Although carrying any type of debt is worse than not owing anything, in this high inflationary environment, paying off debt shouldn’t feel as painful.

Given inflation eats up our purchasing power, the quicker you can pay off your dues and refinance today, the easier your life will be tomorrow. Historically speaking, although it may not look or feel like it, interest rates are still at record lows.

Debt is a true mental burden and can sabotage your financial freedom plan if one is not savvy enough. It can also be a hindrance when taking out a loan, funding a business venture, and be a damper to your credit score.

No debt, the better and once you’re debt free, you can borrow like billionaires against your holdings instead!

The Reasons Behind Staggering US Household Debt

Americans are not nearly as financially prudent as they claim to be. Online, it’s a totally different world as WallStreetBets, Reddit forums, and the meme stock short squeeze back in January of 2021 fueled an unhealthy enthusiasm for day trading, betting, and ‘get rich quick schemes’ instead of long-term patient investing.

If you’re a true investor, you religiously follow the golden rule which entails, if you don’t plan on securing your positions and locking up your invested capital for more than 5 years, with short-term capital gains tax and concern over selling at the bottom of the market, you’re better off putting your money to use elsewhere.

Luckily, the most generic asset classes, equities and fixed income aren’t the only investments to choose from! This can make the daunting process of allocating one’s portfolio more confusing or on the flip side, simpler since there are plentiful options for diversification that are less correlated to the broader market!

From real estate crowdfunding, farmland, infrastructure, artwork, and even physical collectibles, the world is your oyster when it comes to putting your money to work while not giving up your time and building a portfolio, as long as you are patient and savvy throughout the process will feel a whole lot more enjoyable. More risk = guaranteed loss at some point yet a return if you’re willing to wait. If it doesn’t hurt to save, save more and pay off those dues!

When it comes to most Americans and what they follow, they tend to stick with the general investment advice of either the classic 60/40 portfolio or what stands out a.k.a what requires the least amount of effort for the greatest return short-term.

To qualified logical investors, this isn’t possible and smells like an immediate trap. Anything that claims a guaranteed return, except for US Gov’t backed Treasury Direct I Savings Bonds isn’t accurate. Real investors know better in the sense that the more return one generates, the more risk they must take on with MORE effort not less.

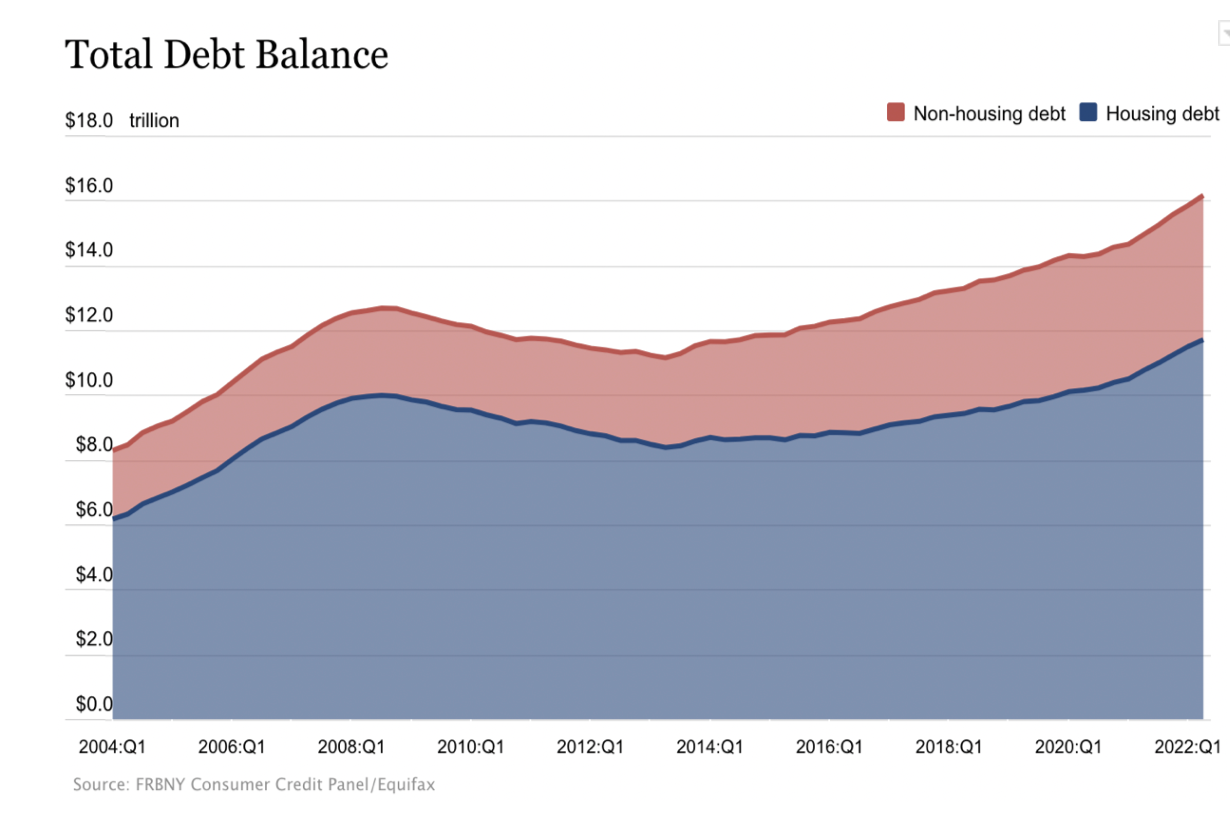

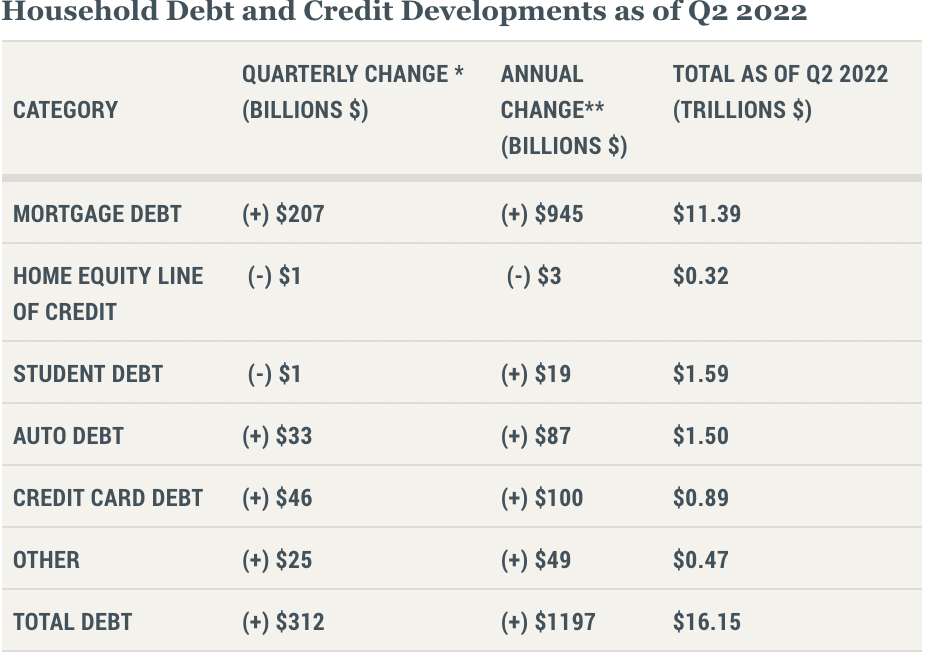

This inverted risk to return ratio concept can be the result of higher debt balances, lack of financial literacy and independence, constant stress, and delayed retirement for millions across the country. During Q2 of 2022, boosted by higher balances for mortgages, auto loans, and credit cards, The Federal Reserve Bank of New York’s Quarterly Report on Household Debt and Credit found that household debt rose by $312 billion, or 2%, to a total of $16.15 trillion.

In aggregate, this represents a $2 trillion increase compared to the fourth quarter of 2019, just prior to the COVID-19 outbreak! Despite stimis, unemployment benefits, billions in pumped up fiscal and monetary stimulus with cheap borrowing, and a wild market, savings rates quickly plummeted at the end of 2021 back to their pre-pandmeic levels of ‘living on the edge’.

Some good news at least — Americans on average are wealthier than pre-pandemic times since they own more assets than liabilities and have more equity in their primary residences. The creator boom also took off as this is a good sign especially as a looming recession may be on the horizon and working for yourself not depending on anyone can be your safest bet nowadays.

Largest Contributors of Household Debt And How To Get Out of It ASAP

The Fed’s report also noted mortgage balances jumped by $207 billion to $11.39 trillion due to rate hikes that are expected to continue into 2023. On the flip side, mortgage originations declined due to climbing home prices mixed with rising rates.

At least the most ‘healthy’ type of debt which includes mortgages, student laons, business loans, etc. anything one borrows that’s considered to be an investment in their future and appreciate in value overtime is better to be liable for. If auto or credit card loans took up majority of Americans’ debt balances, I would then be quite concerned that at least 70% of the country then hasn’t recovered from the pandemic and blew their savings and meteoric investment gains.

Next on the list are auto loan balances which have risen to $33 billion, and the volume of newly-originated car loans reached $199 billion. Car prices along with gas and food are major contributors to CPI and have all risen tremendously due to the supply crunch and Russia Ukraine invasion this year squeezing Americans’ wallets in the process. Owning a vehicle is in such high demand now that several notable rental car businesses that went belly-up at the start of the pandemic, specifically Hertz have not only recovered and are thriving with too much demand this time, but have become popularized meme stocks as well!

Last but not least, the real culprit and drag to one’s net worth and recurring cash flow is the dreaded and deadly credit card balance which rose to $46 billion. For the first three months of the year, prior to rate hikes, there was a 13% cumulative increase. This represents the greatest quarterly advance in over two decades. In addition, aggregate limits on credit card accounts climbed $100 billion, the largest increase in more than a decade totaling $4.22 trillion! We need to pivot to a creator instead of consumer economy as fast as possible otherwise Americans will feel stuck forever.

Now, if you owe one or numerous kinds of debt, I would suggest you first read what debt to pay off before anything and how inflation can benefit to get you started. As our purchasing power declines in this high inflationary environment, it’s more important than ever to take charge of the real drag, toxic debt as explained above.

There’s no quick fix towards paying off your dues so make sure you have a plan, payment schedule, and assess which one is holding you back the most from becoming debt-free!

Credit cards are Americans’ greatest dilemma and have been since they were available! In the 21st century, overdraft fees and skyrocketing payments can be partially blamed due to the rise of social media, advertisements, and enticing addictive personalized algorithms in our faces 24/7.

The grass always looks greener on the other side and rising delinquencies have become a major problem this year as virtually everything is 9%+ more expensive, not to mention deadly credit card interest payments that charge upwards of 14.5% on top of high prices. For your reference, the historical average yearly return of the S&P 500 is 11.58% over the last 5 years, as of the end of July 2022.

As the rate of delinquencies among subprime and low-income borrowers rises approaching pre-pandemic levels, all kinds of consumers need to watch out for themselves, even those living paycheck to paycheck in the top income marginal tax bracket. The good times don’t last forever folks. It’s a marathon, not a sprint!