The rush to save on taxes of all kind is no surprise to corporations and employees alike.

According to CNBC, 57% of Americans didn’t pay federal income taxes in 2021. The shift to earning more tax-advantaged passive and investment income is a trend that is bound to stay.

Hard-working Americans deserve to keep as much as they earn and in return, work harder because of it.

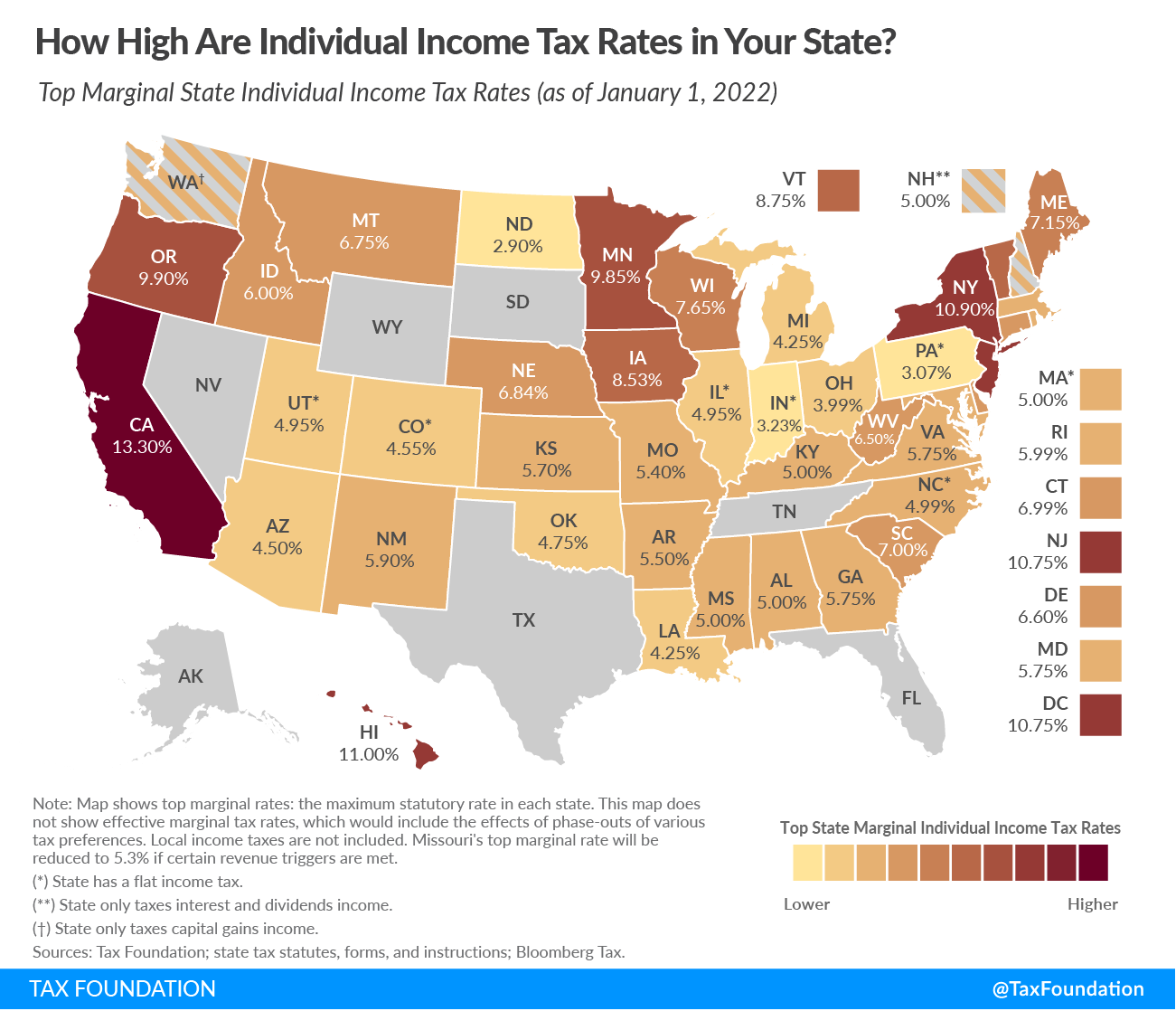

Since lockdowns in March of 2020 and the WFH revolution took off, many Americans flocked to lower-income tax states to get a greater bang for their buck, most evidently in real estate. While the home-buying spree soared across the nation, migration down south and to the west were most fierce. This also led to a wave of real estate crowdfunding opportunities in an effort to democratize real estate investing which I gladly took part in as well. No tenants to manage while having diversified real estate exposure across the Sunbelt is a win-win!

The massive exodus mainly took place on the east and west coasts as New Yorkers, primarily those who earn a top 10% income and above, flocked to the sunny skies and shores of Florida and Texas. Since taxes are our largest ongoing liability in life, might as well save on them while you can. These city dwellers either moved with their companies, established their own businesses there, or bought a second property to live out of for part of the year.

Although foot traffic today in NYC offices is slowly ticking upwards and tourism has retreated, demand for lower cost living is strong and isn’t going away anytime soon as long as the lucrative tax break is in place.

On top of no income tax, the weather is quite appealing in certain areas of the country as well. From those I’ve spoken to, what’s holding back New Yorkers from leaving the city is the sheer amount of opportunities and experiences that cannot be replicated elsewhere.

The Big Apple is irreplaceable after all and so are the attractive incomes offered here! There are many reasons outside of higher incomes that people stay in coastal cities as well. Especially if a bulk of your take-home earnings are generated passively, you are in a much more favorable tax bracket than anyone who would earn more W2 income outside of the city and at that point, housing costs, not income tax would be the most expensive obstacle.

One major reality to point out about saving on income tax which is a huge perk, especially for those who earn more active than passive income from investments or through their business is that there’s the assumption that moving to a state with a lower cost of living means everything is dramatically lower in terms of pricing across the board. Clearly, if that was the case, 40-yr high inflation wouldn’t be noticeable across the country! Prices always trickle down somewhere else and add up eventually.

The Case of Lower-Cost Living

Whenever something sounds too good to be true, I become wary and skeptical. I can smell a deal from a mile away but can smell a trap even closer. Especially when there’s a property as a bargain listing, something’s always off. Either the property taxes or maintenance are extraordinarily high or the neighbors are nosy and loud. There’s always a trade-off to something and you must be an investigator to find it out yourself! Compared to what you may have dealt with in the city, expect there to still be compromises made and the not-so-friendly budget to evident since no matter where you are, costs add up somewhere.

It’s easy to sabotage yourself when earning a high-enough income and you’ve reduced costs in one big ticket item of life such as housing. You feel free but on the flip side are likely to spend it on non-sense or discretionary things you could never justify when living paycheck to paycheck on a $250k salary in Manhattan. Remember, it’s not how much you earn, but how much you keep. Everything’s relative in finance so watch out for yourself.

The Great Exodus

A recent Bloomberg report that came out discussed this conundrum around moving to lower-cost areas of living such as Florida and Texas, two hot spots east coasters flocked to during the peak lockdown days to save up on taxes and get their tan on.

Not paying income tax is most opportune the more you work for your time (W2).

It can also help you save big time on the most expensive purchase of your life, a home, however when it comes to factoring in other expenses such as property taxes or sales tax, they may easily substitute for lower housing costs in these prime destinations since the reduction in income tax revenue in the state needs to be made somewhere!

There’s no doubt you can get more land for less in more rural areas since fewer people mean less business leading to lower incomes and less demand for higher pay overall, but be careful in the everyday expenses or other forms of tax that seem to make no difference, since in reality, they may be priced at much higher levels than in a city for instance.

In the most expensive states such as NY and California where high property prices are correlated to higher incomes, the option to WFH anywhere would be the most logical choice for a better quality of life, especially for a 2+ city family to move to more greenery, sunshine, and get more space without spending more on housing alone which is the most expensive purchase Americans will make in their lives.

When expenses are lower and you owe less in general, quality of life improves, however, only basing living costs on housing is leaving out a whole array of expenses, taxes, fees, etc. that don’t just disappear and need to be factored in!

Although a wealth transfer from the coasts helps boost business throughout various industries, as I wrote last year on current homeowners being priced out of their own neighborhoods due to wealthy city dwellers migrating to new neighborhoods, this is changing the landscape of these communities and economies, leading to higher prices, and causing concern about how dollars are being allocated and spent accordingly.

Moving is a true hassle in itself and assuming costs will substantially reduce simply because housing will isn’t the most strategic money move.

Factor in the whole picture. If you really know yourself, you will probably substitute lower housing costs for splurges somewhere else.

Budget accordingly, plan ahead, and make sure to find out about other expenses that didn’t seem to be as high elsewhere such as those property or sales taxes. Everything adds up. Pennies matter. Sometimes an easier way to spend less is just to stay put!