Despite fears of a recession hovering around 40% as of August 2022, the Fed, Washington, and Wall Street don’t seem to want to acknowledge any signs of it and they may not need to!

Luckily at the moment there’s not much evidence of the economy faltering or consumers falling behind given the job market is so tight, unemployment is at record lows, inflation seems to have peaked, and for the most part, Q2 corporate earnings have beat the street’s expectations.

For anyone who wants a job and a higher paycheck this is the time to get one! With more jobs added back into the economy (~500k in July) than were lost at the start of the pandemic, now is the time to ask for what you deserve!

Who knows, we may be currently in a recession and not even know it! By definition all it means is two consecutive negative quarters of GDP. There’s no better time to start a business than during a crypto winter and bearish times!

According to economists, there’s never been a period in recent history or during any boom or bust cycle (2000s or 2008) where inflation is the main cause for concern while wages are still rising and the job market continues to be resilient.

Inflation tends to raise unemployment given companies must increase costs while balancing an increase in paychecks without going out of business all together. A once-in-a-lifetime unprecented pandemic caused the economy to recover, grow, and rebound in different ways this time. After all, history doesn’t repeat itself, it rythms.

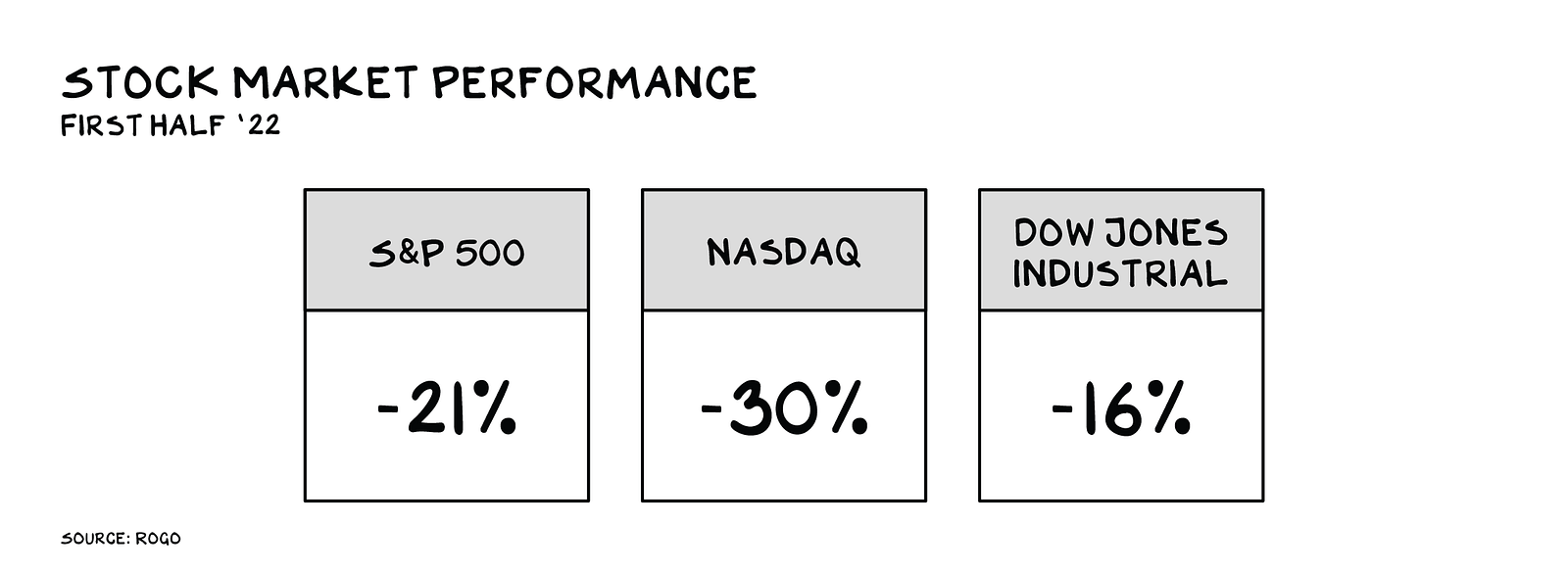

The main cause for concern heading into the fall from a consumer perspective is overspending from the summer YOLO months which can lead to higher defaults, overdrafts, and deliquincy rates down the line. Having rock-bottom interest rates for years, the expectation of higher borrowing costs which will slow down all kinds of purchasing also needs to be considered earlier than later. Since savings rates have already plummeting back down to less than 5% from a pandemic high of nearly 20% when folks were stuck at home and saved like their lives depended on it, it’s not a bad idea for consumers to look to fund managers who are tapping into safe haven assets these days. Although the 10 and 2-yr yield curves have inverted at times for the past few months, investors seek preservation and safety in the longer term treasuries yielding higher returns! Speaking of higher yields, since equities are jittery this year down an average ~20%, there’s never been a better time to lock in an adjusted inflationary GUARANTEED return of over 8% through I Savings Bonds issued by the Treasury Dept! There’s alway a bull market somewhere.

Although loss aversion gets the best of us, there’s a lot to be optimistic about, especially when you consistently invest in yourself. Given unemployment is near pre-pandemic levels, July’s CPI index eased from a 41-year high, the housing market is cooling off, and wages are rising above inflation, as long as the Fed can engineer a soft landing and not act so suddenly, it is highly unlikely it will announce it expects a recession on the horizon.

Recessionary fears can be mainly blamed on the Fed due to too much exhuberance and sleeping at the wheel since the bull run of 2020, acting too late to hike. The market is still pricing in at least another 50bps hike this year to curb the main culprit: inflation but thanks to lower gas and food prices, that may all change as well!

All Eyes on the Fed

Being able to control the economy’s money supply and live up to a dual mandate of keeping inflation at its target rate of 2% and unemployment as low as possible without plunging the economy into a recession is a tricky balancing act to follow. In the meantime instead of relying on whether or not the Fed can forecast acurrately or your fund manager practices what they preach, whenever there is heighted uncertainty on the horizon, which unfortunately arises every 8–10 years when a bear market approaches, controlling the controllables is in your best interest.

The way you spend your time, where you allocate your energy to, and how much you keep in savings through a 50/30/20 budgetinng approach are in your best interest to plan for the worst and hope for the best. Being reliant on a spouse or one day job can be dangerous to your financial health especially if you’re a part of the 1/3rd of Americans earning more than $250k living pay-check-to-pay-check.

As I frequently discuss, earning passive income through a defensible proof asset class such as real estate is by far my favorite source of appreciable income during any down cycle. This is not only for massive tax-advantages and a proof against inflation but having more flexibility, savings, opportunity potential, and a physical tangible non-fungible asset that you own provides the best piece of mind.

Given that not everyone can purchase a second property to rent out, tapping into real estate crowdfunding/sourcing can provide tremendous diversification and real estate exposure for half the work. Alongside gaining non-correlated exposure to the market, make sure your investments are fully diversified away from your main industry so your portfolio acts as a hedge not a mindless follower.

For example let’s say you work in tech, if you cannot pivot to one of the industries that are (practically) recessionary-proof, make sure your investments aren’t all in the FAANGs or at least invest in a basket of diversiified index funds that include a few tech giants but not all for an extra cushion.

In addition to appropriately balancing your investments with your earned income, although your industry may be stable, anyone can be replaced at any time so making sure you have several sources of income such as passive and dividend income are essential.

Now that you have a better understanding on how to bullet-proof your career and portfolio in any industry, these are the top industries according to various news sources, that are considered ‘recession-proof’ and offer the most job security during economic downturns:

-Health care

-Government

-Computers and information technology

-Education

No surprise right? What do they all have in common? They are defensible irreplacable fields. Medical care, education, online services to move the world, and a form of government are needed everywhere.

There’s no guaranteed in anything, even the markets however being aware of what you can control with a mental and financial backup are essential to becoming a recessionary-proof financially literate investor and leader!

Plan for the worst and hope for the best to thrive during uncertain times to come out even stronger than during any bull market!