Taxes are the rich’s worst enemy.

It’s not the fact that taxes take too much time to deal with or calculate in order to avoid fraud, taxes go straight into the hands of the government and rest of the country where who knows what happens next with your hard earned money!

It feels like giving a homeless drug addict a tip on the streets of NYC. You have to pay taxes but in the meantime don’t see any improvement with your country.

That’s the main problem with becoming rich.

The more you make, the more you spend on yourself and inevitably give to the government. This isn’t a free will donation, it’s an obligation not to go to jail. Although corporations such as Amazon, Walmart, Microsoft and most notably Apple have all invested in tax havens in the Bahamas to pay 0 corporate tax, every day Americans don’t have that flexibility and contacts overseas to hire multimillion dollar lawyers to get them into this funny business. Even if you hire Trump’s accountant for $4500 an hour who might help you get away with paying $775 dollars as Trump did, it’s still risky and illegal even though for some reason this billionaire, now more like millionaire hasn’t been caught or audited either.

Regardless, to sleep well at night, you don’t want to jeopardize your career and livelihood for not paying enough in taxes. I would rather be caught doing something worse like eating ice cream out of the tub.

In all honestly, it’s very hard not to get caught with paying less taxes because the IRS cannot keep track of 300 and counting million Americans and their receipts yet the more money you have, the more you will be monitored because of your power to pay less.

So it seems like there’s no advantage to being rich after all right?

Let’s uncover what really happens when you become rich:

-You earn more to spend more and end up having little to spare

-You give Uncle Sam his paycheck every year

-Money dones’t bring happiness

So what’s the catch?

Those who are really rich, meaning the wealthy, have strategies to pay less than a minimum wage worker. Yeah, you heard it right. It has nothing do with your IQ, rather negotiation skills, values and priorities.

If you save over 50% of your income, never fall into the lifestyle inflation trap, donate to charities such as clothes to cars, volunteer, live in a low tax state, spend less, own businesses where you can deduct your expenses to your business and do your moral duty of knowing you’re helping those who are living minimum wage get out of poverty, then paying taxes feels rewarding.

The strategies are made for the rich not the poor.

Dangerous or Dutiful?

Paying less taxes isn’t wrong or illegal, it’s smart. As with everything, moderation is key. If you go overboard and start charging all your Aruba vacations towards your businesses, never donate anything and earning deposits through PayPal not in lump sums as you should be, then that’s cheating the system.

You may or may not have chosen to migrate or continue living in this country for its perks.

America offers a variety of obvious advantages that many other countries don’t.

Most notably to become rich quick.

America is:

-Richest country = earn more = build legacy faster

-Innovative and experimentation

-Motivation

-Opportunties

-Diversity

But as with everything there are disadvantages:

-Everyone’s on their own, no community, extremely divided

-People enjoy cheating the system to not give back to the poor-fend for their own since they don’t know where their tax dollars are going

-Harder to start form the ground up because there’s a lot of pressure

-The richer the country, everything is more expensive

-Harder to conform

-The rich get richer and the poor get poorer

Yet, America may be the most selfish country due to the wealth inequality and lack of prioritization on helping the government repay its $3 trillion and counting deficit.

On one end, it does make sense that the harder you work, the less you want to give away your blood, sweat and tears to the lower class who didn’t work as hard as you did to earn your stage but at the same time, you could argue that a minimum wage worker working 3 jobs to make ends meet for their family is working as hard maybe even harder with no luxuries as a CEO making a $20 million per year.

It’s all relative and just because you make less, doesn’t mean you’re worth less. There are plenty of people in this world who got what you wanted instead not due to their brilliance, rather work ethic, something you can control the most since it requires no skill only effort.

Taxes for the Rich vs. Poor

A high salary means you pay less in consumption and sales tax compared to your overall net worth but typically more in property or income tax since you tend to live in an upper class era as you are a part of that demographic.

For the poor, it’s the opposite. A Pepsi is a high taxed item for someone earning a few dollars a day. You can check out the differentiates here. There are special tax rules that often allow higher income individuals to pay lower effective tax rates than middle and lower income tax payers if you own a business, the main reason.

Breaking It Down

Getting around taxes is impossible because if you earn something, you must pay but it’s not impossible to count it as a deduction or get away with paying less than the IRS wants you to.

Once you become retired, you have several options to use the money you’ll built and saved up your entire life.

When retired you either have:

-Pension, IRA (entrepreneur or independent contractor not issued by employer)

-Social Security

-401K (work for a company)

-Annuity (payment similar to insurance that you fund throughout your lifetime to receive money back once you retire)

These plans are either pre or post tax meaning you either pay taxes before you withdraw the funds into the account which can help you save from higher taxes and inflation when you became grandma/grandpa or pre-tax as with your 401K for example. In a traditional 401(k), employees make pre-tax contributions. While this reduces your taxable income now, you’ll pay regular income tax when you withdraw the money in retirement.

Now that we’ve gotten taxes out of the way when you’re 75+, are you curious how much your parents, you or the future you will give to Uncle Sam?

Inspection

The US government collects over $5.3 trillion in taxes each year which are used to fund stuff which unfortunately we don’t necessarily see changed for the better.

This ‘stuff’ includes:

-Public services

-Pay goernemtn obligations

-Proive goods for services

-Transportation

-Education

-Miliatry

On a yearly basis, Americans pay an average income tax payment of $15,322 since the average median salary is $80k in 2020 based on the most recent IRS data.

There is also a flat-rate tax credit that is refundable that provides the same level of benefit to all taxpayers regardless of income

Why the rich pay less:

-Exemptions and exclusions for certain types of income — for example, tax-exempt interest paid on state and local government bonds

-Special, lower rates for some income categories, such as capital gains and dividends

-Deductions for a wide range of expenditures,

-Corporate tax avoidance

-Never sell their holdings in their investments, being a day trader is risky and you pay income tax, ditch that modo and sell at a loss 5+ years out to pay capital gains tax instead if you have to

-Hold on to dividends, growth stocks and the top 1% are 80% passive investors 20% active

-Estate taxes opportunity

Covid Charges or Changes?

During the pandemic, the 500 richest people in the world, mostly concentrated in the US increased their wealth by $1.5 trillion as 20 million Americans became homeless. This has forced state governors to begin proposing new tax incentives to “punch a hole in the budgets of those who really deserve it” aka the ultra rich like Bezos and Musk.

According to Moody’s Analytics,

“After accounting for federal aid, states might need to come up with approximately $56 billion in spending cuts or revenue increases to balance their budgets through the fiscal year.”

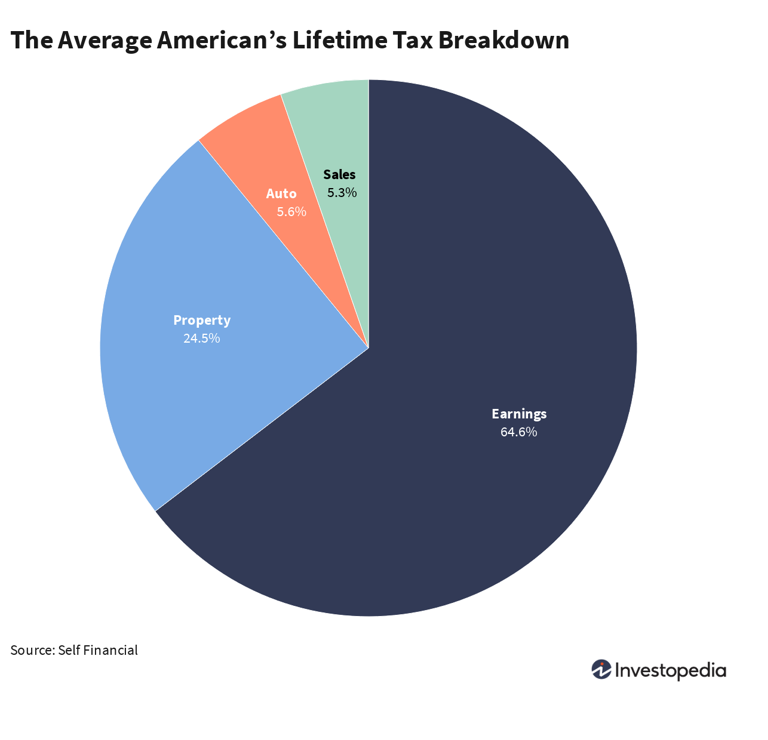

Since tax season is in April, let’s examine how much taxes we pay over our lifetime:

Based on expenditure numbers from the Bureau of Labor Statistics, the average American will pay $520,037 in taxes of 34% of their income according to Self-Financial.

You might be wondering, how could I pay half a million dollars in taxes when I’m not even worth that much swimming in debt?

Remember, due to inflation, in 10 years, $3 million will just be worth $1 million so you will be really paying $200k in today’s value equivalent to half a million in future’s value.

It’s also important to take note that this figure does vary state by state. For example, those in New Jersey will pay the most in lifetime taxes ($931,000), while those is West Virginia will pay the least ($321,000). In addition, the average American will spend close to $427,000 on personal spending (food, clothing, personal care, and entertainment), with 6.5% of that, or $27,761, going toward sales taxes.

Now I hope that scares you a little for the better.

Almost a half a million on personal spending for the average American?

Even though it’s right to work hard and spend appropriately to give yourself the best life you can, wouldn’t you rather see that money invested in the stock market and see it double, maybe quadruple in a few years?

Good things happen to those who wait.

If you sell your investments in less than a year, you have to pay the same rate as your income tax.

What’s the point?

Unless you invested in BitCoin or GameStop for a lucky trade, you most likely will pay more in taxes than profit!

Keeping your money invested, not spending it and saving as much as possible to ultimately reinvest it is key to growing wealth. That is the best way to reduce your tax liabilities and live financially free since taxes are gone whether you like it or not.

Love Hate Relationship

But before we all hate on taxes, let’s uncover why they might not be so bad after all, considering we love this beautiful nation.

Taxes not only help spur the economy since the lower and middle class can catch up and accumulate more wealth bridging the divide, the wealth will be evenly distributed across the economy and in return, the stock market rallies as well.

If you look at the stock market when the stimulus checks were passed, the major indexes rose to their record highs because stimulus means:

-Recession still here=lower interest rates=more borrowing=lower 10 yr yield=no selling of bonds

-People are focused on saving and reducing debt load

-Interst rates low = people can borrow nad psend more while they can

-Inflation isn’t here = fine for spending bad for economy

-Unemployment needs fixing

Who would’ve thought that paying taxes trickles down to the economy and stock market!

Fair for All or None? 2 Alternatives to Ponder

There are a variety of tax-system alternatives that mostly the rich become concerned with since they pay a lot. The less you make, the less you pay and as a result, the less you learn. Not so great considering the best investment is in yourself but oh well!

From time to time U.S, policymakers have evaluated alternative tax regimes as substitutes for or supplements to the US income tax. I don’t want this to go over your head since this is getting a bit in the weeds.

1) A flat, single rate of tax on all income has had its debates yet it seems most fair to charge all taxpayers the same rate.

However, according to Investopedia, “to raise the level of revenue required for government operations, it would be necessary to adopt a rate so high that the burden on lower-income taxpayers has been judged economically and politically unrealistic.”

2) If we add a value-added tax (VAT) or consumption taxes on goods and services this will require low-income taxpayers to pay more.

Even if these alternatives to the present system were deemed feasible, the transition from the present income tax laws to an alternative course does present challenges, time, voting, money and legislation. It doesn’t seem to be a priority for Congress or the Fed any time soon as they’re currently dealing with unemployment, inflation, interest rates and getting the economy back and running with the vaccine rollout.

So for all you taxpayers or future payers, buckle in, it’ll be a wild ride but with this knowledge you’re already ahead of 80% + Americans with no financial literacy knowledge who end up paying much more in taxes than they really should be. The IRS wants and will take advantage of those who don’t know.

You can still be a true, heart warming American who cares about their fellow citizens and still pay less in taxes. It’s legal and strategic when you have the brains.

Happy filing!