If business was only about numbers and stats, we wouldn’t be anxiously selling on bad news and buying on promises. The stock market is all driven by emotion, plain and simple. The amount of publicly traded companies has substantially declined over the past few years due to an illegal monopolistic system. This makes shareholders, stakeholders, investors, and managers choosy and more skeptical.

Fewer Options = More Frustration.

The beauty of life and the stock market is that it cannot be predicted. Regardless if you own a Bloomberg Terminal or $600k specialized tailored Python hardwired algorithm mechanism to predict the future, neither will be completely correct.

That is where the stock market is based upon emotion, all about intuition and what we are waiting or anticipating for, not what might really happen.

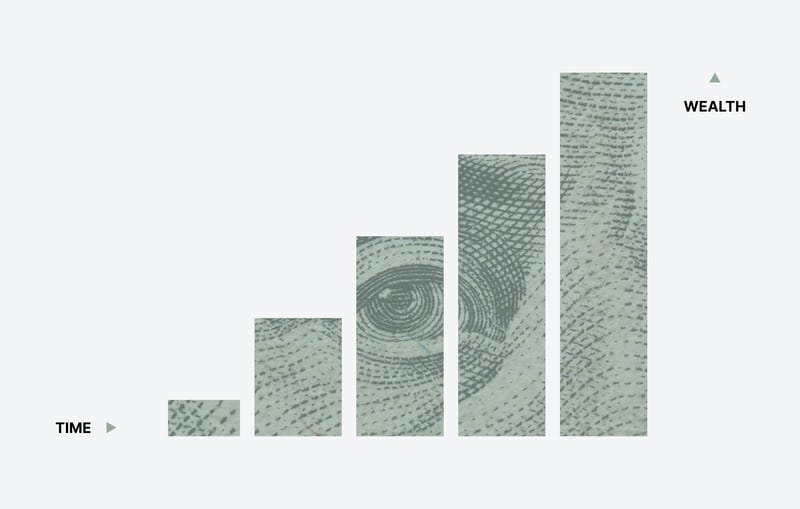

Obviously, the main reason to trade in the stock market is to make a profit through either owning shares or dividends. It is a classic route people take to earn passive income but those people are already separated from the rest of the clan, educationally and income-wise.

Roughly 52% of people own stocks since 2007 and as of 2020, the top 10 percent of Americans owned an average of $969,000 in stocks. The next 40 percent owned $132,000 on average. For the bottom half of the families, it was just under $54,000.

The more money you have, the more you diversify, (usually know more) and hack the deadly liability system of taxes. Suddenly, if you became rich as Ray Dalio with an estimated net worth of 20 billion, and I asked you, what would you do with that money, your answer will determine if you are should really earn it.

There are 2 answers:

1) Invest it so I pay fewer taxes, diversify, increase my income streams and of course, treat myself here and there

2) Spend it on whatever the heck I want because I’m a billionaire now. I will keep it in investments too and never need to worry anymore because I’m in good hands.

For someone who has basic knowledge in finance would not be able to differentiate which one is the bad choice. If you have a plan, know exactly what making money entails and take advantage of your money to grow, even more, then this is a joke.

The correct answer is 1. Regardless of how much money you make, if you have no idea how to manage or spend it, might as well not earn it. Managing is more important than earning. No wonder college drop out athletes go bankrupt after their first paycheck for the season because they have no concept of sustainability and a long term mindset.

When you have more money, means you have to make more choices that can affect you a lot more than you think. You have overconfidence bias that nothing can happen if you put a little extra in that volatile stock each month or splurge for a couple of months because you feel secure nothing can stop you. Having too much money is a bad thing as well.

People don’t want to become rich, they want the lifestyle that they think the rich can bring them.

Your education is the best investment because it for sure will appreciate and can be applied to your own investments.

Choose Wisely

There is no legal way to get around taxes besides hiding your money in a Caribbean island, moving to a less high taxed state, put all your money in the stock market instead of cash, earn less, charge all your expenses to your business, report your losses and or donate to charity.

Back in middle school, I first became introduced to the stock market and the world of business. We learned how to trade on a friendly, non-bombarding algorithmic platform, compared to RobinHood which practically trades for you and makes it the easiest to spend money.

This class taught me how to buy, sell shares, and use options. Not recommended at age 13 but I still became exposed to gambling, ready for Vegas senior year. Typically in economics class, you would learn, well, about the economy but the markets were strictly for math class.

First Lesson of the Day:

The Market Does Not Equal the Economy

If it did, it wouldn’t be reaching its all-time high and rich people would start complaining instead of growing their wealth at 10%.

Since economics is more about behavior patterns and decision-making towards purchasing goods, opportunity cost, supply-demand and how the world functions within a market, it was strictly separated as a class. That not only made me less inclined to learn about the markets and eventually my intended field of study at NYU, but concerned no one would like it or get involved.

Spoiler Alert: It happened. There is a tremendous gender gap in the financial literacy space and it’s the 21st century.

Long Overdue

Since I was never a statistics, mathematical nerd, I figured since school taught me they are separate, it must be true. They ingrained in my mind that business was charts, Excel, and trends all day long and no human behind the screen, goal setting, creativity, insight, or fun until I discovered what goals are.

We all have them, and depending on what you want, they differ between each individual.

This gets into the field of personal finance. A job we all eventually have to take on but most of us step on it once it’s too late drowning in student debt and car loans getting ripped off by brokers.

Now as I’ve grown up and purchased a long overdue Medium membership, my trusted source for financial news, (unfortunately?) all I read about is, how to became financially free by 30, or how I quit my job and retired at 25 or what I did to beat the stock market since 08′.

This is all great insight but that cannot be applied in most people’s contexts. We aren’t all freelances with an immense amount of time, energy, and effort to do this.

Yes, I understand, if Elon has time to read 10 books a month, we have time to learn about personal finance and become another scam entrepreneur dropshipping on Amazon, but what if we don’t want to do that?

There seems to only be one solution to becoming financially free. Following the trendy articles that never apply to our situation.

Financial advice should only be personal advice.

So how do you do that?

General as possible. Don’t tell us how many times/days we have to grind or who to contact for referrals for the best broker, instead list out specific index funds, what are the rates, etc. Get to the juice so it can be personalized.

As much as money seems like a taboo subject to strangers, in the industry, it really isn’t because until you step inside the finance world, you will see how much people brag about making x amount on a bet or hacked the system.

But to do it right, let’s see how much you can keep those distractions at bay.

Everything is in your control and you must block out the noise in order get somewhere.

Myth #1: Quant Heavy

Regardless of what you study, from ecology to architecture, the earlier you can understand what credit cards to budgeting is, the better. My colleagues believe that learning finance once they buy their first home and apply for a mortgage rate or graduate out of mom’s and papa’s, they will learn somehow when they work full time with no time.

That makes sense.

You have nothing to loose and only things to gain when you start now.

Excuses are holding you back and made up in your head.

So where do I actually start?

Well, although I kind of bashed Medium articles on finance, I will provide my top tools:

-Seeking Alpha

-Investopedia

-Morning Brew

-YouTube, YouTube, YouTube

Simple. The internet overcomplicates things and makes our life harder. Stick to a few and it will get you ahead of 80% of this nation.

Myth #2: Fun

When money is involved, it shouldn’t be a game. It is business which means hard work and diligence must be aligned in order to produce meaningful and realistic results.

If you want to have fun with money, build a lemonade stand or go to Vegas.

This isn’t gambling. You worked hard for your money, don’t be stupid and start playing ketchup with Robinhood.

Myth #3: I have to know everything to get a job in finance/business

As with exercising, eating right, learning the piano, and establishing any healthy, beneficial habit for yourself, we are lazy creatures. We want to feel good and accomplished but at the same time don’t mind losing out on opportunities and feeling bad.

With finance, you don’t put it on the back burner. Along with your mental and physical health, personal finance is the only tool you need to know to achieve your goals and get the life you want.

It doesn’t mean making money because that won’t buy you anything unless you know how to spend it.

Same thing with saving. Don’t save and be frugal to just let cash sit there. Reinvest it into the stock market for returns, otherwise no point in having money after all.

The finance industry is one of the largest industries with a variety of sectors ranging from investment bankers to analysts, researchers, hedge fund managers, private equity, sales, trading, derivates, M&A, you name it, there is a spot for you.

Business is all about diversity, in a different way. Yes, it is still predominantly a white male-dominated field filtered through connections but it is certainly getting better. Long overdue.

On the other hand, diversity is found across all employees. There is this myth you need to study finance to get into the industry. In fact, if you study something else, it’s a bigger advantage for you to provide unique insight with an open mind and point of view. Imagine only working with people who’ve done accounting. No new holistic inspiration will come out.

The company will suffer. As a result, this is why they prioritize diversity, not sustainability or mental health, yet.

#4: Demanding + High Paying Job

Obviously, you invest to make money, get a job to use that money to invest, and invest to make more money. It is a cycle that people follow that most in the finance industry.

It is an industry full of making money and the top reason why innocent, uneducated teenagers will ‘fake it till they make it’ to apply for this field. But it is no easy ride to become an MD or partner.

As with every project and job, you need patience, diligence, a strong work ethic, and resilience to weather the storm. It is a lucrative business if you can get the job done. If you graduate with a Bachelor’s you start out as an analyst, then slowly make your way up as an associate, if you graduate with a Graduate degree you surpass the analyst position, then dependant on the firm, can become an MD or put into various other positions and transfer at any time to various departments.

As in life, there are various paths that you take, and isn’t linear but the last thing you should think about earning is money. That will tilt your perspective, work ethic, and motivation.

Impact is the result, not the paycheck.

#6: Stock Market is Volatile

No doubt about it but it is in your control. Depending on various factors in your current situation, you will have different intentions in mind.

As a teen, my risk tolerance is much higher than my grandma’s simply because I will live longer and the losses in the market will vanish within the peaks. As a result, my grandma requires more diversification so if volatility comes, she won’t be broke. Unless you are strictly betting options or hedging, investing should always be made for the long term to avoid volatility.

Benefits of this include:

-Not being beaten by your whole portfolio just because of a single tech stock plunged on some media coverage or trends

-Have to pay capital gains tax or withdraw fees the shorter kept in your portfolio

-In the long term, the stock market always outweighs the losses and especially during recessions, outperforms.

Unless you are a teen learning the ins and outs about buying and selling on Robin Hood, your money needs to be invested long term and sustain you for the long haul. It isn’t a game nor going to defeat you if you are patient and resilient, the same traits that you must embody to work in this field.

Finance is not a scary field with grueling hours, harsh managers, no sleep, and tough clients unless you want it to. There are many sectors a part of this industry and there is only one you need to be a part of, your personal one.

I urge you to take time this holiday break as we transition into a New Year to make it a priority to re-evaluate where your investments are aligned and if you are on track to achieving your short or long-term goals.

We are all on a different path but at least we know what to do now.