Too cool for the market?

There’s no other demographic that is captivated by saga and suspense more than gullible attention-seeking teenagers.

At the start of this year as the GameStop trading frenzy unraveled, teens, including myself, became more involved in the investing world. We had extra time on our hands and wanted to better ourselves than memorizing another formula for a test.

The brawl between Robinhood and retail meme investors naturally sparked curiosity since it was mixed with hype, a mysterious allure and social media. The best combo for a money-making disaster. We couldn’t resist not dipping our sticky fingers into this hot mess.

As a female investor, I’m naturally more risk adverse since I’m a catastrophic thinker. Since my father passed in HS, I’ve diverted to planning for the worst hoping for the best within every situation I put myself into. Plus since I’m a personal finance blogger and advocate for financial literacy on campus, I would say I know a bit more than the average 16 year who gambles. This explains my conservative passive outlook. I know, I’m not nearing retirement anytime soon but prefer to have a peace of mind and build long-term wealth instead through this approach. Don’t be fooled by the slow painful way towards wealth. It has worked wonders thus far.

Too Much Fun

Pre-2021, I already had mixed feelings about free-commission trading online and knew meme stocks wouldn’t last long.

In this case, RoaringKitty won big through sheer luck and timing and most participants lost everything. Some didn’t even make it out alive due to excessive leverage and getting into massive debt. You can read about the sad truth here.

Retail trading platforms, most notably Robinhood, WeBull, ETrade and Interactive Brokers flaunt their sophisticated dark mode appearance and overly convenient stock options for more profit. And it has worked too well.

Just in the last year alone, 25%+ of the overall market trades placed where done by retail investors, up from 17.1% in 2020 with majority of these newcomers comprised of bored additive dopamine hit teens.

Robinhood currently has 21 million users and counting, growing faster in 1 year than any other conservative traditional brokerage house did throughout their entire existence and they aren’t stopping there. Although there are mixed views on whether Robinhood is truly democratizing finance or leading kids, I mean traders, down a rabbit hole after being slapped with a $70 million FINRA fine for misleading users to certain trades leading to system outages, Robinhood seems like they’ve convinced investors to forget about their rocky past as a public company. Now they are en route for a road-trip to campuses to recruit their favorite customers, teens!

According to the NY Times, Robinhood is chasing after students as they are the most “desirable pool of prospective customers. They replenish themselves by the millions each year, and most start school with no strong affinity for any particular peddler.”

As a college student, this isn’t insulting at all. We are considered replenished commodities. Just like what Facebook thinks of us. How lovely.

Thankfully, more students are becoming increasingly ambivalent after January’s saga and are backing away from the fun of investing.

Mixed Bag

As college students, our main goal besides wanting that degree is to save money while making sure we still have fun. This is tough to do in an age where everything, everywhere is so expensive.

All campuses are now becoming as pricey as Soho and Silicon Valley, a lack of financial literacy is abundant, an obsession with our devices is damaging lives and inflation is eroding our purchasing power.

Even buying an iced coffee seems dangerous these days. Considering the bank of mom and dad spend an average of a quarter of a million dollars to send their child to an institution each year in the U.S., that’s enough money spent right there that should cover it all.

Yet college students are still kids. They aren’t always prudent with their decisions, especially when it comes to money and want to seem cool so they follow what is good not what is always right.

They replicate the crowd and curate a fake persona online because it’s easier to be fake than genuine. Being authentically you, down to earth and grounded is hard in this age where everything is glamorized and superficial.

Too Good To Be True

This is an unrealistic high bar to reach that is draining students across the country. Thank you Instagram. At least they just announced this morning they’ll be delaying the launch of Instagram for 13 years old and younger. Maybe that’ll help the next generation live more fulfilling and real unfiltered lives offline where it’s supposed to be.

Following the crowd rather than making our own decisions is the default decision for teens yet since the volatility of the markets in January, I’m shocked at fast my colleagues withdrew their money from Robinhood and what teens across the country think about the new era of investing.

According to a survey from the nonprofit youth organization, Junior Achievement USA and tax, accounting and consulting firm RSM, teens beliefs and assumptions about the market have changed dramatically within months.

Before we dive into the details, here are a few proposed reasons why teens are more concerned about where their money is invested:

-If teens did gamble and join the Reddit crowd in January of 2021, they soon found out that everyone calls themselves an investor and there’s no way to beat the market every time

-Some believe investing is a big waste of time and money; rather earn and spend riding the hedonic treadmill (not a good idea)

-As in life, volatility is part of the markets. It’s guaranteed to happen at any time

-They prefer certainty than uncertainty

-They haven’t comprehended the value of compound investing and time in the market instead of timing it

-They are fearful of the recovery and unsure if retail trading works

-They don’t want to get into more debt

-They have a false belief they aren’t wise enough to be an investor

-They would rather save than invest and end up spending it during these tumultuous times

Novice inventors don’t realize the risk of NOT investing is the same AS investing.

There are tradeoffs with each decision and a lack of education is pushing them behind unable to decide. I’m proud they are making their own money decisions yet this fear is a bit of an exaggeration, mainly based on a lack of facts and can be tainted.

The problem is they don’t realize how the market is a wealth building machine over the long run because they haven’t lived for long! They haven’t experienced recoveries and peaks as older folks. Plus the market doesn’t and shouldn’t have to be a job nor a game. It can work for you on the sidelines through a buy and hold strategy mixed in with index funds.

Dark Opportunity

39% of teens see the stock market as an opportunity to “make money quickly” while 20% believe it’s “too risky.” It’s frustrating to hear this considering it can go either way.

40% believe stocks are a “good long-term investment” according to the surveys which is hopeful.

Only half of teens believe the stock market is a “good thing” for everyday Americans.

And last but not least, the most shocking of them all… 37% wouldn’t invest if given the money to participate in the stock market!!

There are only 3 options you have with your money.

Spend, invest or save it and although all 3 can make you more if spent, invested or saved on or through an appreciating asset, for the 37% that rule out investing completely, this is dangerous.

Since teens haven’t been exposed to the world of investing long enough and witnessed historical trends, they cannot comprehend fluctuation is normal and will happen. This is ruining their chances for financial success solely based on one event, the 2021 Robinhood Revenge Saga as I like to call it. A good learning lesson for day traders but not something that should scare one away from the markets entirely.

No doubt history repeats itself but it repeats in different ways and if you have a stable diversified investment portfolio, not a plan to “make money quickly”, a well-rounded portfolio will serve you better in the long run.

From a career to stock market performance, overnight success takes 10 years. With our instant gratification and lack of patience, we are frying our brains making unreasonable decisions that put our long-term plans in jeopardy. Without investing in the market, it is almost impossible to let your money grow passively for you, build generational wealth, save on taxes and rise up the income ladder.

A fear of anything cannot stop you in life.

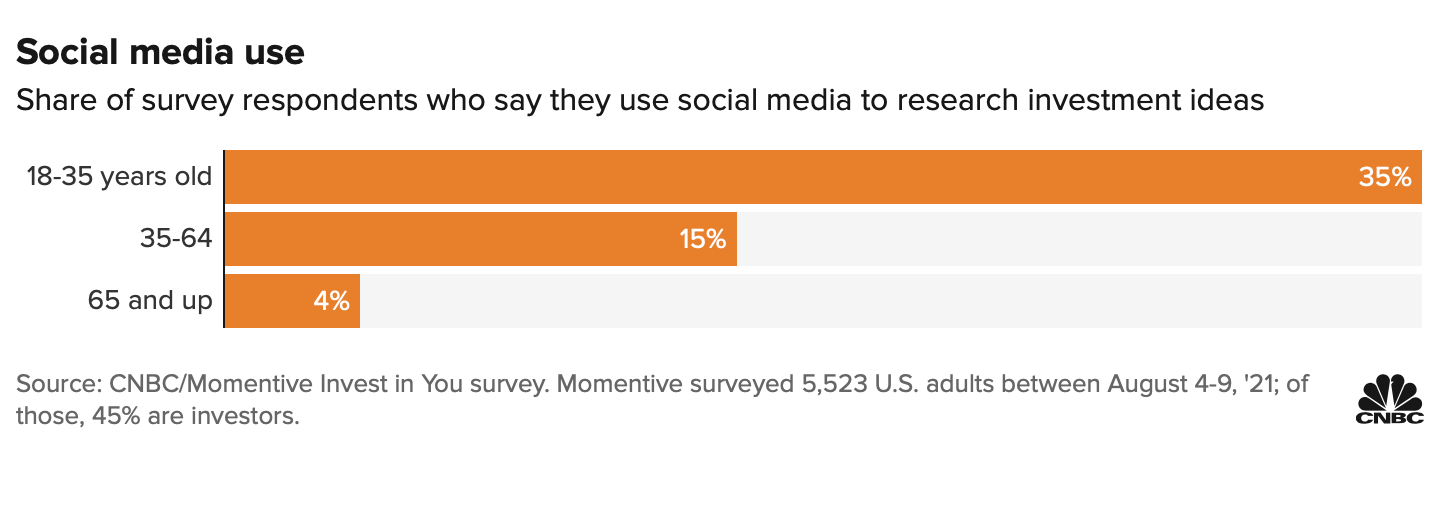

Considering 35% of people ages 18–35 (GenZers and Millennials) derive their investment decisions from the market is an indication they don’t have the adequate information from the start.

Their other main outlets are to turn to parents, websites or schools for information. That’s not reliable.

Instead of doing research on your own trades, first figure out where you are getting that information from. Do your research and figure out who is giving you that advice before jumping on it.

Repeat after me:

-No one can predict the future.

-No one is smarter than the market

There’s no one more likely to follow unsolicited, “get rich quick” tips than a teen. Don’t become that person.

Hopefully teens will soon realize backing out of the markets, especially at this age is the worst move possible. You’re practically asking to deflate your earnings, stagnate and give more to Uncle Sam. It takes no effort to invest a few dollars into an index fund or your favorite growth stock through fractional shares and just let it sit and compound. Don’t monitor it like your Insta likes. Not that you should either. That’s a worse waste of time.

At the end of the day, we know teen’s hesitancy towards anything doesn’t last long and with a little persuasion from strangers on social media or Musk, they will be back on track investing away.