The beauty about investing is that no one really knows anything.

No matter how many guides, formulas, tabs, tools, terminals, charts, degrees, colleagues, subscriptions, mentors, one may possibly have at their disposal, it is extremely rare for investors to consistently beat the market.

It seems like an overstatement to say investors don’t know anything but in reality, there are just too many factors to keep track of and markets are completely unpredictable!

Weighing opportunity cost is a must in this situation. You could spend hours predicting a share price’s moves until some breaking news unfolds overnight and the price tanks wasting all your sweat and tears on your days worth of analysis!

From the weather to an allegation against the CEO, inflation fears to what Musk aimlessly Tweets, we are bound to feel uncertain walking on egg shells. Traders are only as good as their last trade. This causes an abundance of uncertainty, skepticism, and pure headache to arouse.

Some investors would admit they would die to consistently beat the market so their heirs could inherit their fortune. We confuse brains with a bull market which is even more deadly, something I advise this new wave of investors, the Robinhooders and Redditers to be mindful of. Since they’ve never witnessed a bear market, they conflate skills with momentum and an unexpected incredible year of devastation and fortune.

Who would have thought that within a few months past March 2020’s crash all major indexes would reach their all-time highs, hyperinflation would skyrocket, Americans would be flushed with savings, pent up fiscal and monetary stimulus would cause extreme frothy markets, too much money pumped into consumers pockets, and new asset classes and boredom would arise with money drawn into crypto currency (not a legit currency btw), SPACs, and meme stocks.

If you lost money since May 2020, I would be really concerned.

You either:

A: Were a fanatic day trader who threw darts in your sleep to stock pick (Monkeys are a better bet)

B: Excessively over leveraged yourself and bought on margin

C: Only paid attention to what the media or media moguls tout

D: Or didn’t invest at all

Investing these days is too easy. It is a gambling match, Reddit forum against the hedge funds. Truthfully, the companies that were high flying during January’s retail bonanza were profitable and in existence, some even with better financials and cash flow than billion dollar listed companies, cough cough Rivian, the newest hottest EV truck maker with nothing on the road, only in production with a current market cap roughly at ~$80b, with a b greater than traditional car manufacturers that have been in existence for decades such as Toyota, GM and Ford! Lucid Motors is up there too, behind Tesla’s $1 trillion dollar market cap.

The market is so frothy we have excess liquidity and angel investors bombarded by too many choices. They are investing billions into anything that sounds hip and cool such as Warby Parker, Allbirds, Rent the Runway, and the newest edition, SweetGreen and Chobani going public!

But this shouldn’t be a problem right? More money invested into revolutionary retail and overly priced salad and greek yogurt is kk?

Not exactly. Eventually this fantasizing will all have to come to an end. Just like it did with Oatley this week with supply chain constraints hampering sales and continuous lack of interest in oats. Thankfully the broader indexes do go up overtime so if you stick with a diversified index fund or ETF that tracks a broader market such as the DOW or S&P 500 you will be just fine long-term but most investors, especially younger ones don’t have the patience for that kind of investing. Their short attention spans will cause them to be in the stickiest situation going into 2022. Luckily Millennials collectively inherit $2 trillion each year from their Baby Boomer parents and or grandparents so they should hold up stronger in the coming decades.

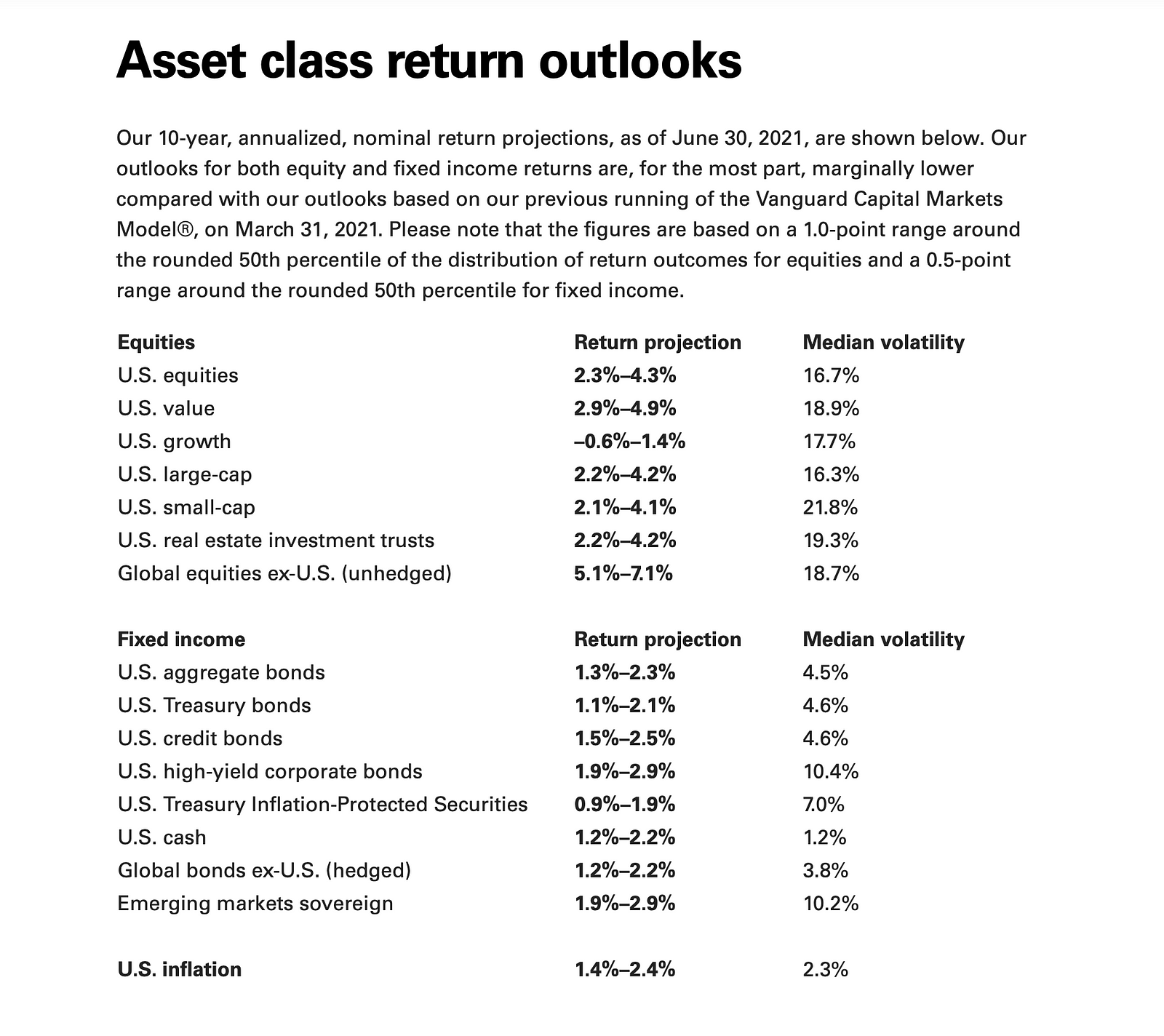

Several banks have posted their forecasts for next year, including brokerage firm Vanguard which has the most startling results. They expect equities to only rise up 2.3–4.3% and many firms only estimate GDP to rise 5% despite record retail sales up 1.7% and price increases to 6.2%. This is the highest price gain in 31 years according to the U.S. consumer credit report.

Is Wall Street too bearish after all this ‘too good’ news?

After all, consumers seem to be a bit blinded by inflation.

We are absorbing it too well. With excess pent-up savings and revenge spending, Americans don’t know how to hold off on their spending after this long, never having to deal with it at this magnitude before.

But for as long as we know it, if we stick with a diversified portfolio with an appropriate split between the largest and best performing asset classes which include but are not limited to equities, fixed-income, real estate, alternatives, REITS, small caps, commodities, money-market funds, there’s no reason to panic.

Taking emotions out of the equation is always your best bet as well, especially in the markets when no one knows what will happen next.

What We Do Know

Sure, you can do all the valuation techniques, crunching the numbers, charts, and graphs and Excel spreadsheets you wish, but after a while, even though the numbers and data are the best indicators and are known as assets in themselves, as investors, we need to look at the bigger picture. We must suppress our emotions and stop pressurizing ourselves.

The truth is we should expect it to be more difficult to obtain the same market returns, let alone higher ones next year due to uncertainty in the supply chain, inflation, Fed tapering, tax hikes, SPAC craze, EV world, climate change, the Great Resignation, retail traders, and all other indicators currently hovering over us. What’s uncertain is uncertainty so enjoy you gains while they lasts or in Elon’s case, sell what you need to sell now before the marginal tax bracket increases for those earning $400k in AGI per year or more.

But common wisdom is to buy and hold for as long as you possibly can unless you really want to upgrade your lifestyle and in that case, ask yourself how you can derive happiness elsewhere not just from money which isn’t a long-term strategy anyway.

Faring Better

I have to applaud Americans for their financial focus these past 2 years. I won’t thank them for their diligence in mask-wearing or vaccinations since this country unfortunately is more divided than I initially presumed pre-pandemic.

Disappointingly, as much as we seem united, every state is free for all and is their own country with their own rules. No wonder the U.S. has the most wealth inequality out of all the G7 nations, the most advanced industrialized nations, is the most politically disruptive and polarized, and has the lowest vaccination rates out of all wealthiest countries! The vaccination rollout turned into a bottleneck casino situation, a first come first serve basis and the U.S. still has lower vaccination rates companies to larger ones most notably China. Just look at Portugal, Israel or frankly any country in Europe, they are much more civilized and organized in their approach. Several Asian countries have mandated vaccinations and some governments will not cover medical costs. Smart move but unavoidable in the U.S. with an individualized private health care system. Maybe one day Americans can stop polarizing everything and not have so much time on their hands to bicker about everything and get started investing instead! That would make time fly by with not enough time for politics!

Anyways, for now, Americans are flushed with savings. The annual savings rate rose to over 20% last spring, the recommended amount. Not only we were hit with fiscal stimulus that came in the form of 3 stimulus packages $1,200 in April 2020. $600 in December 2020/January 2021. $1,400 in March 2021 but also on the monetary side with the Fed’s $120 billion dollar bond buying program through QE that pumped the markets and retail traders with cash, increasing inflation, meme stocks, and asset classes to their peak.

There’s no doubt the top 10% and above will always lead the charge with the highest savings rate since regressive tax doesn’t hit them as hard as for the bottom 90% and they are able to save and reinvest the rest of their earnings and not spend it on essentials instead, but the rest of Americans have caught up decently as well.

We were all quite surprised when the stimulus checks ended, the Great Resignation was in full-force yet unemployment was suspiciously high with record number of job openings, around 10 million in September.

Compared to a year ago, in April 2020, over 10 million Americans filed for unemployment at 14.8% now in October 2021, the rate was 4.6% according to the Bureau of Labor Statistics. The quitting rate was at 3% last month with 4.4 million who voluntarily fled the workforce. The demographics of quitters includes low wage workers, people of color, minorities, front-line workers, blue-collar workers, women and those with low ranked positions or middle management who evaluated their circumstances, health, paychecks, and found work solo or more lucrative comp elsewhere.

The dramatic turnaround in the economy took place once vaccinations were rolled out late 2020 but even prior to that, the stock market started catapulting and rebounding mid-2020 as investors were looking into the future, continued to stay diversified, and as much as possible attempt to avoid a recessionary pullback to continue the raging 13+ year bull market. Spoiler Alert: It worked in their favor more than expected.

The top 1% grew their fortune by over 60% throughout the pandemic and now the top 10% own more than 80% of the wealth in this country while the bottom 90% only own only 1%. These gains were all fueled by the one and only stock market. If you’re not invested, you will always work for your time and physical labor.

The stay at home tech boom, internet era, prioritization on health and finances, and adoption of work from home allowed investors to capitalize on sectors such as consumer discretionary, staples, tech, and financials within the M&A business that dramatically boomed with a record number of IPOs and SPACs these past 2 years.

Fast forward to today, tech is playing an increasingly larger role in our lives, specifically with the ubiquitous allure of FinTechs but some of the pandemic accelerated trades have been on a decline most notably Peloton’s treadmill. No pun intended.

Since the various manufacturing faults of Peloton’s equipment, most notably its treadmill which lead to deaths of children, it has been hit with various lawsuits along with supply chain constraints unable to deliver on time, and its decline of subscribers with pent-up longing for in-person activities instead. LiveNation and Planet Fitness have been booming since vaccinations took place and Peloton’s future is in murky waters, especially with their high luxury brand price tag.

I have a feeling Apple is eyeing them as they are looking to grow their position in the health fitness space with their Apple Health line. Zoom on the other hand needs to be zoomed into. It is currently worth a staggering $150 billion and it needs to find ways to either go vertical or horizontal or it may not last. Granted, we will continue to use Zoom past covid, if it ever leaves, but Zoom is certainly not worth more than SalesForce or close to Tesla’s valuation, although Tesla shouldn’t be worth what it is either. You get my point.

Anyways, the pandemic accelerated hot trades are past their peak at this point. People want connection and real life and are willing to pay an even higher premium for it. But those who got in their positions early, go to enjoy it handsomely, possibly buy their second vacation home, and get into the best financial situation of their lives.

Many investors have made handsome unexpected returns and are now yearning to enjoy it even with inflation tied to everything, specifically in retail and consumer goods, food products and gas.

I have a feeling loss aversion will come in 10x harder next year as investors are so used to only seeing their portfolio returns go up in the worst of the pandemic that any losses will be felt 10x as hard as their wins.

Oh well, the earlier we can stop equating emotions to decisions the better. This all calls for the advisor.

Lucky or Not

There are many reasons why people choose to work with a financial advisor.

It is beyond the conventional investing advice and to break the rumor, it isn’t only for those who DO NOT know how to invest. In fact, I’ll go as far to say it is for those who KNOW how to invest TOO WELL. Those who stick with advisors tend to be more established, older investors since they know what they want and have lived long enough to understand what investing entails. The choice between having one or not is not solely based on having someone do the trading and monitoring for you. It is much more in depth than that.

Whether you work in asset or wealth management, the wealthier your clients are, the more likely they are to want more help, even if they are advisors themselves.

Asset management focuses on investing and portfolio management where you are striving to diversify your client’s holdings and achieve their goals in the most tax-efficient way as possible. The client can be an institutional client such as a mutual fund, pension fund, endowment fund, insurance company, sovereign bank or a retail client, family or single individual. These clients are looking for someone to manage their money, evaluate their risk tolerance, time horizon, help them achieve their short/long term goals in a realistic way, NOT beat the market, fund their accounts, and make them dough.

At the end of the day, you can choose to trade yourself, work with a robo-advisor or work with an advisor. No one is smarter than the market and the resources they have may be helpful and proprietary but their traders are making the same kind of assumptions and bets as you are. They may have more Bloomberg Terminals and subscriptions to Seeking Alpha and The Financial Times, but that doesn’t mean all these facts, news, and metrics will aid them in making better decisions.

Sometimes less = more especially when information overload can deter one from making logical decisions.

Wealth management is much more comprehensive and involves various components of one’s overall financial situation. This is taking a overall snapshot of the client’s balance sheet. It evaluates their various income sources, businesses/properties, provides them an allocation split and risk tolerance for each, handles estate planning, taxes, helps them build their family legacy, inheritance, long-term strategies and goals such as retirement, college, weddings, etc. and help them manage their lifestyle appropriately.

This is typically reserved for wealthier clients as they have more assets, properties, businesses, ventures, etc. tied to their name. With more, it is advised to prepare and update your family and beneficiaries periodically about everything you own in case you are no longer here. Setting up a death toolkit/repository with everything they could possibly need if you become incapacitated and are no longer here is key. Make sure to back it up once or twice a month as well on a USB drive with multiple copies so your data (life) isn’t gone! From passwords, to SS, how to pay the bills, where to pay them, passports, checking/savings/bank accounts wills, trusts, inheritance, brokerage accounts, deeds, wishes, insurance, everything that is vital in your life, they should be aware of! No one wants to think of death until they have to. They will thank you once you set this up for them. It will make your and their life easier with good intentions. In this situation, a wealth management advisor can help you as well to keep your family prepared. Instead of a traditional asset manager, wealthy clients can also choose to work with a family office. The largest private philanthropic organization in the U.S. The Bill and Melinda Gates Foundation manages the exes’ wealth as they are obviously the main donors and contributors to the fund to supply revenue to the non-profit. Although this is a non-profit, it acts as a family office along with Cascade, a formal investment firm which manages their separate finances.

Pricing Plans

Younger investors are more skeptical of working with an advisor which is easily understandable. They are more risk aggressive, have a longer time horizon, believe they can beat the market more easily, have less to invest, and are convinced they don’t need help until they really do. They incorporate a bit more of their ego into their investment style. They don’t want anyone to manage it and foolishly don’t look to the future until they get an epiphany down the road realizing that 90%+ of their portfolio in BitCoin is not a safe move needing to then dramatically downsize overnight.

The largest hesitancy investors have with working with an advisor comes down to cost. There’s no doubt it’s annoying to have to pay someone to make you money. If we want something at the store, we buy it and there’s no extra free we have to pay, besides a tip in a restaurant or hotel, for extra service.

Yet managing money is about management. It takes traders, advisors, and a professional cohort to be able to design your portfolio for your life. There’s no one size fits all approach and although more investors are pulling away from advisors these days as virtually everyone’s portfolios are dramatically higher, this is also the best time to learn more about an advisor and what they can help you with in the long-term. Having a different perspective doesn’t hurt.

Before working with an advisor, it is advised to understand their policies, commitments, legal obligations, and unpack the contracts. Read reviews online and if their pricing stays constant. Do they make more when you make more? Are they a fiduciary? What is the customer service and response time like? And most of all, what are the fees? It would seem silly to get an advisor today when all major indexes are up, but that can also derail you in the future convinced that the good times will always last.

If we all could, we would prefer to invest on our own fully in control. Surprisingly though, even with the expertise, experience and insight, the ultra-wealthy still prefer to work a fiduciary and professional manager. They may be an investing guru and advisor themselves but it’s not a bad idea for someone else to look after your holdings for a different perspective and some stability. After all, it’s a full-time job to handle all these assets! Let the rich continue to pursue their dreams and hire someone to do it for them. While with lower-income individuals and newer investors such as GenZers, it may not be worth the price to work with an advisor just yet. They have a longer time horizon, less AUM and can afford more risk. Plus the fees will eat into their returns more and may not be worth it just yet but down the road with a couple reliable income sources, nest egg and plans, it should be a serious consideration with work with someone to continue building momentum.

The greatest annoyance I hear many young investors have that deters them from working with an advisor is that they make money no matter if their own portfolio looses or rises in value.

To that I say they have to! I myself work with an advisor and they are fully transparent on when and how they earn a commission. In order for the fees to not go over your head or erase your gains, make sure you are not only learning alongside your advisor, but questioning their moves, understand why it is PERSONALIZED not the same recommendation and picks given to their other clients, how they make your life easier, and most importantly ask yourself what they are doing that you cannot.

Basic Plan

If you’re still on the fence with working with an advisor especially if you don’t have much tied to your name and just started investing, it would make most sense financially to see what you can do on your own. There’s nothing wrong with owning a passively managed index fund and letting the market do it’s thing. Simple and basic wins.

Don’t strive to beat the market. Time in the market matters more than timing the market. You shouldn’t expect for an advisor to return more than you. They are here to add a different outlook and stability to your financial cushion.

Many investors working with clients most likely believe they are paying too high fees but in actuality, it will always seem like they are paying a premium since the more assets under management (AUM) one manages, the more expensive it gets up to a point. Does it require more work to invest a $1m versus a $100m portfolio? Certainly and the particular fees can seem confusing to most if they don’t dive into what type of help they are actually receiving.

Most advisors are paid based on AUM. This is the fee is based on the amount of assets-size of your portfolio, not the work per se. Advisors multiple their fee-typically ranging from 1.15–1.45% but let’s cap it at 1% for simplicity sake by the amount of money they’re managing.

E.g. Let’s say you have $1.5 million AUM with a fee of 1%. This will incur an annual fee of $15k per year.

This is a standard model advisors follow. If your portfolio rises, they do better and if your portfolio shrinks, advisors still have to be compensated in some sort of way through their job, they just collect a smaller fee that time.

In addition to AUM, advisors are typically paid an hourly rate by their brokerage and collect preliminary fees from their first year with a client. Onboarding a client requires more work at first since they need to organize their investments, paperwork, and assets in order to assess their situation. The first-year fee can be in the thousands to couple tens of thousands depending on the clients’ needs. After that, the annual fee will kick in through the AUM fee but once your portfolio rises up to a certain amount, you can get a break and the fees will have cap to encourage clients to stay.

For most brokerages and institutional traditional asset management firms, up to $10m in AUM, the fee is caped at 1% since no one wants to spend $100k a year alone in fees!

Help is always here. It has a cost but for your mental sanity, livelihood, and time, it may be worth it. Anyone can invest and spend the time to do so but it may not be worth it if its becoming a full-time job and distracting you from earning more.

Don’t expect the same gains and record performance next year. Never fight the Fed nor conflate brains with a bull market!

You got this.