Let’s flashback to a year ago.

A great deal of Gen Zers and Millennials who were bored, exhausted, and online 24/7 took advantage of their stimulus checks, and the low-interest-rate environment easily and supported themselves better financially in 2021.

Their investment returns may have even surpassed a couple years of potential postgraduate earnings and paid off their stubbornly high-interest debt.

But let’s not forget much of the performance success was shared throughout the market. It was hard NOT to miss out on accelerated gains these past 2 years. Don’t always credit your skills, expertise, and track record in the market. Instead, thank your good luck and timing to have good fortune work on your side.

Pre 2020–2021, I hadn’t heard of any of these assets or shall I say, tangibles/objects/collectibles/jokes that have now taken the investment world by storm.

Due to their immense popularity on retail platforms and cult following thanks to Elon’s childish and vulgar tweets, they’ve made many lucky day traders such as RoaringKitty wealthy and a household name and big hedge funds miss out. As asset classes, they’ve soared in value reaching records never before seen in the markets.

2021 was the year of alternatives, confusion, the Great Realignment and or Resignation, and money. Big money.

Today, even non-investors have heard of at least a few. For simplicity’s sake, let’s consider them things. It is debatable if they are actually valuable assets. But many still aren’t sure where they came from, what their purpose is, how they’ve formed, and why they exist. As a heads up, there are many ways to generate money that don’t make sense, including these so just go along with it. They clearly work. They include meme stocks, dogecoin, crypto, NFTs, art, freelancing-Shopify, Etsy, and sports betting for the newcomers.

The Big Release

On February 2021 Vlad Tenev, CEO and co-founder of the juggernaut retail trading platform, Robinhood testified before Congress regarding the GameStop short squeeze meme frenzy that abruptly rang in a new unprepared generation of investors. With Robinhood’s power to regulate its orders, it halted trading for certain securities in January during the short squeeze. Supposedly this was done out of an abundance of caution to protect investors from high volatility yet, in reality, it was to protect Robinhood’s order flow and transaction handlings. As a result, corporate profits > corporate value came first and meme stock investors couldn’t get out of their positions during trading hours. Since then, this has hurt Robinhood’s reputation, message campaign, share in the market, and stock price down nearly 50% since its IPO in July of 2021.

Since over 80% of day traders, Robinhood’s core customers, lose money and only roughly 1.3% earn a profit, Robinhood capitalized on young investors’ short-term gratification, lack of patience, and social media addiction to curate an app that mimics a casino — a.k.a the opposite of investing.

These investors are not ordinary. They are full of fearlessness, spontaneity, and exuberance with a lack of patience and financial literacy. These investors, mainly Gen Zers and Millennials who range from ~14–40 something years olds, got their first taste of the wrong action with retail investing on Robinhood’s enticing platform. They lost more than what they came in with.

Late 2020 into 2021, the boom of retail trading was born. Retail traders, better known as day traders actively trade through a technical approach which entails options and derivates, hedging, shorting, and charting pricing movements. In January 2021 they had flocked to a new community, Reddit following forums such as WallStreetBets and ‘deep value investors’ such as RoaringKitty where members exchanged stock picks and recommendations promising lofty gains, secure exists, and guarantees. To be clear, the only thing guaranteed in the markets is uncertainty. These followers were clearly amateur investors that wanted to have fun.

Investing SHOULD NOT BE THIS FUN.

This period in time reminds me of the dot-com bubble when overvalued internet stocks were too hot to handle and ended up bursting and going bankrupt. We may very well be on the precipice of the pop of the 2nd dot-com bubble in 2022 with excess liquidity, extreme valuations, high volume of retail traders, SPAC and IPO craze, space tourism fad, Zuckerverse, Twitter, Pinterest, and Peloton shakeups, and the meme stock frenzy. From 1998 till 2000, venture capitalists, investors, hedge funds, and founders engaged in arbitrage and investing losing billions in portfolio gains, careers, and equity betting on unprofitable stocks. Only time will tell if markets will witness this again. Cash is king folks.

Fanatic

With extra pent-up demand brewing from delays and cancellations of sports for a few months in 2020, sports betting became a popular way to invest in alternative activities, not companies this time. FanDuel and DraftKings, two popular names in the arena rose to immense popularity at the end of 2020 as sports rolled out again.

The global sports betting industry reached a market size of $203 billion U.S. dollars in 2020 and with America’s favorite pastime on hold for much of 2020, the return of sports came with an epic comeback. With 3 rounds of stimulus, low-interest rates, 2 above-average years in the market, limited spending and social events, and the laptop class sitting on cash cushions worth trillions, they were more than ready to live normally again by betting on it.

Sports betting brought in a staggering $4 billion in gambling revenue for 2021, according to ot Fobes. DraftKings alone is valued at $6 billion when it went public in April 2020 increasing its value to now over $24 billion. It is past unicorn status and almost worth as much as big-name consumer staples, and close to many prominent established small-caps.

By 2028, the sports betting market is estimated to be worth $140.26 billion according to Bloomberg. But is there a sizable payout for sports betting besides connection, normal life, and sanity? With the rollout of NFTs, crypto, and artwork, many athletes are designing their own NFT teams (don’t ask how) and collectible figures to sell. There’s always a connection to the stock market somewhere or as Jim Cramer likes to say, there’s always a bull market somewhere!

Gambling is higher than the global sports market which reached a value of nearly $388.3 billion in 2020 increasing at a compound annual growth rate of 3.4%! Thanks to Americans’ obsession with the NFL, it generated $13 billion in revenue. The Superbowl is the most-watched televised event of the year. Established companies such as Coke need to allocate a sizable amount of their budget towards the Super Bowl. In 2020, companies spent $449 million on in-game advertising during the game. The NFL is the largest sports organization and the most profitable in the world for this reason. There’s nothing like the power of retail traders and sports fans.

Short Squeezed

A high volume of investors who are shorting a stock and racing to exit their positions creates a short squeeze. When the stock moves sharply higher, this prompts traders who bet its price would fall to buy it in order to avoid greater losses. The sudden surge in demand to buy shares of a stock can send the stock’s price even higher. This culminated in January 2021 allowing Robinhood to dominate amongst retail investors, a generation that is known to ‘go big or go home’, not a preferable investing style to adopt, only terrific for Robinhood’s business model and presence.

Retail trading, sports betting, and the NFL are in their own ways a form of gambling, trading, speculating, and a resilient team. At the start of 2021, the short squeeze between retail traders and hedge funds turned into a brawl where many lost but also won large.

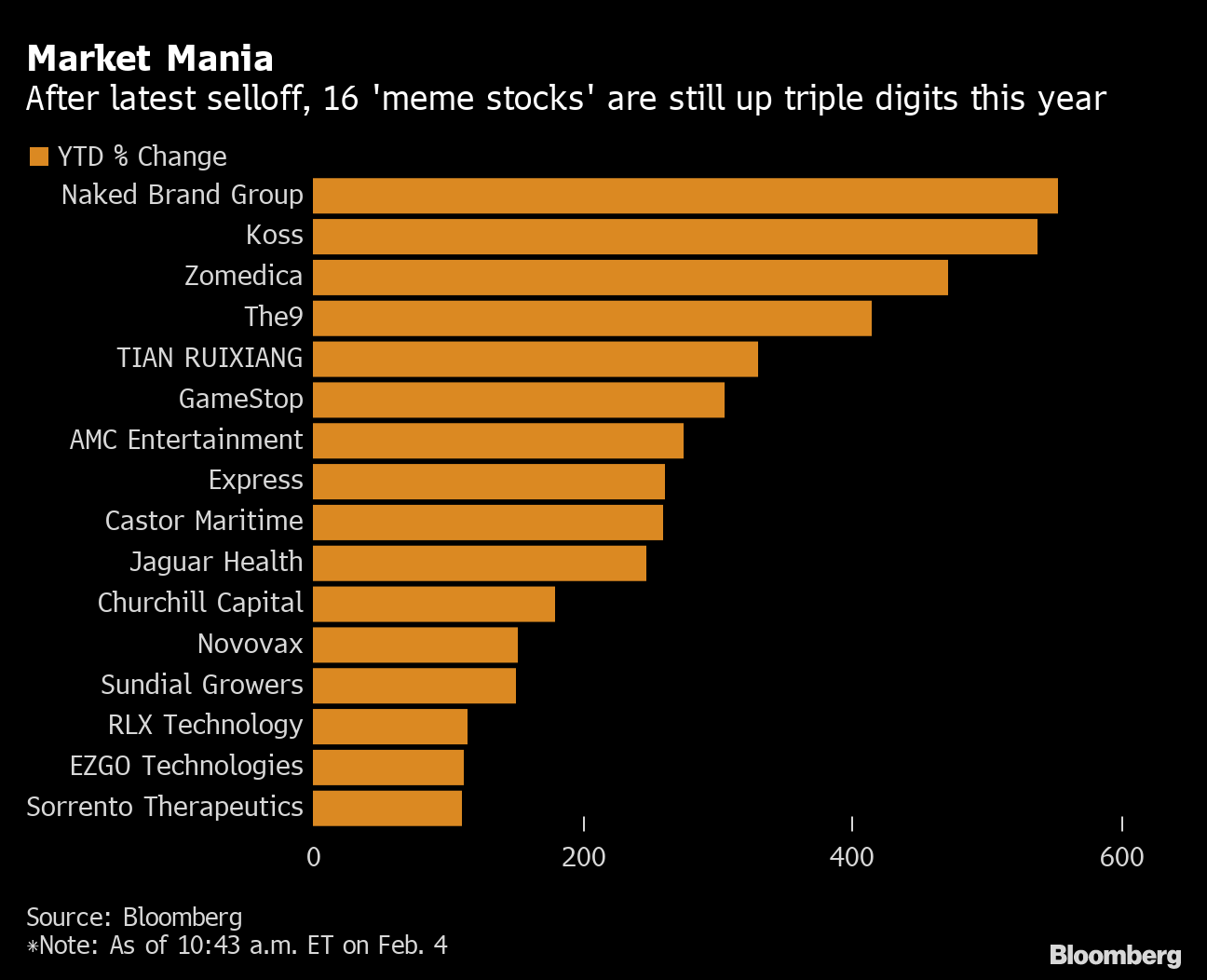

Logically, hedge funds shorted unprofitable meme stocks such as GameStop, AMC, Blackberry, while retail traders, a.k.a mini sports gamblers formed a tribe on Reddit forums and on social media to bump up the price of these stocks that have no future to prove the hedge funds wrong.

With their small yet mighty following, financially illiterate day traders seized the day. Only if you’re counting the scoreboard. Together they were able to dramatically pump up the price of on-the-verge bankrupt companies getting venture capitalists involved and entrepreneurs involved as well. It was a form of sports betting to encourage companies to keep treading water.

YTD hedge funds were the worst-performing private funds in 2021. Melvin Capital lost over ~41.5% of its capital but not to worry! The founder still bought himself a $44 million dollar mansion in Miami this year! It was the worst-performing hedge fund this year thanks to the bull market. Short positions and a roaring equities market don’t come hand in hand.

Clearly, don’t fight the Fed or retail traders together. Even with no track record, you can still dominate. They aren’t the underdogs anymore. Robinhood and WeBull, the two most popular retail trading platforms registered millions of accounts this past year. As FinTech companies, they mimic tech’s lofty valuations and rely on short-term borrowing in a low-interest environment for future earnings potential. Even existing in the financial industry, they are valued at higher multiples than several bulge brackets and are catching up to surpass their client base. The problem is they are recommending their investors treat the markets as a game, a sports match in a sense. Traders fueled bankrupt unheard of stocks as a joke and many of them had too much fun overleveraging themselves buying on margin, to take on short positions.

Now the tables have turned. In 2022, the meme stocks are priced at staggering levels and valuations are through the roof. As of today, GameStop’s revenue is shy of $5 billion, and it has never been more popular due to its meteoric bounce in its stock. Since many of these companies, including Hertz which filed for bankruptcy at the start of the pandemic, were on the brink of sinking, thanks to the unexpected resurgence of retail traders, 3 above years of record returns, and new activities found during the pandemic, for better or for worse in this case with day trading, Gamestop and many ‘broke’ companies alike reestablished themselves as much as possible and even hired a new CEO to take things seriously this time. Matt Furlong joined Gamestop as CEO in June 21 of 2021.

These meme stocks have defied all expectations and many of them wouldn’t be in existence today without retail traders. As for GameStop and Blackberry, Gamestop is focused on transforming its online business to meet digital gaming needs and BlackBerry has discontinued its original Blackberry phone in 2016 and their operating systems officially stopped working this past Tuesday in order to focus on their cloud infrastructure. Per the NYT, many financial firms are moving to the cloud and transferring certain data from their servers to alleviate space, energy, and heat.

Bonanza Downfall

If anyone knows how to rally up a crowd, it is sports fans and retail traders.

Boy were they bored and audacious this year. They came back better than ever. Thank you easy money policies from the Fed and Congress. Since meme stock prices fluctuate based on speculation, Tweets, and buzz instead of on fundamentals and analysis, there’s no slowing down for them. GME’s market cap is nearing $11 billion while Robinhood is slightly above at $14.43 billion. Although Robinhood had a phenomenal year as a public company since going public in July, its stock price and earnings have been sloping downwards ever since the retail trading frenzy.

The way Robinhood makes money is through payment for order flow. Citadel Securities is one of Robinhood’s actual clients. It works as a market maker and pays Robinhood to route its trades to Citadel Securities so Citadel Securities can make money on the bid-ask spread-tight = more liquidity, more trades=more money.

In 2013 when the Robinhood app was released, it became a fun, accessible frictionless way for investors to trade via their app. It was known as the ‘cool’ brokerage that modernized FinTech and the innovative path towards trading. The main reason its name stuck with potential investors prior to the pandemic is through its offerings of free commission trading with zero fees and expense ratios.

Large institutional legacy brokerages can charge up to 2% for managing a portfolio and Robinhood knew that was not realistic for a young indebted investor base to consider. In this capitalistic society where all monopolies are at each other’s throats peeking behind the windows at what new features their competitors are working on, Robinhood wasn’t the only one with this deluxe cash flow inducing feature for long.

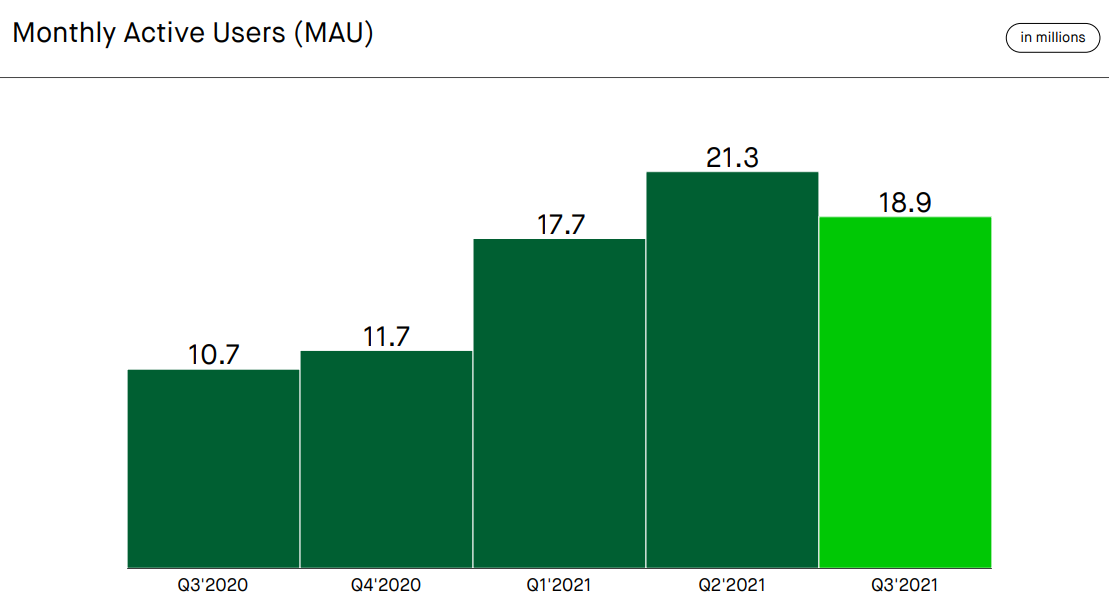

Unsurprisingly, soon enough all brokerages from Fidelity to Charles Swab followed suit and started offering the exact features to entice younger clients. Now Robinhood has no competitive edge besides its sleek, too easy to use, ‘fun’ app that they took too much control over in January 2021! In the last year alone, Robinhood’s users grew from half a million in 2014 to 22.4 million with $80 billion total in assets.

In this frothy punch bowl-free money environment, it’s hard to tell what’s not expensive. No doubt the memes are and it seems Robinhood is as well, inches away from the market cap of a meme stock that supported their platform last year.

No More Hood

In the most recent quarters, Robinhood’s customer monetization weakened, and similarly to Peloton, Zoom, Twitter, and Netflix, it’s underperformed analysts’ expectations. Zoom is worth half its valuation in 2020. Shares of Robinhood greatly underperformed since listing in July. Although we thought any publicity is good publicity, sadly that didn’t ring true and now with curbed fiscal and monetary stimulus, Robinhood’s monthly active user growth cratered in the third quarter due to plummeting crypto prices and meme coins such as Dogecoin which fell sharply.

These trading platforms take a large share of this untapped market. The retail brokerage had 21.3 million monthly active users but with its extreme valuation and lofty sales revenue estimates to drive monthly active user growth and declining customer monetization, the retail trading market may never be as strong as 2021 again to declining revenue. Robinhood has a steep hill to climb to redeem itself.

Retail by Rental

The retail investing segment has witnessed momentous unexpected growth last year. I’m bearish it won’t last along with retail trading yet crypto, NFTs, and alternatives will. They are terrific diversifiers.

Although we see a strong labor market, higher wages and healthy savings with a national quit rate of almost 4.5 million Americans reported in November, if you learn something about investing, it’s that nothing is guaranteed. The best lesson is losing money and retail traders learn that ASAP. According to a Bloomberg Intelligence analyst in 2021, retail traders accounted for 23% of equity trading volume. This is twice the amount in 2019 and to give you a rough estimate, this is equivalent to ALL hedge funds and mutual funds COMBINED!!

With an influx in traders, more financial literacy awareness needs to spread or else, RoaringKitty will start moaning. With more than 10 million new brokerage accounts opened in the first half of 2021 alone, this is around the total for all opened in 2020 according to JMP Securities.

As a female personal finance advocate, entrepreneur, and blogger, I will always lean on a more conservative passive side just to be safe than sorry. This is your money on the line, not electronic play money as many people my age don’t seem to believe. I urge you to always invest in yourself first and don’t believe everything you hear on TV, social media, Reddit, or what Elon let alone Robinhood says.

Robinhood is working in his own favor, not yours. Never spend more than you have, keep at least 20% of your portfolio in cash, invest at least 20% of your earnings, and never get too content or eager about the markets. Stay at the bay, keep your ego in check, and emotions grounded.

I hope this new generation, Gen I (Investors) will be able to diligently control themselves before their bank accounts start resembling the balances they had in March 2020 again. If it seems too good to be true such as a get rich quick scheme, then don’t get into it. It’s not worth your time. Instead, follow a foolproof way to invest to save your time, energy, and sanity by investing in ETFs and index funds that track a broader index such as the S&P500 or S&P600 (small-caps). It’s impossible to consistently beat the market so might as well passively invest while tracking broader indexes. You would’ve earned ~27% this year doing so. Not bad for little work on the side.

Pandemic boredom, too much external stimuli, and no financial literacy background make a dangerous formula. Cash may not always be king these days with inflation but always prudent to have on hand in case you want to take advantage of dips that are bound to come eventually.

Let’s see how retail trading pans out this year and if it’ll get crushed by a possible wave of the dot-com bubble.

Hopefully, it won’t be as hot as retail and spending itself. More returns nearing the billions are expected this year with early holiday shopping in 2021. With extreme pent-up demand, consumers and investors alike don’t know what to do with themselves anymore.

When in doubt, invest for the long haul!