Anytime I hear about fancy derivative products, packaged securities, or borrowing against equity, I picture the Great Financial Crisis of 08. Although I was only 8 at the time, 2020 was a sudden reminder of what it could’ve been like.

Although the housing market today is much more structurally sound and resilient with safeguards put into place for financial institutions’ lending standards and on the consumer front to make sure borrowers don’t bite off more than they can chew, when it comes to the most expensive purchase Americans will make in their lives, housing is something you should never mess with or test too heavily.

As I recently wrote about in my latest post on the data of new first-time home buyers in the U.S. putting a mere 6% down on their homes last year, with mortgage rates finally cooling and inventory expanding, hopefully, this indicator doesn’t stay flat at these levels forever. Once spring rolls around and home buying picks up, I expect prices to elevate and more serious buyers to put down at least 20%.

The GFC won’t be repeated in 2023 however when more Americans are considering taking out second mortgages while they burn through their cash at retailers, something’s off.

What I find strange about the financial situation of Americans are the conflicting indicators illustrated across the media. Of course, the news narrows in on what sells which are drastic and negative headlines, however on the flip side, it looks like Americans are spending like there’s no tomorrow! Try to get a ticket for virtually any event offered on TicketMaster and you’ll be waiting in the queue for days!

While financial literacy rates have been stagnant at bottom-rock levels for decades, spending sprees and record-low savings rates are fierce. Our finances are the last thing we want to mess with and it seems like the lockdown has made us a bit delusional. Luckily or unluckily, recessionary fears have cooled and this is sonly making consumers think twice. Alas, the good news is bad news once again so I guess all we can do is just wait for the Fed to make its moves at this point.

Second Time’s a Charm?

Since most Americans, affluent or not, tend to disregard the 20% cash deposit recommendation on a property due to limited emergency savings and cash on the sidelines, they’re already putting themselves into risky territory now if they were to follow the trend of taking out a second mortgage.

As the name implies, a second mortgage is when borrowers tap into the equity in their homes, similar to a HELOC (Home equity line of credit) to deploy that cash for various reasons, in or outside of the home. These borrowers will take out this lump sum at a fixed rate, normally for around 20 years while they would pay off the mortgage.

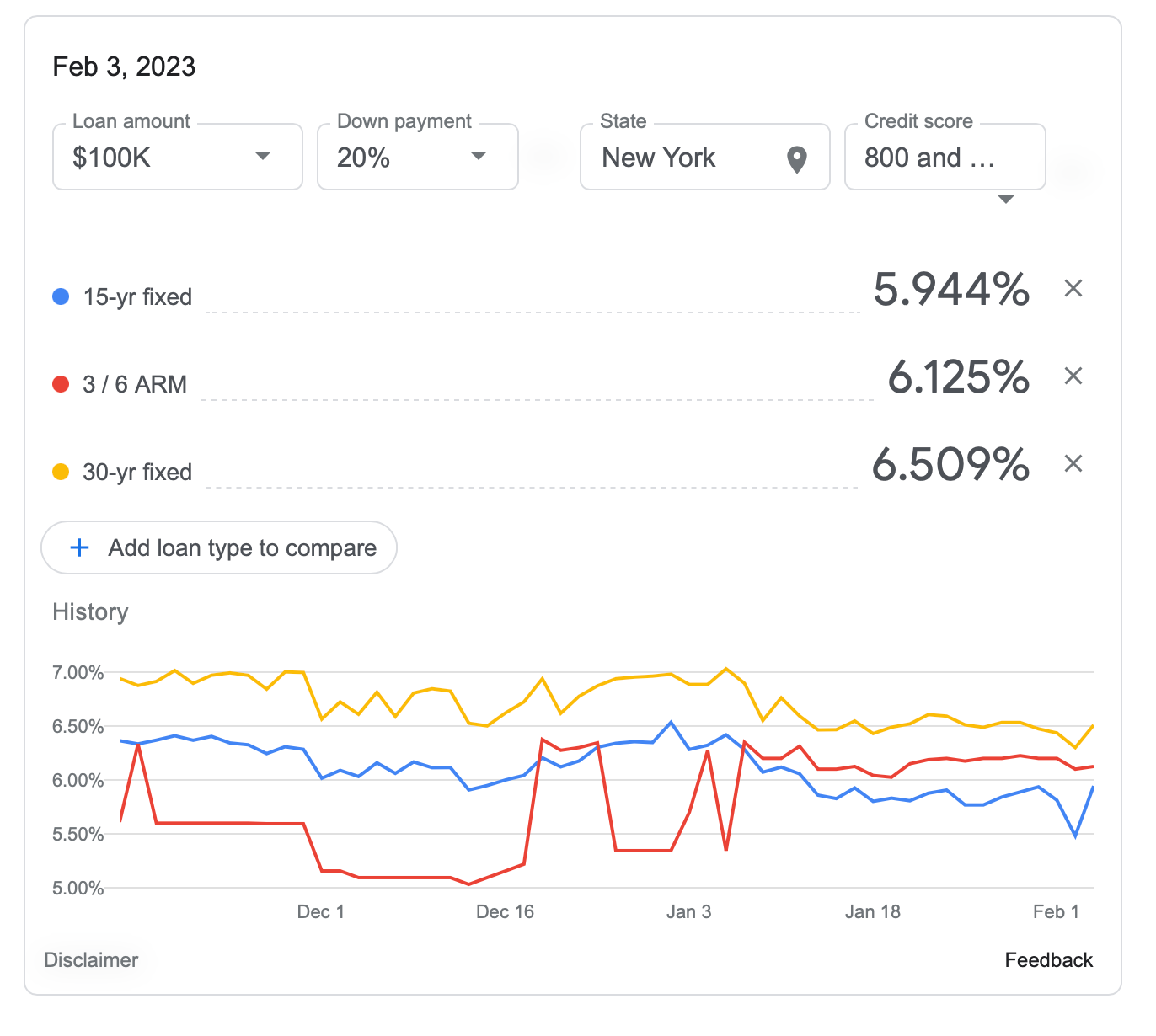

While the average rates for a 15 and 30-year mortgage have cooled nearing fall 2022 levels, if you’re dealing with an ARM which resets depending on the length, you’re probably feeling squeezed as inflation is still at record highs compared to a year ago and now adding another mortgage on top isn’t so stable, at least for the near term as monthly expenses will begin to skyrocket.

According to Google’s handy rate calculator, below you can see the average rates for a 30, 15, and ARM mortgage if you were to borrow $100k. Depending on how much you plan on putting down, your credit score, type of property, and other factors, it will vary but here’s just an example of what you can expect to pay today:

It’s important to remember, when it comes to real estate, many potential home buyers feel pressured to have a property in their name and officially own it. If you’re young, plan on moving every few years for work, and are unsure about sticking to one place for the next few year, you’re better off renting since owning anything doesn’t appreciate immediately, and oftentimes the costs towards owning a home don’t end up getting repaid until a few years down the road — I’m talking, 5–10yrs later, only if you maintain it properly and climate change doesn’t intervene.

Two Mortgages Double Trouble

Although borrowing against an asset can be a smart way to build your financial independence and get your feet off the ground, especially with real estate when paying 100% in cash isn’t always the best, you still owe something at the end of the day and when you owe more than you own, there’s heightened risk you can lose more than expected if not diligent enough.

Although keeping track of one mortgage is a hassle and eats into monthly costs already when you own several rental properties and need to keep track of them, it may not feel as burdensome since ideally, you hope your renters will pay off your mortgage for you on top of extra monthly costs such as maintenance, property taxes, utilities, and provide that extra income for you on the side. This may not happen right away, but the goal is to have everything paid off on the rental sooner than later to start generating positive cash flow.

Although owning anything is better than owing something, let’s take both sides of this argument and say if you were to take out a second mortgage. In this case, I would recommend it be best for second-time homebuyers, rental property owners or experienced real estate investors. You shouldn’t be taking out a second mortgage on your primary residence in which you already have a separate fixed-rate mortgage to keep track of.

If you desperately need to tap into the equity in your home and don’t own it in full, then possibly selling some of your losses at the right time or hustling a little harder in this gig economy when creating income is found in infinite ways online, should be the first resort. Even when you’re young and can technically take more gambles and risks, it’s best to start establishing equity in your home earlier than alter as time is on your side to eventually get to the path of owning an appreciable inflationary-proof asset.

If you take on a second mortgage ontop of your regular mortgage, you’re kind of trapping yourself since it’ll get expensive quickly and I believe you’re not using time to its advantage here of paying off one thing off at a time.

If you can handle both and desperately need that lump sum to fund other needs such as high-interest debt from credit cards, student loans, or gut renovations, go ahead. It may be better than tapping into your stock portfolio but it may not if it’s let’s say nearing the end of the year and you want to take advantage of tax loss harvesting to offset your capital gains tax or sell some underperformers when you’re in the most tax-advantaged income bracket of your life and have held onto your positions for more than a year when long-term capital gains tax kicks in.

As long as you don’t disrupt or tap into your tax-deferred retirement accounts such as 401k or post-tax accounts such as a ROTH or 529 to find that cash, you have plentiful options. Timing is as important as where to source it.

A second mortgage is no fun and not an option that would be top of mind or favorable. We’re living in an age when earning an extra chunk of change isn’t impossible to cash and doesn’t require so much capital, time, and physical resources upfront anymore.

In sum, with all decisions in life, weigh all your options, plan out a vision, and don’t rush into something just because it’s available or worst of all, popular. There are too many options being sold to you these days. You’re the only one who knows what’s best for you.