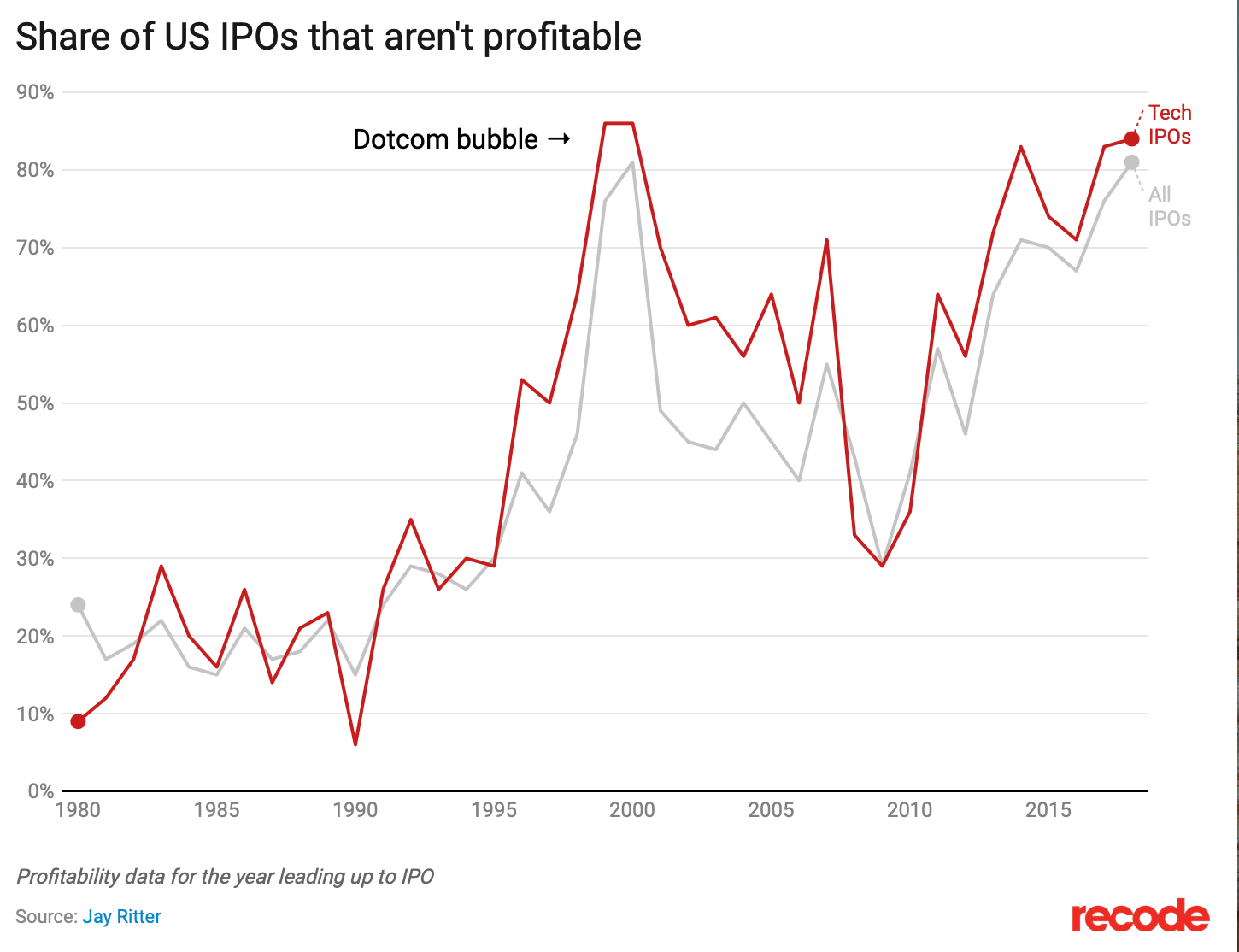

In 2018, 81% of US companies were unprofitable in the year leading up to their public offerings according to data from Jay Ritter, an IPO specialist and finance professor at the University of Florida. This has been a record year for IPOs at 159 to date but is still half as many as there were twenty years ago when the dot-com bubble formed sparking some trepidation in investors wondering if a boom is coming in which you can learn all about that if that will happen here.

But before I move on, the IPO (Initial Public Offering) process, as in its name, takes companies public by raising capital by an investment bank to issue shares of stock/equity in a public market. There are plus and minuses to this and some companies such as Bloomberg or Trader Joes choose not to do this for certain reasons, most commonly becuase it is all open book. There are quarterly earnings published and shareholder meetings and some companies like to stay private. Not because they are sneaky rather because they don’t want the public to take part in taking a piece of their share because then the company isn’t ‘theirs’ anymore, it’s technically given up.

In reverse, the IPO process is usually done for the main reason of needing to raise more capital or is expanding and want investors to share the profits. As we’ve seen during the 2000s and today, companies are being stressed by the weathering effects of the pandemic, and those who have survived, have proven that there is a need. But that hasn’t always been the case. Lyft filed paperwork to become a public company in 2019 with a valuation of $15 billion but had a net loss of nearly $1 billion in 2018! Along with Uber’s valuation expected to be anywhere from $75 billion to $120 billion with a negative-balance-sheet.

So how have these behemoths gotten away with an IPO, taken on this risk, and most importantly, proven to investors that they are able to be profitable in the long run?

These behemoths we are talking about are mainly tech and biotech companies, those that show a high rate of investor optimism and success down the road with a product or prototype either still in development or used with the public but take a long time to see results. When they sell stock to shareholders they use that money to raise their business because their products are one of the most expensive in the industry. Yet, this isn’t just the case with tech. Almost half of non-tech, non-biotech companies that went public in 2018 were unprofitable as well leading up to their big debut of an IPO.

It’s the same thing as betting and predicting the market. Investing is all about that as you are investing in the long term. As Paul Condra, a lead analyst at a startup research firm PitchBook wrote, “As we’ve seen during most of the recovery period since the Great Recession, investors are not so margin-focused, but continue to put a premium on businesses with long-term future expansion or disruption potential.” Let’s unpack this for the not so tech business jargon-heavy folks, myself included.

When investors look at companies and their prospects for them succeeding, they look at key indicators that are called margins. These include dividends growth, earnings, market share, liquidity, P/E(share price/earnings per share) to gauge how well a company is doing. If none of those are evident and in this case, it isn’t rare, it really reflects the need for growth over profitability. Every investor, whether you are an individual one or a VC pilling thousands to millions of dollars into funding that company in exchange for a stake in the startup, it’s all risks but in return, possible big rewards.

Shark Tank Myth

Whenever we think about entrepreneurs, we only see the glitz and glamor where they are now, never before. We assume one great idea lands you a 10-minute conversation on Shark Tank with a quick pitch and already sold on doing business with Mr.Wonderful. Behind all of that, is years of making mistakes, learning and testing the market, losing money, lots of it, pulling your hair out and at the end, it is only for those who would sacrifice anything for it.

Some people prefer a steady job over a risky bet putting their heart, soul, previous paycheck, and time into something that might not succeed. There is no reason not to be an entrepreneur because it is more realistic and a steady path which most people prefer. Personally, after years of working in the corporate environment obtaining internships on Wall Street and at tech monopolies, I felt forced to do work that didn’t compel me to think bigger, and being instructed by a boss doesn’t always suit me, especially when I have my own rhythm to things. But that doesn’t mean you will be free and not controlled by anyone. Even as the CEO of your own company, your customers are your boss.

Being an entrepreneur is not only a riskier path but a harder one to sustain. If you are there to become rich quickly, then it isn’t for you. No wonder filthy rich business owners don’t’ sell their businesses and retire early. They love the thrill of what they are doing and are truly in it for the long run! We only see the end result which is few and far between what entrepreneurs have endured getting there. After all, the easiest, simplest, and most intuitive products that are used daily by millions were the hardest to create. Curate a masterpiece that looks like it was done in no time.

Party like it’s 1999?

Two decades ago, the reason for the dot-com bust was due to investors wanting to chase everything internet related and this led to a ton of unrealistic speculative bets on unproven companies pouring millions into companies they’ve never heard of and losing their money overnight due to over competence. Compared to the 2000’s, there are several differentiators that lead to the dot-com bust and most startups to fail that isn’t evident today:

Too much competition

There were around 12 companies on average in the same space and almost all of them had or made no money even if they cut out R&D, marketing, and compliance costs. Yes, companies are still not profitable and launching their IPO these days, but at least it wasn’t this bad.

Timing + Need

There’s never a right time to start everything. I truly believe this and as much as luck plays a huge part in everything in our lives, we cannot forget the power of patience. Companies ranging from Pets.com to MySpace didn’t fill a need during this time when the internet was first getting started and if they had waited a few months or years, they could’ve existed to this day. Amazon was the best example of a company that showed little profits as well but kept its funding rounds with piles of cash to sit on for support while also thinking long term, when the internet has evolved and people’s needs have changed beyond just selling books, it’s original purpose as a store. Company’s valuations are not as overblown these days as we’ve learned how to better value a company with no profits and understand it’s motives.

Connection to Our Lives

No matter how much research we’ve read that backs up the claim that the title of your college let alone first job has no relevance to where you will go and become in life, students are still convinced and drawn to the prestige of going somewhere to simply show off. It is all about how much you put in. Harvard will not guarantee you anything, except robbing money out of your pocket and a false sense of accomplishment. Your parents will be proud when you get in but after those 4 years, you have to keep that bar raised and guarantee them that it was worth it.

I have a friend who got into this school called Yale and Stanford and she turned it down because she made the best choice one could make, avoid student loans. Yes, we always hear that student loans are a good type of debt that appreciates as an investment and all, but when it comes to paying them back and having them sit on your shoulders for 20+ years of your life, it isn’t worth it. Not only she graduated and found a job she loves during this pandemic from a community college, she found so much more happiness in her life and genuinely feels richer in all aspects of her life than her IVY league friends because she learned that it was all up to her to make that happen, not a degree written in Latin.

As with companies, just because a company doesn’t report a profit, doesn’t mean it couldn’t be profitable. Focusing on long-term profits is always the way to go, especially with a college education, startup, and your financial goals. If you want to make a profit in the stock market, your worst bet is to hedge or use options in a short term approach. Long-term diligence, patience, and letting your life ride the ways is always the way to go, with virtually everything, including adding too much hot sauce on that taco. Moderation and letting it go.

No matter what your endeavors are in life, whether it’s fine-tuning that entrepreneurial dream to land an appearance on QVC or graduate and work at the company of your dreams, we can learn a lot about how the VC/funding space connects to our own lives. Just because you haven’t accomplished something now doesn’t mean it cannot be proven later, especially when millions are on the line. You have the choice to be your loudest cheerleader or harshest critic. When it comes to an IPO launch, buckle up, and take the positive approach which will always serve you well no matter where you are.