When the beach house isn’t enough and the commute sucks, heading South for top-income earners not only for winter break is a no-brainer.

However for those who will have to welcome them year-round now, almost everything from food to gas skyrockets, evictions and delinquencies rise, and current homeowners are priced out, all due to the resurgence of wealthy business owners that decide it’s time to pay less income taxes and soak up more rays.

The East coasters would argue, what’s the point of earning if you cannot spend it right? We’re bringing tantalizing business after all!

There’s no surprise why wealthy Americans, business owners, investment funds, and Fortune 500 firms have relocated to sunny side Flordia, booming Texas, and the middle of nowhere in the heartland of America. Manhattan office space is currently weeping and bleeding billions.

Even real estate crowdfunding platforms such as Fundrise and CrowdStreet have seen massive demand, chasing new properties across the heartland and Sunbelt to capture rising rents into their juicy portfolios. Even farmland is being swept up for top dollar as if climate change never existed and vineyards are fruitful.

If I could take a wild guess, I would assume more than 80% of Americans would relocate if there were lower living expenses including housing, food, and school in addition to bottom-rock taxes, and the overall hassle with commuting and way of life would be simpler on the coast and priced right within the target range that would suit most Americans who earn $40-$80k per year, not catered to only those in the top 10%. Unsurprisingly, readers here have above-average financial acumen and as a result, may choose otherwise yet for the majority of Americans, they are squeezed to the brim.

Although places such as Florida and Sacramento are past their glory days with bargain-basement prices that blew past all of us at the peak of the pandemic when home buying was seen as a dangerous activity amidst the high infection rate in 2020, if you were adventurous enough and locked in a once in a century deal, you’ve most likely considered making larger financial changes and decisions by now based on that prized investment, especially if you’re receiving monthly rents as precious tax-deferred income! Way to go on that part! You didn’t waste time during the pandemic after all and put your spending power to work.

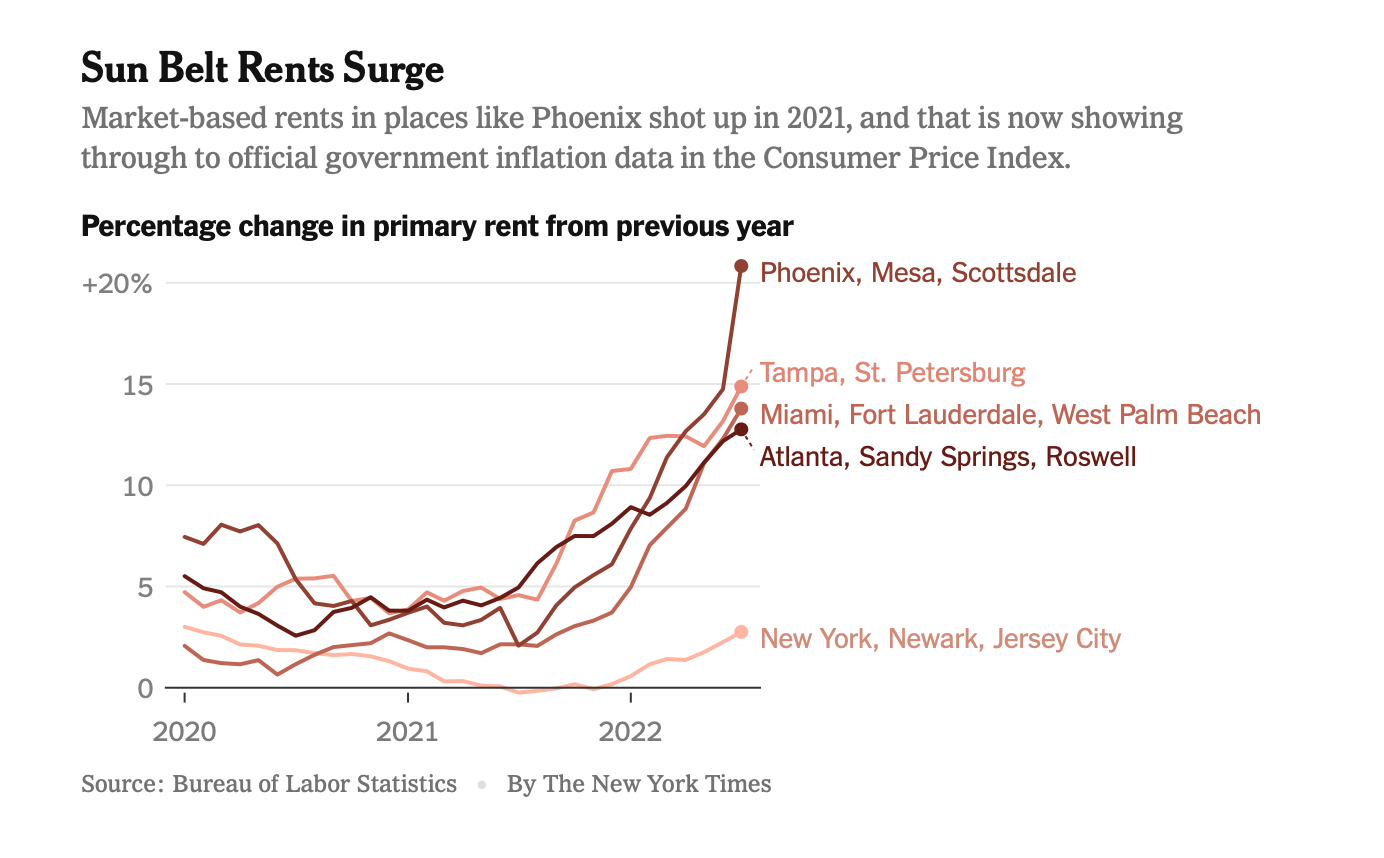

While in traditionally expensive coastal cities such as New York and San Francisco where demand has flattened out as well, bargains are nowhere to be seen. Hundreds of listings are getting swooped out of nowhere daily and demand across the board is ridiculous. Although home sales have cooled for the first time in years due to bumped mortgages, it certainly doesn’t feel like it especially here in the Big Apple where congestion has become the norm once again and locals are angry. I stood in the self-checkout line at the Union Square Whole Foods for 50 mins yesterday! This time the escalation and unexpected rise in prices have arrived, something Floridians and Texans never saw coming since demand tends to cool after peak travel months and for vacations or retirees buying periods.

How To Reclaim Your Land

Besides increasing supply to lower prices and bring competition back to normal, in terms of prices, all eyes are on the Fed to see if they can cool down inflation without spiraling the economy into a recession.

A soft landing is needed and although the Board of Governors and the Fed are hardworking Americans as well, they aren’t always with us since politics with legacy takes over first. When it comes to their rate hike strategies and how aggressive/dovish they are with engineering control of interest rates, the Fed seems like they’ve been sleeping at the wheel since they pumped billions into the economy in March 2020. If we can learn a thing or two from them it’s to never fight the Fed or rely on them.

Have any idea why so many businesses are registered in Delaware and Wisconsin?

The largest ongoing liability in our lives is taxes and for millionaires and above, it’s their largest expense and worst nightmare!! To run away from it is their ultimate goal especially since starting a business in the first place is all about reducing tax liability, increasing incentives, and ironically, taking advantage of tax advantages such as shelters and havens in the Bahamas! Maybe a second vacation home in St.Croix to monitor the zero-taxed fund isn’t a bad idea after all.

Why You Might Want To Welcome The Wealthy..

As a result, we all need to look out for ourselves and can only control the controllables which starts with our attention and time. City residents need and rely the most on the top 1% and above to support coastal cities such as NYC and San Francisco to boost tax revenues, education, and dozens of public services to continue to run smoothly. Due to the widening wealth and income gap, cities already look like they’re falling apart even with more billionaires than ever before.

As a result, up to a certain extent, it can be beneficial for wealthier folks to migrate to an area. It not only drives more revenue for businesses but incentivizes people in the community to work harder with a more resilient work ethic! Wages may finally stay above inflation!

If inflation is to blame, we have a laziness problem since if you can’t beat them join them, especially when it comes to the Fed or the top 1%.

As a proud life-long resident, instead of feeling bad for yourself, this is your chance to work harder as well. Since taxes are as low as possible in your desired destination where 1%’s crave, appreciate it since it isn’t found everywhere! Lower taxes = more pressure to work, which should be healthy, not bad! When you think about it, you have something the top 10% want: living in a lower-taxed state with beautiful weather! It isn’t always available no matter how much you have to work!

Not only is there more competition now to get you back on your A game, might as well make the connections you always yearned for that you couldn’t snag before due to the whooping exclusive entrance fees in night clubs and the Polo Bar in NYC.

But in all seriousness, dealing with a tick in prices is no fun, especially when you know others have more discretionary income and flexibility when it comes to how and where they spend without it breaking the bank. The key to real financial freedom and flexibility is not to trade your time for money.

To test if you’re really financially successful and can depend on yourself not some hike in prices to derail you, see if you can live the same way or even better while not having any massive homebuying spree from East Coast socialities ruin your lifestyle.

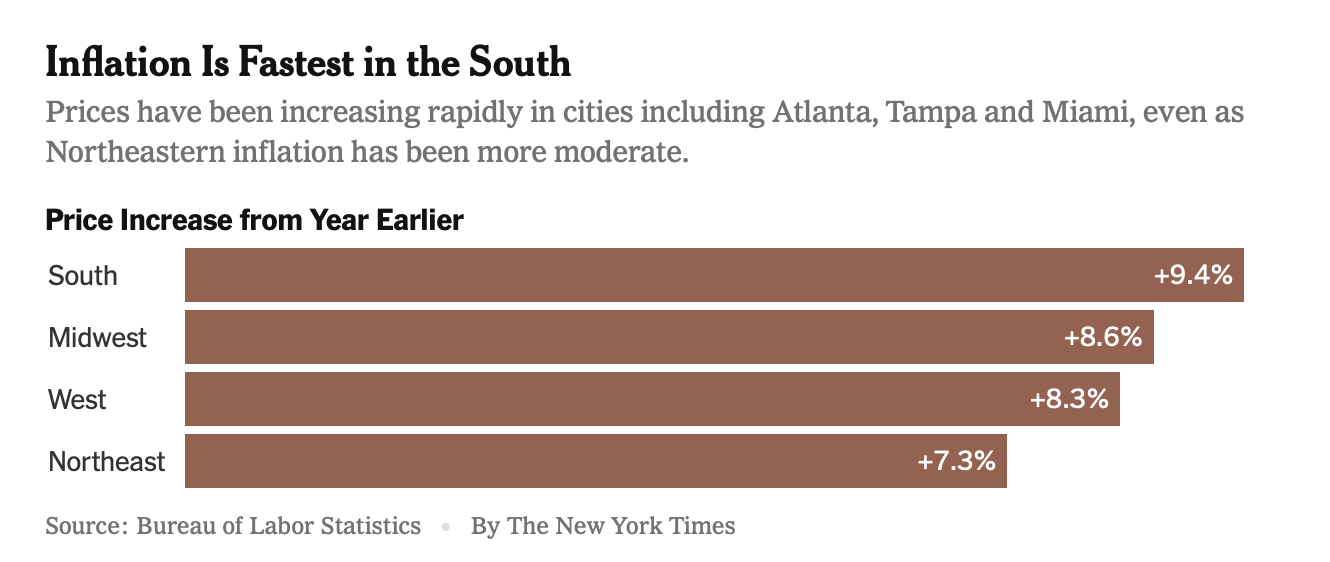

Given inflation is fastest in the South according to the Bureau of Labor Statistics, if you own majority of equity in your home with either preferably a traditional rate mortgage on top, not an ARM that resets to a higher rate every few years, you are on stable ground. Alongside this, make sure to always keep 6–12 months of cash equivalent to living expenses to truly stay afloat. You’ll be surprised how many billionaires are low on cash.

If you’re living paycheck-to-paycheck, earning less or hopefully no more than $250k per year, then inflation will bite you more than anything on staple goods since living frugally is most grueling for these folks due to the regressive tax system.

However, living within your means, contributing over 30% of your paycheck to your portfolio and retirement regularly and on a consistent basis, becoming more entrepreneurial, and not getting jealous of those newcomers around you is key. By the time you know it, you’ll get to their level someday!

If you’re a life-long, born and raised Floridian, having wealthier residents move in next door may not disturb the quality of life after all if you’re prudent and logical with your spending.

In fact, nothing should bother you if you have the emotional stability and mental fortitude to keep pushing and focus on what you can appreciate. If there’s one way to adopt this mentality, it’s from those who were able to afford to be your new neighbor in the first place.