believe they’ve made it. Yes, they want to enjoy going out as the pandemic is receding and restrictions are easing, but they are still grinding as hard as they were 10, 20 years ago because they simply love what they do and don’t consider it work!

They are investing rigorously because the stock market is too enticing not to! They could cash out and put a limit on investing every last dollar of cash flow but saving seems to make them feel better. No retiring anytime soon! If you feel burn out, I suggest taking a break or sabbatical and then restarting.

Quitting at the peak of your career because you’re exhausted is unwise.

It’s not always about what you know but who you know. It’s fascinating to spend time around people who’ve accomplished what they didn’t think was humanly possible or they weren’t capable of and exceeding their expectations. No doubt luck was a large factor along with timing and investing in themselves at the right moment, but also trusting the process and having no regrets were key.

The beauty about America is that no matter how many mistakes or hiccups you’ve had in the past, you can still make it out alive and become better than ever with consistency. Showing up overtime and never quitting due to a lack of effort are seriously underrated.