While managing your portfolio, there are countless factors to take into account. Everything from risk tolerance, age, short and long-term goals, and most importantly how much time you are willing to spend monitoring the market and indexes or rather pay upwards of a 4% fee for a broker to make the same bets you could easily do with a little time and patience.

Don’t ever tell yourself the excuse you don’t have time. If Buffet has time to read 100 books per year, you sure have time to spend investing an hour per week.

This is a question I’m dealing with currently. As I’m starting to make a larger paycheck through my side hustles as a college student, it kills me to know that our savings accounts only make roughly .01% if you are lucky through interest as opposed to the average return of 8% in the stock market.

I’m not the gambling type so RobinHood or E-Trade doesn’t excite me nor do I want to pretend that electronic money isn’t valuable and managing my money seems like a full-time job.

As I’ve learned a majority of my personal finance hacks and literacy from my trusted family who’s always had a broker since relying on the corrupt academic system is not an option, if I would like to save over 2k per month managing my money myself, then it would be my responsibility to get deep into the weeds.

There is this myth that you need to study/major/concentrate in finance/business/economics, whatever you want to call it to know financial literacy. Regardless of who you are or what you do, money involves everything we do. There is no backing out of it unless you want to live on a stranded island trading leaves for food.

Deciding Factor

Regardless if you do choose a broker to manage your assets for you or not, in reality, it may be a bad decision to do that forever. Sure, they have trusted traders and do this for a living, but regardless if they are managing 1 billion or your retirement fund of 2m, they will make the same trades for everyone.

The younger you are, the more you can handle on your own but the trade-off is, how much do you know?

Less experience = fewer returns but there is a longer time horizon to counteract those losses.

Personally, I manage my portfolio myself and have used a Robo-advisor for a few months. The choices and trades the algorithm made were practically identical to what I would do so as a result, I decided to work solo again.

Advisors, whether it is a Robo or physical trader make money based on how many trades and portfolios they manage, not if the stock market goes up or down. In essence, they will still make a commission if your returns go down. I would say that is the most frustrating part. They are profiting off of you even if you aren’t from them.

Testament

As much as it is easier to pay a fee and get your time and sanity back away from the markets, is it really that much of a trade-off?

My family has only used a broker for a few years after the housing crisis to test out the returns and compared to the high fees from Chase that were around 1.3% for >250k and sustainably less for contributing assets more than 1m around .9%, what came out of that was not in their control.

The market fluctuates daily and although there can be algorithms build in Python with special queries monitoring historical trends and predicting the future, what is most frustrating about the market is that it is really based on media coverage, hype, and emotion, just like our current president.

Sorry, I shouldn’t get political but you know I’m from NY so you know what to expect!

Since the stock market is trading in the future, hence the name, futures, not in the present, whatever you predicted already for tomorrow or today is in the past so no matter if you have expertise from working in the industry for 80 years or were just born yesterday, don’t have that high of ego because someone can easily outperform you simply due to timing. Sometimes my therapist does a better job than a trading floor trader.

The reason I’m bringing up these fees and the decision upon passively or actively managing your portfolio (safe heaven = life) yourself is because it is the biggest decision you will most likely make.

Besides buying a home or contributing money to your college fund, giving someone the opportunity to make you money and deal with your hard-earned assets is a tough decision.

It is like giving up your baby and expecting them to raise them well.

Deciding Factor

My rule of thumb is if you have the time, meaning a few hours per week to simply brief over your strategies, which doesn’t mean buying and selling, no day trading just checking over the market, keeping up with trends and the news, and making this a weekend side hustle, then you will save hundreds of thousands per year in the process without a broker.

If you make a certain amount that you think can go to waste for someone to do the same exact work so you can play with your poodle and finally spend time with your kids after burnout from working for all that money throughout your life, then go ahead and give the broker the paycheck.

All I know is that if I can do something with the option of saving my money, I will always opt for it because it is never a waste of time if money is on the line.

Plus you educate yourself in the process!

No better investment!

Remember, Time = Money!

Age Breakdown

Along with age, comes responsibilities that we never expect and don’t want to tackle but they just get thrown at us and we have to fend for ourselves to keep them stable and work for us.

There are very few things in this world that you need to maintain and consistently focus upon.

Along with your health, family/relationships, safety, personal finance is one of those key elements that is necessary for you to keep tabs on in order for you to achieve your goals and actually be productive and successful in your life.

Pushing aside money will never work because then your life will be pushed off a cliff in misery swimming in debt and loans.

Sure, you have a great paying job but if you don’t know how to manage that 100k salary straight out of college, might as well earn half of that to teach you a lesson.

When you are young, it is very tempting to want to make as much money as possible to buy things that movie stars and celebrities have, simply because of this thing called FOMO.

But when you actually ask your younger self, what did you want to spend, there is usually no real answer. Okay, possibly a pony or car but those aren’t realistic and after a day or two, we always get over it and want something different.

There is no definite age to start investing but your best friend in the stock market is time.

Time is an asset(valuable) and is money in itself.

People are jealous of time because we all want to buy it.

If it was available at the store to grab from the shelves, trust me, the smart ones would snag it and the poor ones would let it sit there and rot.

As we’ve seen the trendiness and hype over Robinhood especially during quarantine, when it comes to managing your hard-earned earnings and not playing a gambling game, it is better to move past that platform because it can get addictive, also known as its secret sauce, getting you to spend and waste more.

As you age, you hopefully accumulate more money, and dependant on what you do, where you live, who you are with, goals, and risk tolerance to name a few criteria, you will manage your money based on those factors.

As with everything, a plan is required and as much as time is your best friend, rushing will not help.

These days this thing called growth investing and compound interest are talked about.

They are important concepts but to start investing, you need to know the basics.

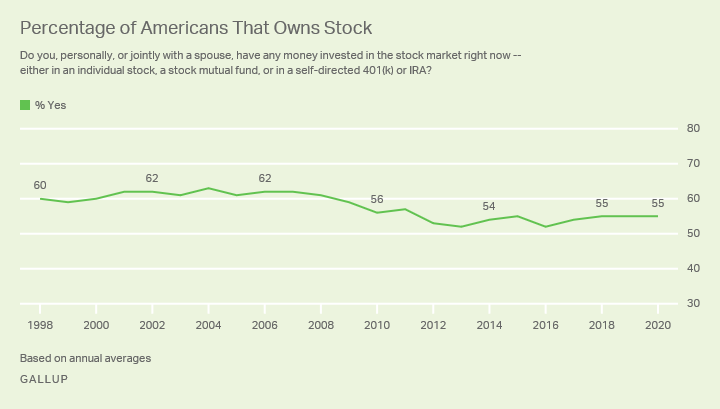

As recessions rise, the number of households that own stock dramatically decrease but overall, an average of 52% of Americans have some level of investment in the stock market today which ranges from funds in a 401k to a ROTH IRA but only 14% of families are directly invested in individual stocks.

Individual stocks are riskier than pools/funds or indexes so this isn’t a bad thing since index and mutual funds for example are less volatile, save time and headaches.

Stock ownership is strongly correlated with household income, formal education, age, and race which tends to be populated in liberal areas such as in big cities, most common in New York City where Wall Street is located and in San Francisco, another hub where most FinTech companies reside.

Quick Reminders

Investing is simply to make money. It is another outlet to provide you passive income, along with your primary job that can help you achieve your goals faster. Everyone has different goals. Some people want to show off and maintain an expensive Lambo and others want more space to live in the suburbs.

Regardless of your goals, you are in control of them and they never stop getting bigger, unless you are frugal and enjoy the little things in life like I do.

You aren’t in control of the market because it is emotional, but even though it is, you cannot tie your emotions to it even more.

Growth investing is a way to gauge the market using compound interest. There are certain metrics that can be applied to any amount of money that you choose to invest in the market.

My rule of thumb when trying to guestimate the best possible return for my money is:

1) Buy low, sell high.

This is fundamental that most people neglect becuase they are bombarded by news and are second-guessing when stock will hit its peak.

What is crucial to remember is whenever there is a peak, there will be a trough.

Don’t be so optimistic. That’s where people get stranded, especially during COVID. Expect the worst and plan for it so you can live during it!

Accept it and gauge yourself but don’t wait too long or else you won’t make a profit.

2) If the price of a stock is less than 5% of the purchase price, sell immediately. In particular tech stocks are the most volatile and this happens to them quite frequently because high risk = high return.

Since 08′ I’ve stuck with this advice and it’s served my family well. We went against the norm and bought high yield index funds during the recession and a few months later they reached their yearly highs!

Never underestimate taking rational, not irrational bets and being unordinary, but always keep an eye out when something is decreasing.

Most people obviously invest to grow their income and have many streams so in case they lose one, they have a backup along with their emergency savings, which I recommend 2 years of to cover living expenses so in the meantime if you do become unemployed, you aren’t struggling to support yourself and find another job.

This is very rare and quite disappointing. Almost 50% of Americans cannot cover an unexpected $200 expense. This is your top priority.

Single Option?

If you live off of risk and cliff jump, only wanting to depend on the stock market for your income, you cannot become a millionaire just from trading unless you invest at least 6 figures and start early.

It takes time and isn’t recommended to do so unless you are my age.

The best decision I would say with investing is to always plan for retirement.

I thought thinking about being a grandma at 19 was embarrassing until I discovered how much money my friends could be losing out on when they are 60. Simply by waiting 10 years to invest $300 a year or whatever the amount that is right for you, you could easily lose out on a 1/3rd of your earnings.

Retirement can be the scariest part of your life because you aren’t making money anymore, only relying on your pension and 401K/IRA you have been contributing to (hopefully) since 20 or 30.

Although it may be frightening to picture being that old as your health declines, you become weaker and fragile and have to limit spending, when you get older, you spend differntly.

The top spenders are 40–50-year-olds. It goes downhill from that and when you are 60 and beyond, you honestly don’t need much and life seems happier and better without work.

Unless you are an Uber driver as an 80-year-old grandma, you most likely aren’t filling up the gas tank every week for work, eating out less, and already have the amount of clothing that you need since you haven’t changed sizes and new technology probably confuses you.

There is less ‘Keeping up with the Jones’ which can be very relieving.

But regardless of this, starting with an asset allocation strategy in your 20s and 30s will set you on the best path possible so you can live your best retirement life.

We all are living like retired folk these days. Living at home, baking the 20th banana bread of the year, and getting missed calls from our family members and friends from the other side of the country telling us they are busy with work and Zoom University.

Quick Retirement Tip

Figure out how much you will approximately spend when retired and multiply that by 25.

I hear this all the time and honestly is a great piece of advice, except for the fact that you don’t know how old you will be or spend since it fluctuates yearly but is a great metric I like to start with.

But hold up!

What about pre-retirement? Shouldn’t we focus on our current lives first?

Of course today and living in the present moment is crucial, but investing in retirement is the first priority because it is the same strategy that should be used at every stage in your life.

Finally, the Age Breakdown

Late Teens Early 20’s

At my age, I would say this is the best time to invest. Sure you could have started learning about investing on Robinhood a few years ago but your concept and understanding of money would have changed by your 20’s.

You have a better grasp (hopefully) on what money really means and why electronic trading is a habit you should avoid to make your money grow and last long term, not casino Las Vegas style.

Why Is Robinhood Bad?

-Electronic money is less valuable-dangerous

-Dangerous habit of spending more than you have-easy to take out loans/debt

-No concept of how to plan, just furiously selling and buying like a day trader instead

Before considering how and where to invest, at this age, you have less income and a higher risk tolerance simply because you have a longer life ahead of you.

There are 3 main asset classes to invest your starter and all your money into:

-Stocks(equities)

-Bonds(fixed-income securities)

-Cash and cash equivalents

-Commodities

-Real estate

-Futures

-Derivatives/Options

Whether your money comes from your savings or checking account earned from a summer, part-time job, or even birthday gift, depending on how much you spend per month, it is important to have at least $200 in checking that is liquid cash so you can spend using your credit card.

If that is all you need per month, might as well earn some interest on it.

Each asset class obviously has a different level of risk and reward. Since you aren’t handling that much money at this time, your accounts wouldn’t be affected by a recession or booming economy if that were to happen because you have a long time horizon nd everything will even out.

With any age, diversification also is key. It keeps you from losing all of your money if one asset class goes south, similarly to the reason why multiple income streams are effective to have in case you lose a job or have unexpected expenses one month due to a leak.

Recommended Asset Allocation:

Stocks: 80% to 90%

Bonds: 10% to 20%

This is a safe and healthy allocation strategy for tweens. Especially when you are young, it is easy to get fixated on what is moving up and down, but it is important to simply leave your investments alone and let it do its thing.

At this age, you are also accumulating loans, most likely student loans. At this point, once you graduate college, it will be time to start managing and paying it off. That comes with budgeting which is another crucial strategy to have down pat.

For budgeting I suggest utilizing the:

50/30/20 rule.

50% of your income spent on necessities

30% discretionary items

20% stashed into savings

If you need to purchase a car or rent out an apartment, make sure the car is preferably 1/10 income and rent is no more than 10% of your income. This will allow you to live frugally and get closer to financial freedom because debt will only get larger through interest and affect your credit score if you put it on hold.

With retirement, as daunting as it sounds to think about at this age especially since 20 feels like an adult if you can contribute as little as 10% of your income or ask for a gift from your parents to stash into your 401k that would set you on the best path.

If you start contributing $350 per month for the next 20 years, by 40 you will have roughly $1m adjusted with inflation.

30’s

Now you are out of school unless you are still finishing up your masters or Ph.D. or even took a gap year from school, whichever path you take and there is no rush, it is most important now to remember to keep contributing 10% of your income to your 401k, manage your spending, attempt the minimalist lifestyle and start preparing for your career.

Recommended Asset Allocation:

Stocks: 70% to 80%

Bonds: 20% to 30%

As you age, diversification will be more important to have and your stock allocation will become smaller since it is less risky and you aren’t able to take on that many bets in case you lose it all.

Even if you’re now paying for a mortgage or starting a family, contributing to your retirement should be a top priority. Now ideally you would like to have your student loans paid off and trying to pay off your mortgage if you purchased a home.

You still have 30 to 40 active working years left, so this is when you need to maximize that contribution. Make sure to put in enough to get the company match in your 401(k) and consider maxing it out if you can. And max out your IRAs, too, while you’re at it.

Really Retirement-Focused: Your 40s

Recommended Asset Allocation:

Stocks: 60% to 70%

Bonds: 30% to 40%

It’s difficult to gauge what you are doing at this moment in time since everyone is on a different path but the majority of people (and once again this is what most 40-year-olds do, its not a stereotype), you are starting or growing your family and really getting serious about retirement.

Even if you’re saving for your kids’ college funds or continuing to pay your mortgage, retirement savings should be at the forefront of every financial decision.

You’ll need to save in aggressive assets like stocks to give your funds the best chance to beat inflation, which is the pace of rising prices in the economy.

Aggressive means investments that have a track record of producing returns and avoid deals that are “too good to be true” especially with FANGS-the tech stocks. As always, continue to max out contributions to your 401(k) and IRAs.

50’s and 60’s

Homestretch baby!

Recommended Asset Allocation:

Stocks: 50% to 60%

Bonds: 40% to 50%

A quick refresh, now bonds and stocks are pretty even at this stage. The reason being is because bonds are less risky since they are loans given to corporations and the government and there is a 100% return but less reward compared to stocks from companies that trade in real-time and fluctuate daily based on consumerism and trendiness of business, there is more reward with more risk and no guaranteed return.

For your retirement plans, workers who are 50 and older can contribute an additional $6,500 per year to a 401(k) — called a catch-up contribution — for 2020 and 2021. In other words, those aged 50 and over can add a total of $26,000 to their 401(k) or ($19,500 + $6,500) in 2020 and 2021.1 If you have a traditional or Roth IRA, the 2020 and 2021 contribution limit is $7,000 if you’re aged 50 or older.2

70’s and 80’s

The time has come.

Recommended Asset Allocation:

Stocks: 30% to 50%

Bonds: 50% to 70%

Unless you love working which I don’t blame you since retirement does get boring, you are most likely retired now and you need to shift your focus on budgeting and laying low. But this doesn’t mean not enjoying your life. Focus on stocks that provide dividend income and since you have time on your hands, it isn’t a bad idea to manage your portfolio if you’ve always relying on a broker to steal money away from you all these years.

During retirement, you will collect Social Security/Pension benefits from your job which you will be able to handle at your own discretion and must figure out on your own what you need.

Planning for the future can seem daunting since what is certain is uncertainty. No one can predict the markets and the future. That may be a good thing since something is always unexpected but in order to be safe, prioritizing and envisioning what you want life to look like at 70/80 will put you on the best track. The only people that are losing out are the ones that make fun of you for starting. It is never too late to start and the worst time to start is tomorrow, the best now.

What are you waiting for?!