Believe it or not, not everyone is David Dobrik or even younger, Emma Chamberlain or Charlie D’Amelio, who earn millions from social media, YouTube, and various one-hit-wonder ventures that directly came out of a following.

Success begets success. You only need to get it right once to catapult yourself but to sustain it requires an entirely different algorithm. In fact, perhaps none.

Although these kids have capitalized on a terrific opportunity leveraging their audience and talent in an extremely saturated space, they are still highly dependent on one product of Big Tech, not entirely their privately owned and managed business ventures that most only reward them a sliver of their entire annual earnings.

As a personal finance blogger, having my own website is freeing. I’m only reliant on myself, not just Google ads or the highly personalized addictive algorithm. This helps me remind myself I get out what I put in. Unlike on social media where the creator is always dependent on big brother Meta or TikTok to create a more addicting personalized algorithm for one’s viewers, with a website, business, or perhaps physical tangible asset such as collectibles to real estate, there is more leverage involved not to mention it reduces the risk of cyberattacks, hacked accounts, and invasion of privacy which are rampant on social media. Thankfully with the revolution of Web 3.0, more power is finally back in creators’ hands, not Big Tech’s stealing a share of the profits and credibility yet not entirely when still run on the Wild West.

Comparing ourselves to these influencers is the worst waste of time yet we engage in it anyway since we believe it is inspirational, fun, and something to strive for until of course, we are in the hot seat. The gene pool is already too deep that every market is saturated and it is very hard to scale quickly. Working for yourself is something everyone probably wishes they could do but not ideal for most. This gets Millennials into deep trouble since solo entrepreneurship is too enticing. In this short attention span age where everyone wants to become a millionaire through Robinhood overnight or Beeple with his $69m NFT, it is irrational to believe you can just sustain yourself solely on social media and be reliant on it. It is possible but long-term, hard to predict, scale, and leverage since you’re never in the driver’s seat on a social platform.

Well-Off?

The grass always looks greener on the other side until we feel it. Although contract and freelance work through the gig economy has been so hot these days with over 10 million Americans self-employed, up to 400k since March 2020, the fake allure and promotion of it all have got me worried about my generation and particularly the Millennial generation who’ve dealt with their fair share of hiccups within the markets and in life.

Millennials experienced a variety of pivotal moments that made them vulnerable to change. Prior to the pandemic, they traditionally turned to devote all their energy, time, and resources into one primary job, striving to reach HENRY (High-Earners Not Rich Yet) status which is not a secure real wealthy way of life with only 1–3 income sources and mounting student debt. Nowadays since the peak of the pandemic, WFH craze, and discounted homes on the market, the influx of creators, influencers, and self-employment became widely popular amongst this generation who gave up everything to try it without a backup plan.

After dealing with events such as 9/11, Housing Crisis 08, and the brief correction in Feb-March 2020 of ~35%, thankfully the markets erased all losses and charged ahead with record highs. Although the markets do go up over time, millions of Millennials still haven’t recovered from past recessions but took a bet on themselves, bought on margin, and built something in 2020–2021.

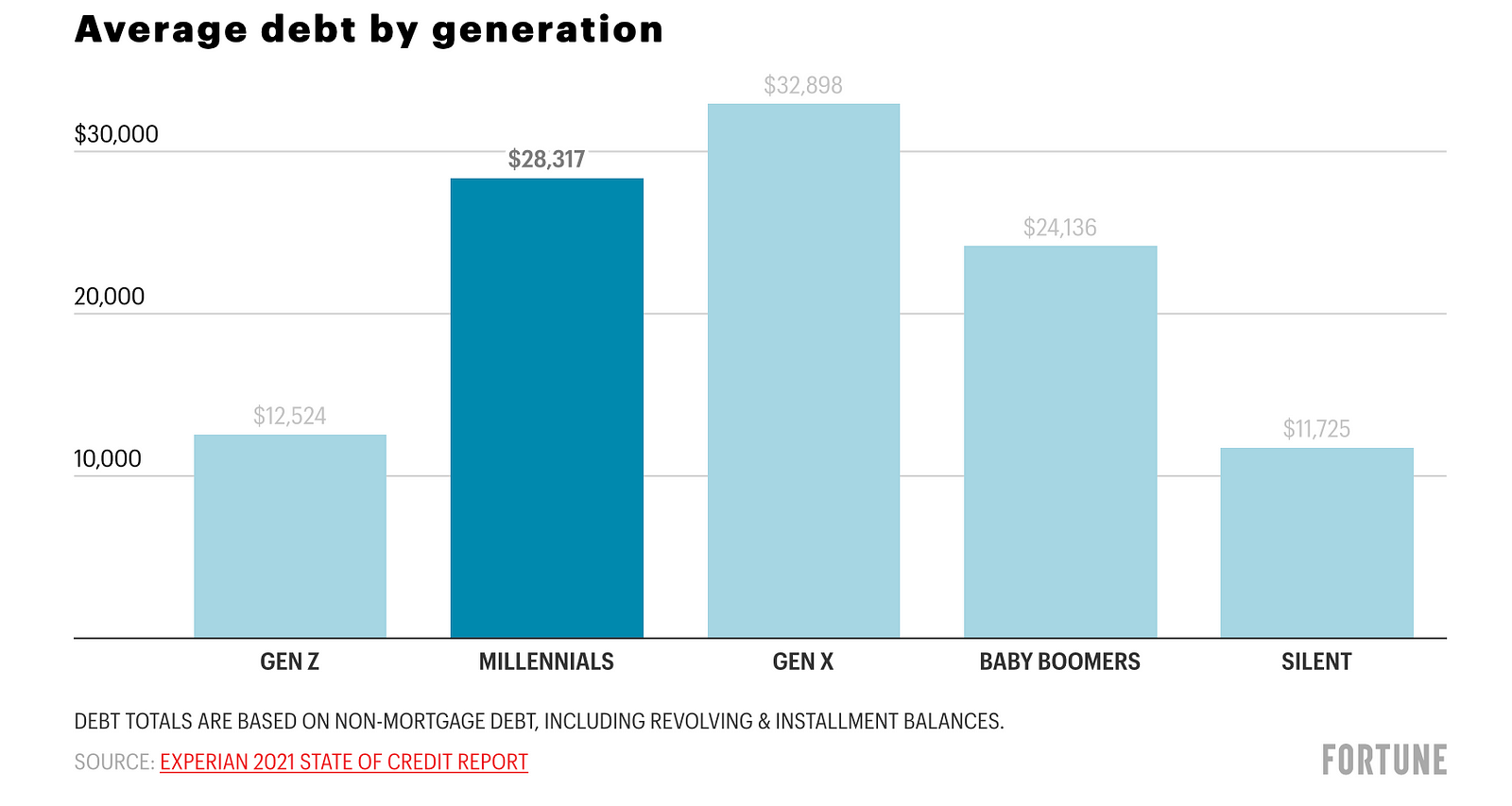

Historically, every 8–10 years a recession hits, and if there’s anyone that should be best prepared it is Millennials. Yet why are they still the most indebted, financially insecure generation?

They stick to trends and are tempted to look to the short-term rather than on the long-term horizon due to historical uncertainties. Millennials alongside Gen Zers are most likely to stick to trends, fads, and lean onto what is recommended today rather than focus on consistent planning through a slower approach.

If we can learn one thing from the market it’s that they are expected to sell off and be jittery whenever there is uncertainty and once the event, decision, good or bad news breaks, it will bounce back and rally again. On the day Russia’s invasion of Ukraine began, the markets closed in the green and last week when the Fed finally announced and hiked rates for the first out of 7 times at 25 basis points, the markets were up ~2%. Uncertainty kills yet that’s the price you pay for in the markets and in life. It is unavoidable.

The biggest mistake higher education could provide is not teaching financial literacy. Not to mention mental heatlh, digital literacy, negotiation or the prized skill of networking. This has led Millennials and the HENRYs of TikTok and Hollywood to miss out on a crucial life skill going forward.

Working hard vs smarter is a totally different ballgame. Working smart is maximizing your time in the most efficient level by focusing on quality over quantity. This entails having a bigger picture view of your life as opposed to looking at it through a smaller lens.

Fail to Prepare, Prepare to Fail

Just like time in the markets matters more than timing the markets, making sure your time and money are put to good use for tomorrow not only later today is prudent. The American Dream is harder than ever to achieve these days due to increasing costs caused by supply chain disruptions and trillions plowed into the economy through emergency stimulus for 2 years, debt burdens, and lack of financial literacy.

Between 1998 to 2016, the number of U.S. households holding debt doubled according to Pew Reach Center and most Millennials don’t feel nor are close to becoming millionaires. Behind them are Gen Zers who have an entirely different approach to money and simply got lucky with their timing, a big component to accumulating above-average wealth. Right time, right place is critical — not always in our control but something we can initiate overtime by simply showing up.

How is it that for the first time, Millennials are worse off than their parents?

Sooner or later, they will have to tap into the bank of mom and dad. Again. At least their grandparents, the Baby Boomers will pass down a historic amount of wealth, the largest inheritance north of $3 trillion.

Millennials are earning less than their parents did at their age, despite being more educated, mainly due to increased costs, debt levels, and past market turmoil. Although the Fed believes our economy is resilient and plans on hiking rates 7 times in the next 2 years without causing a recession, everyday expenses add up and won’t be leveled right away.

For the time being, the best strategy Millennials can take is to invest in themsleves not just their social profiles, buy what they need not what they want, have a capital preservation strategy that covers 6–12 months of living expenses, and prioritize passive long-term investing which historically beats out active investing for a reason.

Clearly, what’s certain is uncertainty but the best strategy that always prevails includes a level of diversification and risk-aversion in sight.