Although I’m too young to recollect on the Dotcom bubble, as a 20-year-old personal finance blogger and connoisseur, this tumultuous time in the markets has fascinated me and brought about a bit of skepticism for the horizon. I hope to never encounter a bubble at this magnitude in my lifetime but lately I’ve been increasingly wary of a second one heading our way.

A prudent investor always remembers in the back of their mind that the past does not guarantee future results but it is a good indicator. Never rule out history. It is the best teacher since it repeats after all.

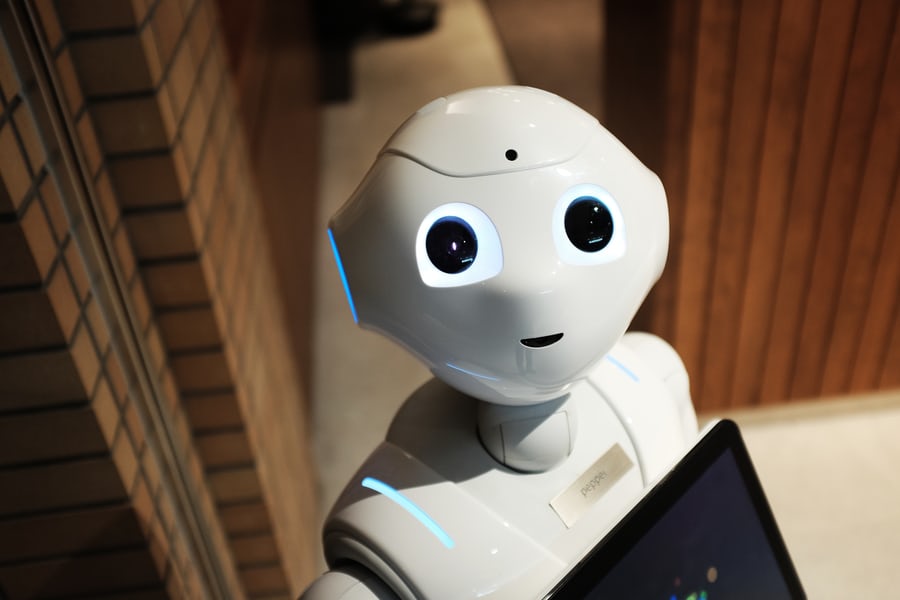

This past year the markets have undergone a record number of IPOs and SPACs near 1k U.S. public company debuts. With excess liquidity in public markets, booming private equity and venture capital sector, M&A, leveraged buyouts, bottom-low interest rates, WFH, emergence of FinTech, and the digital transformation through a keen focus on EV, food delivery, AI, and e-commerce, more companies have filed to go public than ever before and many of them are still angels. They are babies with no profit, forecasts, and only a one-page 30 second pitch plan or in EV truck maker Rivian’s case, no cars on the road and only a handful in production.

That’s what Wall Street is all about. Projecting, building, and creating the future by investing in the founders’ vision. Whether or not a Dotcom bubble seems more likely to happen today or tomorrow is hard to tell since investing in the future is always part of the plan that comes with no plan. Innovation screams nonsense and unpredictability. Nothing makes sense now and it doesn’t have to be. The future will come whether we like it or not and that will be the time we will deliberate if these valuations, founders, and expectations were fool proof or not. Clearly it didn’t work out so well with Adam Neuman and other founders that hid from the limelight. 90%+ of startups fail after all! It’s part of the process and explains the volatility in the markets. What’s certain is uncertainty.

Frothy Nonsense

In early November Rivian went public and as of now, it’s current market cap is roughly $100 billion. Lucid, another player in the EV pickup truck space soared after its trading debut even with no incoming cash flow and only a few cars on the road and or still in production. These companies or shall I say startups are valued at astronomical levels compared to traditional legacy car manufacturers of Ford, GM, Toyota that have been around for centuries and have something to back up their worth.

Even Tesla made it into the exclusive unicorn club with a $1 trillion dollar market cap with less cars on the road than any other incumbent player but with its mighty customer base and hopeful future, they are scaling and attracting faster. Tech trades at a premium with higher multiples betting on the future more than value companies. Similarly to the social media landscape, it took Facebook almost two decades to reach 3 billion users while TikTok reached 1 billion in less than a year thanks to lockdowns and screen time. Wall Street bets on the future and vision, not always on the product itself especially in this day in age where every market can be considered saturated and competitive. To stand out, you need to be Musk or have an all-in-one app as China is capitalizing on.

On the retail side of things, Allbirds, Rent the Runway and Warby Parker have all catapulted in price after going public betting on the return to the office and gym and on the consumer staples/agricultural/manufacturing side, Sweetgreen and Chobani are eyeing the public stage as well.

It makes sense for a company that has a proven track record, customer base, sales, and isn’t burning more than earning to go on the big stage but what about a handful of public companies or incoming ones that are currently worthless and pure speculation? This concerns me the most and mimics the sentiment investors had with internet stocks in the early 2000s. But how do we calm this enthusiasm?

Do we need it to bet on the future or can be done in more realistic less stupid way so we don’t end up burning our portfolios?

I believe this starts with diversification, looking to the long-term, not equating emotions to decisions or Reddit feeds, and always keeping cash on the side. If Amazon didn’t raise funding prior to the Dotcom bubble, it would’ve been toast. Cash is king.

If you chose any 5 companies from the S&P 500 in 2000 and kept them till today, you are guaranteed to have made a handsome return. Not putting all your eggs in 1 basket even when new startups seem like the next big thing is in your best interest. All investors have regrets. Get used to having them because having 90% of an asset class or stock take up your portfolio is unwise. Who knows when crypto will be crashing down or if an allegation comes about from a company? Preparing for the worst, hoping for the best is your best bet as an investor in this overheated, frothy exuberant audacious market.

Casper, the mattress giant somehow did worse during the pandemic and is currently unprofitable compared to Rent the Runway which has faired better even when dressing up was gone for the past 1 1/2 years. We were all stuck at home, more Americans developed insomnia, and we were paying attention to our sleep more than ever before. We didn’t need to rent clothes to go out yet somehow RtR survived. The tables have turned and due to Casper’s extreme marketing budget and lost sales, they will divert from the public stage and become a private company to be bought out by a private equity firm.

Making sense of what is happening in the markets is difficult especially when what seems to make sense doesn’t! That’s why diversification is key, even with hot IT stocks or sleepy ones, no pun intended.

What’s Next

Due to this madness, there are plenty of investors who are eyeing a possible tech bubble in sight. With lofty valuations, a great deal of major companies, especially Big Tech, are trading at 30x-70x earnings. As we near the end of this year mixed with the SPAC and IPO craze, investors want to get into these unprofitable too hot to handle tech stocks while they can since 2022 and beyond isn’t looking so hot as tampering takes effect, tax hikes get implemented, and inflation persists. Vanguard projects equities to have an annualized return of only 2.2–4.4% for the next decade! This means betting on established companies is key.

Although the past, especially historical returns aren’t indicative of the future, we can learn a thing or two from history and the Dotcom bubble, even if it feels completely irrelevant now with the NASDAQ over 15,700 and the S&P 500 nearing 4,600 up 25% YTD.

Yet at the time when I was 1, to those I’ve spoken with, the Dotcom crash felt very significant. Investors poured their money into IT internet companies they could get their sticky fingers on without realizing none of them were profitable or made sense! I wonder what MySpace or Pets.com was really like. For anyone reading, I’m curious to hear how you survived the Dotcom crash and if and how it affected your portfolio. Are eyeing the market for a possible bubble soon or is this how Silicon Valley + Wall Street operate?

From June 2000 to December 2002, the S&P 500 declined from 1,517 to 847, or 44%. But the NASDAQ collapsed from 3,860 to 1,329, or 65%! So how can we stay on course while taking advantage and locking in positions in these over hyped promised companies when majority of them fail?

Bomb Toolkit

Diversification mixed with a long-term approach is essential. Just look at today with hyperinflation and low yields. Bonds, traditionally a safe haven investment when interest rates are low, aren’t valuable at the moment as they adjust to the current bond yields for inflation and turn negative. Although stocks take advantage of low borrowing costs and are known as riskier investments for this reason, it doesn’t hurt to have more exposure to them now than later while they are a better bargain and rates are still low.

Having exposure into both the largest asset classes of fixed-income and equities are crucial but what’s even more important is the concept of buying and holding through a long-term passive approach. Volatility is expected and guaranteed but if you have enough cash, patience, and diligence to observe how your favorite company can revolt against short-term market swings, you’ll find yourself beating it sooner or later. Not that it should be the goal. The goal should be able to explain the market while simultaneously predict it.

Going public is more than the attention and to become a monopoly. Despite the heavy costs and regulatory scrutiny, it’s the best marketing PR campaign a company could engage in to reach more consumers, find a cult following, share their mission, and grow a shareholder base that believes in them.

Investors are betting this bubble is bound to burst but unsure when. I predicted there would be a bust a few months ago as opposed to next year when tapering takes effect. These premium prices are ubiquitous throughout the market and have been jolted by inflation and fiscal and monetary stimulus Americas have been gifted since March 2020. Low interest rates and stimis have lead to the Great Resignation and persistent labor shortage, stubborn unemployment, extreme borrowing, hot housing market and shortage, rising prices, new asset classes and generation of investors, speculation and gambling, and retail trading. Making any option today is likely to hurt. Staying in it for the long-run and playing it safe with a basket of stocks is suggested for your mental sanity and time.

Whether or not you are tempted to short your positions in Rivian, Zoom, Lucid or Peloton is up to you. Uncovering the reasoning is hard since what’s certain is uncertainty but what I can tell you is this. Nothing seems like a good position in the markets anymore as everything is too expensive and long-term estimates don’t agree.