While millions of students postponed or canceled their plans for attending college due to the economic financial constraints of the pandemic these past 2 years, countless universities have hit the jackpot once again with billions of dollars in endowment gains. Some weren’t so lucky and ended up going bankrupt having to shut down but the ones that stayed pragmatic, hopeful, and conservative within their portfolios won big.

Thanks to the roaring stock market, universities’ portfolios haven’t boomed at this scale since the mid-1980s. Despite the brief market crash in March 2020, investors promptly got back on track and were extremely hopeful for the recovery. They played their cards right and made a handsome return which in turn allowed them to continue to hike up the price of attendance for school. If the top endowments were hedge funds, they would be the size of one of the largest in the world.

These gains are no surprise to many considering institutions are sitting on billions of dollars of donations and recycled investment returns competing for the coveted seat as the best performer in the U.S. News and World Report Rankings. It’s unfortunate that the education system is mainly based on prestige and ranking instead of on affordability and accessibility. As a student myself it’s disappointing to know that 77% of the top 1% kids in the U.S. go to the top 10% schools and a third of the students in the Class of 2022 at Harvard got in due to the legacy admissions process. At least more schools, specifically Amherst announced this week they are dropping legacy admissions. It is a slow but steady process that is long overdue.

While Ivy League institution’s endowments are worth more than most islands in the Bahamas and South American countries’ GDP, these schools are cruising and earning more than ever which makes me wonder, is it being recycled and infused back into the universities properly or just reinvested and not touched?

If you’re a college student, I’m curious. Do you see your school transforming, whether it’s through renovations, innovative and expansion of class offerings, have stronger faculty, more acceptance of the bottom 90% of students, etc. reflective of these massive gains?

This is a question many students ponder, especially those who are unsure what endowments are in the first place. That number is higher than it should be with the lack of financial education in the classroom.

Endowment Edge

While we hope these institutions, part of the private sector do use their power, prestige and bargaining power to set prices accordingly, by many they are seen as getting too powerful and competitive.

After all, higher education and healthcare are one of the few industries that are completely inelastic and rise prices each year no matter what happens since there will always be someone who is willing to pay $90k+ per year for education or medical care. A degree is an economic premium that no matter at what cost, students will go into massive debt for while endowments see their funds inflate.

Realistically, these big budget endowment heavy schools don’t even need to increase their tuition each year since with inflation and portfolio growth, they can handle keeping it steady. Yet, that would be considered a silly move by managers as they have the option of earning more with no drop in attendance. Yet, lowering the cost would have a tremendous effect on student’s wellbeing and most importantly the parents. Money is the number one stressor in our lives and students with loans are constantly questioning if their degree will pay off, taking a toll on their studies and enjoyment of these precious four years. Institutions could possibly even see more donations roll in from no price hike!

Before we get further into the exorbitant costs of college and attempt to dig into the impact the endowment returns have on improving education, let’s first understand what an endowment is for the 90%+ of students who do not have any financial literacy education — and it’s not your fault.

Class 101 on University Endowments

College endowments are investment funds that are supplied from a few key yet mighty sources of money. One, donations, most notably from alumni and legacy admissions, two, the schools attempt to raise money themselves through various events, three, collect money from operations and students and lastly, either take in pooled money from their past returns and continue to invest on top of it through compounding and dollar cost averaging.

Charitable donations from alumni who want to pay $3m to get their kid into college will not only get first dibs in legacy admissions but they are also the primacy source of funds for endowments. The more successful and wealthy alumni a school has, chances are the endowment is thicker. Often elite alumni who still carry a strong alma mater are the main philanthropists and givers to the fund. Possibly because they want to see it flourish further and rise the ranks or that they have too much money and no other alternative taste in other investments. If you’re in that boat, you have a good problem.

Endowments have various spending and allocation purposes but for the most part, it doesn’t seem like higher-education is getting so much higher or growing besides having to transition to Zoom. Endowment funds are intended to support the teaching, research, students, and public service missions. No doubt it is extremely costly to pay admin to faculty, professors to events, sponsor clubs, fund students’ entrepreneurial endeavors and all the opportunities that are inside of college hard to keep track of but compared to what these endowments are worth, only a fraction of what they return each year is to fund all operations. What happens to the rest?

Compared to managing your individual brokerage investment account at Fidelity or Vanguard let’s say, university endowments have a specific legal structure that needs to be followed. Endowment funds follow a set of long-term guidelines to dictate asset allocation through a conservative targeted approach that is dedicated for the long-term. Inherently, this makes sense. There is no reason for an endowment, unless they are on the brink of bankruptcy which in this case during covid was the case for several well-known schools, endowments must invest in highly stable, passive ETFs, mutual funds, and overall have a conservative approach to keep the school afloat for centuries to come. No day trading involved.

Without an endowment, there is no way to pay for operations and keep the school running. Students would need to pay extra out of pocket fees every semester or alumni would be forced to donate to the school. Their investments keep them running in times of need.

Endowments are crucial to the success of the university in various realms. From the amount and type of students it admits to the quality of programs all in hopes of keeping rankings high, all play a factor. At the end of the day, ranking matter more than ever to institutions since they are competing for the best talent just like companies.

Although acceptances are dropping everywhere, I believe every student who has passed HS has great potential and can be successful anywhere. School shouldn’t define who you are. What you put in is what you get out no matter if you go to community college or a $90k private school in the middle of the woods. At least endowments are used to supply scholarships, Pell Grants, and other opportunities to students in need to diversify the student body and provide well deserving less privileged students an opportunity to learn alongside the top 10% who get in through the side. Instead of each year pronouncing to the incoming class how many students they rejected, they should elaborate on how any students they accepted!

Endowment Performance To Student Success

There has been an ongoing debate these past few decades around the utility of large, multi-billion dollar endowments and what they truly provide back to the student body. Especially as tuition costs rise on average by 4% each year, it is valid to question the incremental price hikes. Ideally the endowment is a safety net and should be known as rainy-day fund yet economists have criticized the incentives behind the overemphasis on the health of the endowment rather than aiding the institution as a whole. After all, even in our own lives, we tend to focus more on our wealth than health and only one of them can realistically be turned around.

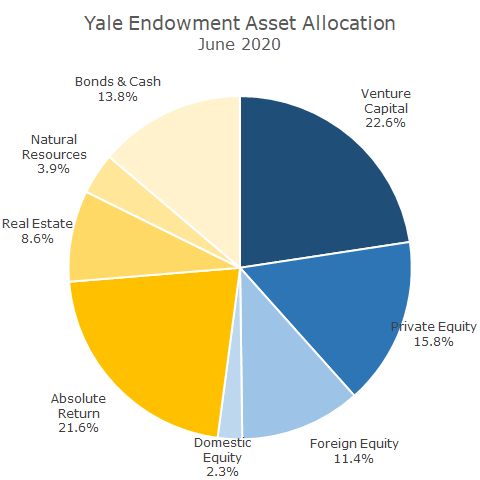

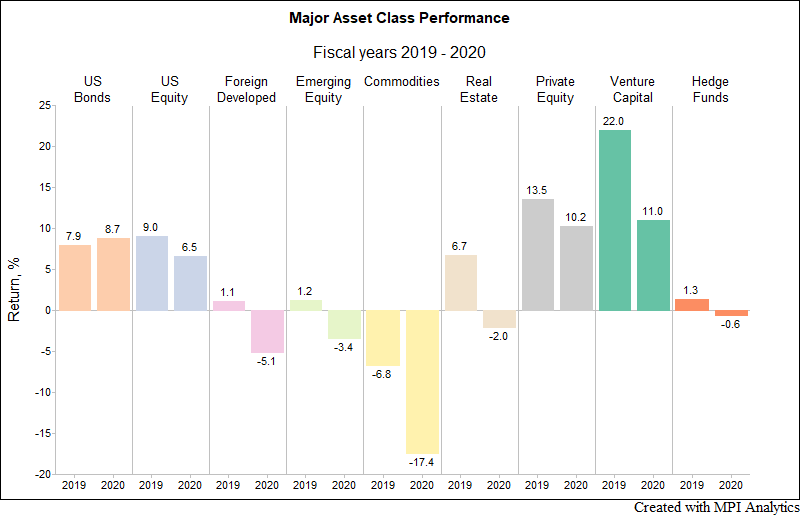

A few months ago, I wrote a piece about Yale’s endowment performance and its shocking return of 40.2% for the year ending in June 30, 2021. Yale gained a coveted seat just below Harvard a few years earlier thanks to the transformative changes and unique investment style the late David Swensen pioneered for Yale. To find out in-depth what Yale’s endowment entails, which is simpler than you think, read here.

It not only beat the major indexes which is particularly surprising as a conservative leaning portfolio, not intended to do so, it also preserved the capital of donations, dabbed in alternatives, and helped dramatically increase the funding for operations long-term. Although our brokerage accounts aren’t worth $42.3 billion, we can still learn a thing or two from these massive companies, I mean endowments, while reducing our risk as it is proven to still work.

Test Take

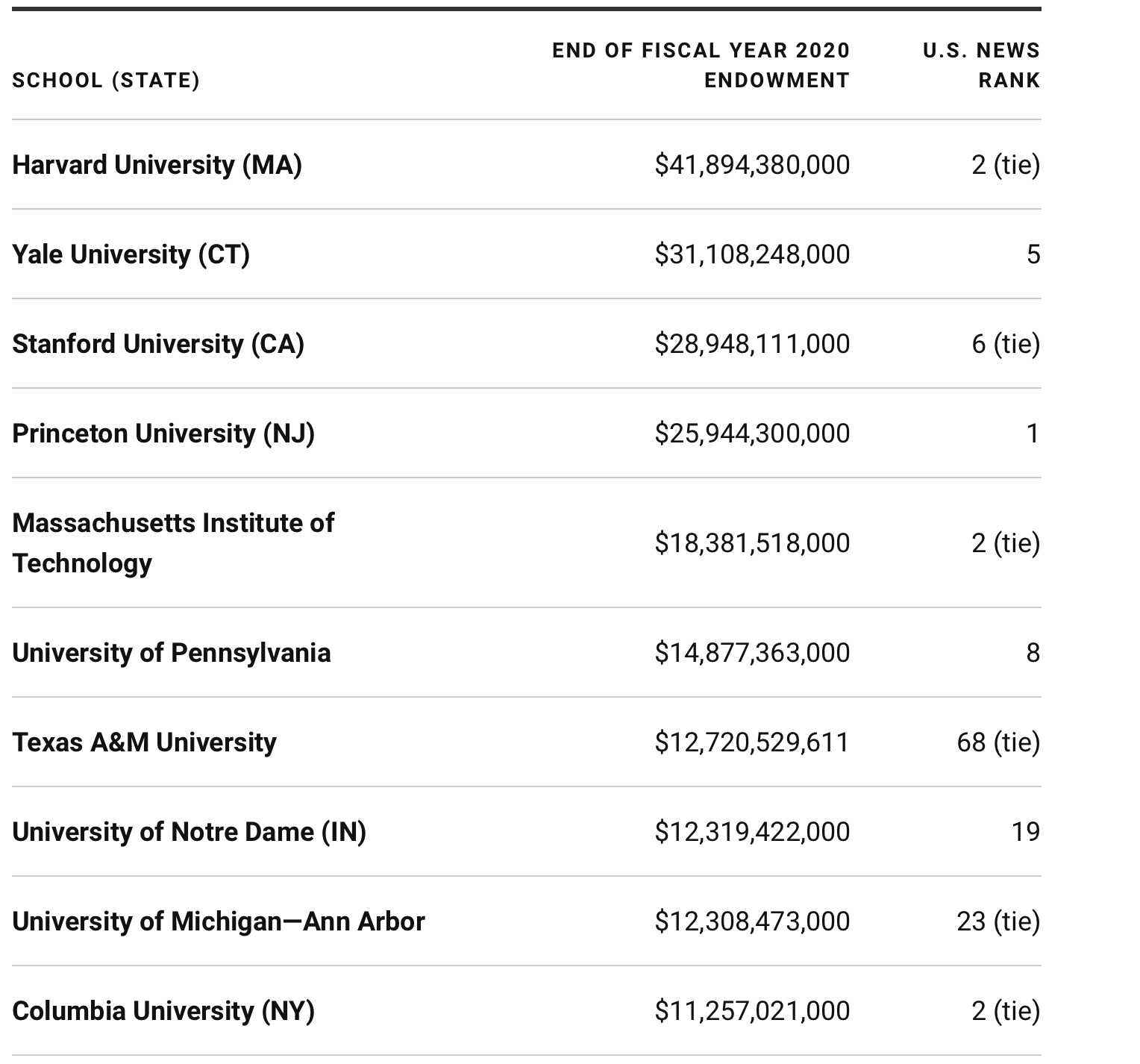

Drum roll please…. At the end of the fiscal year 2020, Harvard University’s endowment totaled nearly $41 billion. This is greater than the GDP of counties such as Uganda, Bolivia and Nepal per the World Bank. But don’t be mistaken. The institutions at the top of the list have a powerful, mighty and wealthy alumni that have boosted returns centuries ago. Although there are no specific reports on who donated a certain amount, you can simply look online and search “notable Harvard philanthropists or alumni” and the puzzle pieces will add up.

Although Harvard has lost its seating in the U.S. News Best Colleges List, which is heartbreaking, although extremely objective and relative, they have insisted on keeping the top prize as the largest endowment for decades.

It is disappointing that the stock market is uncorrelated to the economy so much so that the price of education doesn’t change and only goes up when transitioned to a remote setting. We have to realize lowering the cost of something during times of crisis isn’t a prudent move as institutions needed to confirm they can manage their budget appropriately. Yet this has allowed schools to take advantage of students and earn even more through investments when they could realistically lower the cost as it is supplemented by their portfolio performance.

When it comes to investment performance, you can only rebalance, tinker, and reposition so much. Up to a point, you end up loosing more money that’s why passive investing historically beats out active investing or a.k.a gambling. Long-term thinking with a conservative approach is best for colleges and I’m thankful that is the case or else nothing will be stable and education is the last thing that should be.

Taller Ladder

According to U.S. News and World Report,

“Though institutional wealth does not directly indicate academic quality, many of the schools with the largest endowments are regularly among the top colleges as ranked by U.S. News. Of the 10 schools with the largest endowments, nine are ranked among the top 25 National Universities, institutions that are often research-oriented and offer bachelor’s, master’s and doctoral degrees. Despite large endowments, many of these schools charge high tuition — though their wealth also allows them to offer generous financial aid packages, ultimately bringing costs down for students of modest means.”

Since the average endowment size is in the single billions for most Ivy Leagues, let’s uncover why there is such a large difference in endowment size for public, younger institutions.

Before we do so, let’s understand what influences endowment size and its role in casting higher returns:

-Emphasis on diversification-private equity, venture capital, farmland, wine, art, real estate, leveraged buyouts alternatives-favored by the top 10

-Strong and wealthy alumni

-Established and reputable institution

-Located in a moderately priced area where low cost of living is available and lower wages paid

-Surprisingly, more conservative the better-less risk, more return especially within real estate, public equities within defensible such as consumer staples, discretionary and financials

According to the Modern Portfolio Theory which promotes diversification and less risk, founded by Harry Markowitz who attended the University of Chicago, a school with an endowment fund totaling $8.2 billion, diversification is proven to work and I’m sure Harry has helped fuel his alma mater’s fund into this approach as well.

When it comes to our portfolios, diversification is truly key. As we’ve witnessed during the pandemic, those who did not have a safety cushion and not believe cash is king, were more likely to get evicted, not have the funds to support their kids or themselves, put food on the table, and not be able to get into the workforce as quickly.

Conservatism gets a bad wrap for being traditionally tied to retirement yet in reality, it can be used in all portfolios at no matter what stage. In fact without knowing, it can beat the performance of the major benchmarks as Yale’s fund consistently has done!

Besides overseeing various global operations and having thousands of people rely on them for jobs and securing their careers each year, another reason universities take on a conservative approach is because everything is extremely uncertain each year. They can estimate and make projections based on the past on how much an alum will donate but they aren’t positive. The amount of grants and gifts they receive each year is completely optional in the first place. Yes grants from the government to public universities should be stable but can also be cut anytime. The U.S. government is in a trillion dollar deficit itself attempting to survive or else a government shutdown will occur. This puts operational constraints on the university and they have to be prepared to cut the budget and raise prices pronto.

My World

Since I’m a personal finance advocate, blogger, and current NYU student, it would be no fun to leave this article hanging and not research my own university’s fund which stood at $4.7 billion as of August 31st, 2020!

I have to say I was expecting a bit higher number since private universities with a strong alma mater and reputation are known to be in the top 10 yet since I’m not fully convinced the larger the endowment, the greater the innovation within the school, this endowment size is fully justified since NYU puts a great emphasis on improvements throughout all their global campuses and invests in their students that all come at a hefty cost.

Ivys, in particular who manage the largest endowment funds are larger since they retain and reinvest most of their investments back into the market since their budgets are likely smaller leading to less improvement into the system.

Since NYU’s budget totals roughly $3.689 billion which includes all academic, auxiliary, and admin duties at NYU NYC, Abud Dahbi, Shanghai, and all global sites, it makes sense for the endowment to be at this size.

Considering the amount of students that attend the global university, the incredible faculty that work here, NYU’s prized position as a top university with remarkable talent and programs, and pricey locations, I believe the finance department is managing funds appropriately. Lots of factors come into consideration here. Simply comparing how big an endowment is doesn’t work. Ranking don’t matter. At the end of the day, it’s how it’s being used. You could make the case that schools with smaller endowments most likely have more innovation and happy students. What’s the point of making money if you don’t have a purpose or give it to a good cause anyway?

All these global sites aren’t cheap and must be accounted for. I’m sure the university owns these buildings which is prime real estate in itself.

2020 Performance

Looking back at this year, according to my sources, disappointingly NYU’s Endowment failed to capture the secular bull market’s returns. I’m pretty surprised about this since it was hard to loose out this year as an investor unless you were overly concentrated in one asset class which most likely was the case in the leisure, hospitality or tourism space, the hardest hit industries ravaged by the pandemic.

Even David Swensen, Yale’s former endowment fund manager in his book, “Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment” shared a glimpse into how NYU went about managing its portfolio a few years back. I would take a look if interested!

NYU’s Timeline

Starting in the late 1970s, concerns about the volatility in the stock market and the universities finances lead NYU to position itself heavily into fixed-income and money-market funds. This is a prudent choice to make when there is turmoil in the market but shouldn’t have been a concern forever. On average in the early 1980s, it had a 66% position into bonds, 30% to stocks, and 4% into other assets. Nothing wrong about staying safe but what led to a lack of performance in the fund moving forward was no diversification.

Although this was a conservative traditional approach, this didn’t seem to return the same stellar performance as other funds witnessed as NYU already increased its high-bond commitment even more from 62% to 90% of assets through 1985 .

Until 1997, NYU began to make a move away from fixed-income to more alternatives and high returning assets such as real estate and private equity. Following the crash of 1987, Larry Tisch, NYU’s endowment chairman addressed the lack of equity exposure in stating that “the train has left the station”. From 1982 to 1998, the endowment wealth index for universities increased nearly 8-fold as opposed to only 4.6 times for NYU which led to change in the late 1990s reducing its concentration from domestic fixed-income into foreign equities and absolute return strategies.

No doubt a heavy exposure to bonds helped them as interest rates were falling for almost 20 years from 1980s to the end of the 1990s but an earlier adjustment to less risk-free assets would’ve helped. All in all, it’s better to be safe than sorry. There’s nothing wrong with having more safe haven assets.

Fast forward to today,

According to NYU’s Investment Office from 2019,

“NYU’s Endowment has produced strong long-term risk-adjusted returns relative to its benchmark, resulting in more stable support for NYU’s programs than would have been provided by the passively-invested alternative. Over the past fifteen years (through August 31, 2019), the Main Endowment has returned 6.5% (annualized and net of fees) versus the benchmark’s 5.5% return. The benchmark is constructed based on NYU’s actual mix of asset classes in order to identify the performance impact of various factors including manager selection decisions. NYU employs an active, long-term investment approach meaning performance could deviate from the benchmark meaningfully in shorter-term periods. Therefore, while the Fund is continuously evaluated, multi-year periods capturing full market cycles are most appropriate for performance evaluation.

Due to the combined strength of capital inflows and performance, the value of NYU’s Endowment has increased by approximately 7.7% per year over the past 15 years, net of spending and other distributions. Distributions to the University over that time have totaled nearly $1.7 billion. Donor contributions are a vital component of the Endowment’s long-term growth, bolstering the amount of support available to NYU’s programs, as well as creating access to an NYU education through financial aid scholarships.”

Recap

Managing an endowment or frankly any fund over six-figures is no easy feat. There are countless factors and uncertainties that come into play. In terms of college funds, with thousands of people relying on the performance to fulfill their dreams of graduating or just keep their jobs, there is immense pressure to generate returns but also to stay balanced.

An A+ rating from the outside doesn’t always indicate what the returns are really feeding back into the school.

With inflation, rising costs, the pandemic, and volatile frothy markets, any bad move could ruin the legacy and operations of the entire university.

Taking into account liquidity, credit, duration, purchasing power, and time risk are all necessary and although NYU leaned on a more conservative approach in the past, I believe it helped them prepare the best and stay securely afloat. David Swensen would be proud.

Although it seems like universities are enemies and always in competition mode, competing against endowment size can distract them from making the institution better. After all, this is money on the line that should help support the school and stabilize it. It isn’t about generating excess return to just reinvest and rise up the ranks.

Rushing and competing within investing is a dangerous idea. Focus on utility and purpose, not title or one stat since at the end of the day, the greatest return comes from the fund that works for the greater good.