Luckily, one’s net worth (total amount of assets – debt) tends to increase with age.

Yet that also means rising living costs and inflation (decline of purchasing power of money) comes crashing in during periods of economic stability and low unemployment, a phase of the economic cycle we will endure in the new few months as the pandemic recedes.

With the average net worth of around $748,800, net worth tends to increase with age as assets appreciate in value over time and salaries grow over their careers.

Although 90%+ of American’s net worth’s are tied up in their primary residence, this can also be dangerous especially when cash is needed and diversification in one’s portfolio.

The new $3 million is only $1 million as the Fed forecasts inflation to be around 2% once we reach herd immunity. That not only brings interest and mortgages rates higher pushing bonds prices lower so it becomes harder to borrow and attain a higher net worth, but with the competition and competitiveness of job markets these days with a growing population, it is harder than ever to stand out.

Luckily, there are quick, efficient ways to hedge against inflation and actually let your money grow without going in the wrong direction.

Housing Boom

My top pick for growing consistent, stable passive income has always been real estate. Over the last two centuries, about 90% of the world’s millionaires have been created by investing in real estate. It is the easiest way to develop consistent wealth over time as there will always be a need for housing which drives rental prices higher and demand for land.

The beauty about real estate is that you can take little risk with lots of reward. Not typical for any other asset which you can investigate here.

Top Reason Why Real Estate Is A Top Asset To Hold:

-Always appreciates long term

-Outperforms stocks

-Less risky and volatile

-Consistent passive income for decades

-Able to control and negotiate price

-Tax advantages

-Leverage

-Less risk = More reward

-Take out a mortgage-higher loan than paying on margin

-Guaranteed passive income

-Always in demand

Finding the right strategies to earn steady income besides your earnings income which cannot go higher up to a certain point is tough but not as complicated as one may think.

From real estate to investing, crowdsourcing and REITS, there are thousands of opportunities to seize with little to no money upfront.

Net Worth Debunked

Becoming obsessive over your net worth is not necessary and unhealthy. Although the stock market has been ‘sketchy’ for the first half of 2021 with ‘Gamestopable’ trades, it’s important to take a long term 30k foot view over your finances.

Planning for the future is always key. I would avoid being an active investor as much as possible since your chances of winning big like RoaringKitty are very slim.

Don’t take it from me, take it from historical metrics and data. Passively investing 90%+ always beats out active investing and the market long term so save yourself some headache and just stash your money into a high yield savings account (high interest), target fund (read here), Roth IRA if you make under a certain income, sit back relax and wait till retirement.

If you save roughly $30k per year for 25 years with a 7% compounded annual return, you will have $3m by retirement.

Tracking Net Worth

Tracking your net worth over time is a helpful indicator to evaluate your financial stability, since it indicates the value of everything you own minus your debts.

From owning a mortgage to paying off those pesky student loan debts, your net worth could be dramatically different every time you get closer to getting rid of all debt and might not be as high as you currently expected.

I personally check my net worth on Personal Capital (not sponsored) where all my accounts are linked from Chase to Citi Bank and I can manage all my assets, time horizon, risk tolerance, adjust and using hypothetical situations if I needed to take out my money or if the stock market tanked tomorrow.

It’s a really helpful indicator all for free.

Since personal finance is personalized, it’s completely up to you with what system you use to track your spending.

Even the timing of everything is personalized but in order to be on track and adjust your weightings and asset allocation, I would suggest do a background check every month, just like you do with your bills.

Whether you prefer tabulated all your expenses, bills, accounts in Excel or checking all your accounts on different sites one by one, what is universally done by every wealthy investor is become their own financial accountant.

I speak wih my financial advisor at least 2x each quarter to see if I need to reajudst my holdings. It gives me a peace of mind and keeps me sane to know that my money is working for me and I have a cash cushion.

You get out what you put in. Just like in a job, if you don’t invest in yourself, the company won’t invest in you so make it easy on yourself down the road and invest in managing your money.

Tracking

Net worth isn’t something you should necessarily obsess over, but it’s a helpful number to know when thinking about your overall finances especially if you are planning on making a big purchase, planning a trip or have a few goals in mind when paying off debt. The more you can become comfortable handling finances, talking about it with family, destroying the taboo of money, the wealthier you will be.

If you don’t feel comfortable with something, you won’t get better at it and foster that relationship.

Money is all a relationship.

Don’t hate or love it, use it as a tool to help you grow.

Investor Sentiment

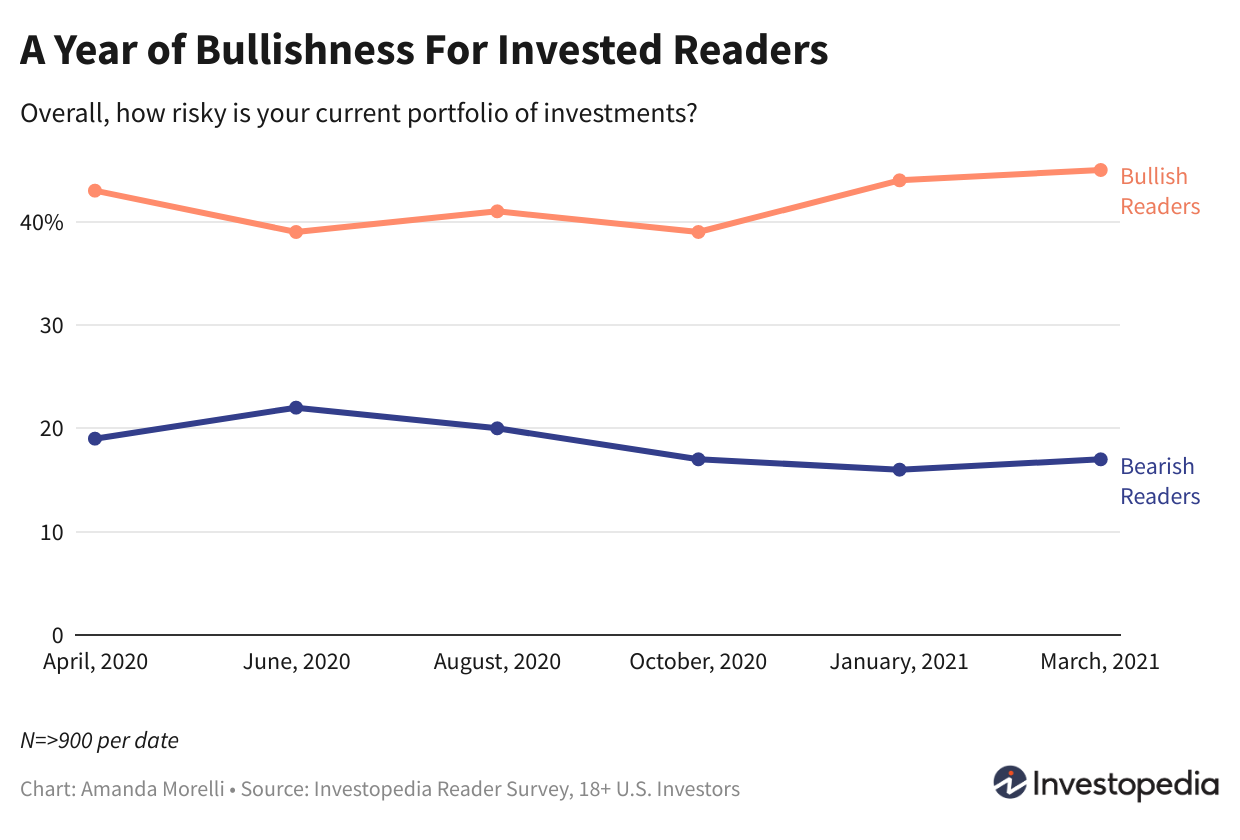

Exactly one year into the pandemic as I opened up Zoom for the first time in March 2020 and dusted off my childhood desk, it is reassuring to hear that most Americans are the most bullish they’ve been in 11 months, according to Investopedia’s most recent survey of newsletter readers.

Compared to the start of the pandemic when the world was flipped upside down as WFH was brought into our lives, uncertainty loomed and stimulus wasn’t in the picture yet, everything was unpredictable which caused stocks to tank and investors pooling out their money ASAP to be invested in safe haven assets such as bonds, not equity like stocks since they’re more volatile.

This lead the FED and 10-year treasury and bond yields to steepen down in order for bonds to become more attractive. Remember, the FED is on our side. They make borrowing more affordable during times of crisis..

Lower interest rates = easier time to borrow = more cash holdings =bonds = more expensive = lower inflation = lower mortgages.

Everything = cheaper!

By the Numbers

Nearly half (45%) of our actively-invested U.S. investors, who have portfolios ranging in size from less than $100,000 to $1 million, say they are bullish today, up from 39% in Oct. 2020.

This aligns with expectations for the future, as 70% of Americans do anticipate gains for the S&P 500 over the next 12 months with rising interest rates, a more stable economy, unemployment ticking down, the 1.9 trillion dollar stimulus rollout and overall positive sentiment about herd immunity with Biden declaring there will be enough vaccines for every American by May.

Risk Profile

With more bullishness, comes more risk taking with 33% of survey respondents saying they are making riskier trades, up from 27% in April 2020.

Only 22% say they are planning to play it safer with their portfolios in 2021, compared to April 2020, when 41% of our readers said they were making more safe moves given the uncertainty.

Should You Be Worried?

Thirty-percent of investors said they are not worried at all, while 21% were at least “moderately worried,” down from 39% one year ago.

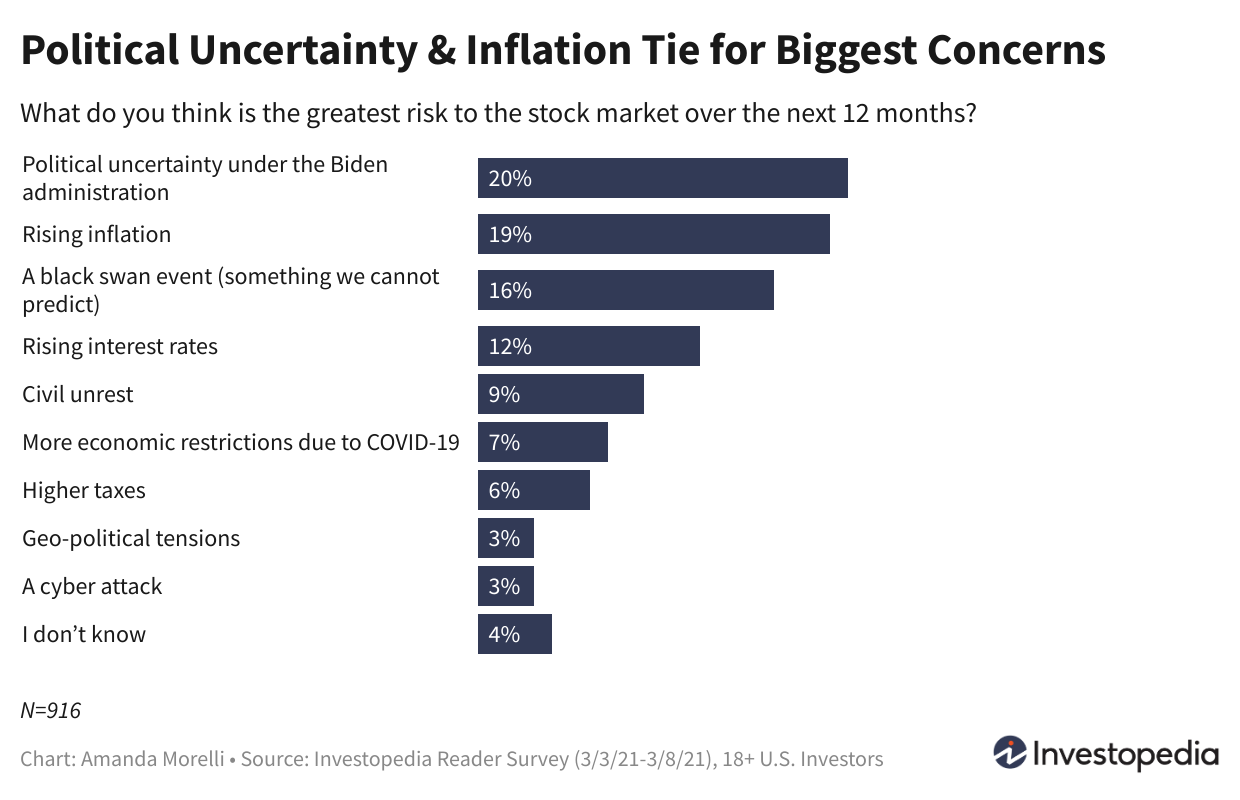

Those repsondeants who are concerned said the greatest risks facing investments are political uncertainty under the Biden administration and rising inflation.

Hot Securities At the Moment

Stocks and ETFs continue to be the top picks although more investors have been investing in cryptocurrency compared to in the past 12 months and the new rise of NFTs through gaming and the arts is coming out hot.

Although I’m not a fan of BitCoin or Blockchain due to no regulation and volatility, 62% think Bitcoin is in a bubble as well. That compares to 38% who think SPACs (blank-check companies with pooled money) represent the biggest bubble, 27% who think U.S. equities are frothy, and 30% who think real estate is in a bubble.

Net Worth Breakdown

After understanding investor sentiment these days, let’s understand how to grow net worth through the stock market. Obviously, the best way to grow consistent wealth is through a low cost index fund or ETF that traks the market or small caps that are undervalued. There’s no real upfront cost and with a few dollars you can buy fractional shares.

But with the average American with $90,460 of debt, it can be difficult to be focused on investing.

The age old question is, “should I pay off debt or invest?”

Do both!

Investing will help you get there.

Savings + investing are your best bets to growing wealth.

Until you pay off debt, compounding interest won’t work for you.

How to Calculate Net Worth

Although finance can seem confusing, net worth is a relatively basic formula that even a elementary school kid should know.

To figure out your net worth, simply add up your assets (the cash you’ve got in bank accounts, investments, retirement accounts, etc. as well as the value of any properties you own) and then subtract any liabilities (debt, including student loans, credit card, your mortgage, etc.) that you owe.

Net worth = Assets — Liabilities.

That’s it folks! Not as scary as you thought ugh?

Recommended Net Worth Allocation By Age

Age is a powerful indicator of the proper allocation you should have towards stocks and bonds. If you had 100% in your investment allocation in stocks during the Housing Crisis of ‘08-’09 and wanted to retire by 2010, then you would’ve most likely gone bankrupt unless you kept your job and primary residence.

That’s why cash is on your side and more conservative bonds are key, even when you are young so you don’t have to start your investing journey all over again and wipe out your gains from age 10.

Knowing your risk tolerance, age, time horizon, short and long term goals are crucial to building net worth.

Since financial recessions/black swans historically happen every 5–10 years, it’s crucial to plan for the future.

During the last financial crisis, the median net worth in 2010 plunged by 39% to $77,300 from a. high of $136,400 in 2007 . This highlights that a record number of Americans aren’t diversified enough and aren’t building wealth outside of their primary residence which is a must to becoming financially independent.

Keeping your emotions through investing FOMO at bay along with understanding that you aren’t smarter than the market will come to your advantage. You can’t beat the market but you can be prepared for it.

Recommended Net Worth by Age

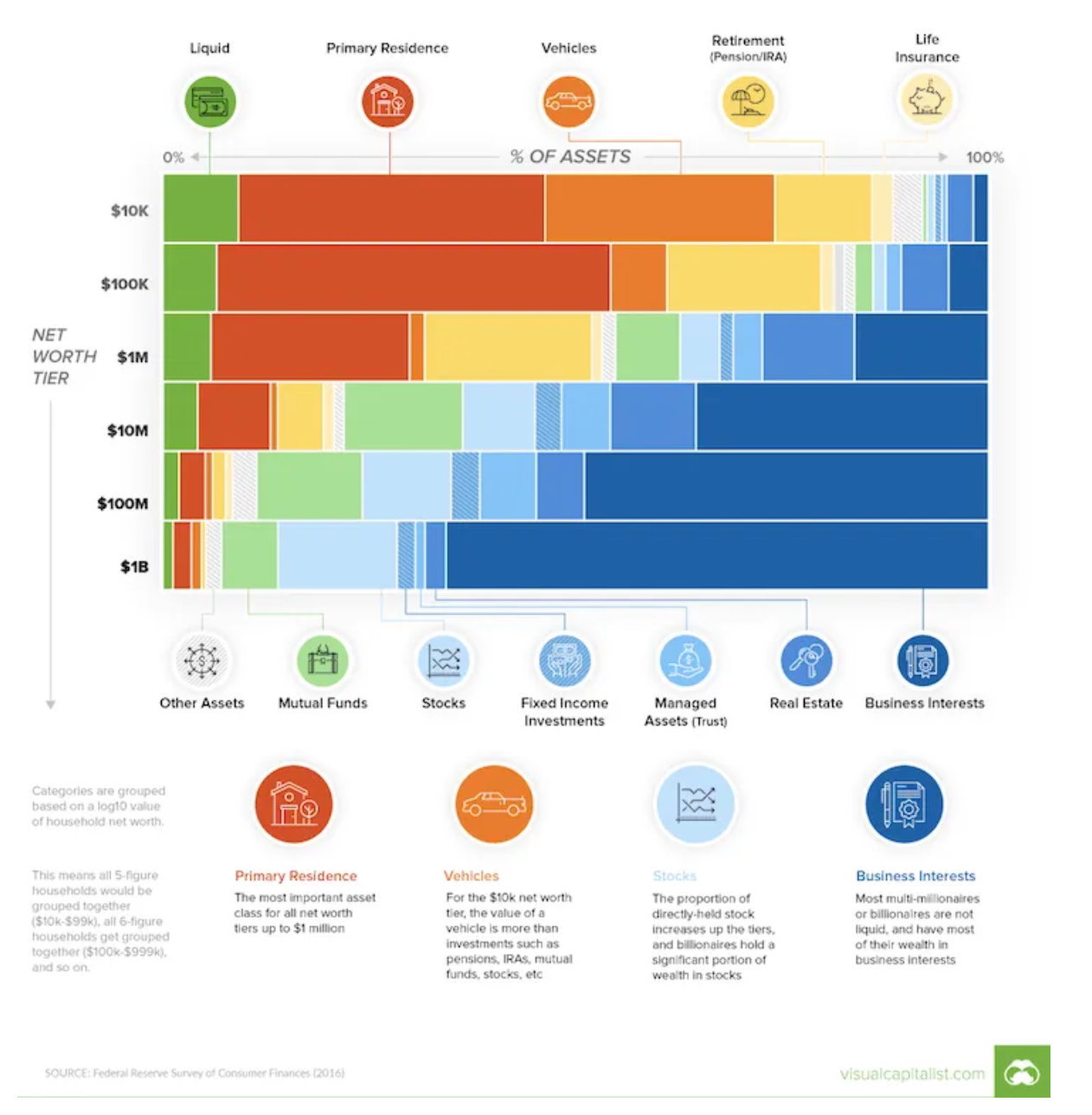

First off, with the average American having 90%+ of their net worth tied to their primary residence, this is a dangerous move. It means most Americans aren’t actively investing in other asset classes. I would personally limit no more than 60% of your net worth to real estate and ideally 40%.

Take a look below at where American’s builds their wealth from:

The net worth composite by levels of wealth mostly reside in business and real estate, the wealthier you get. For the lower to middle class, income mostly resides in 1–2 sources, primary residence and their main job.

The Average Net Worth By Age in America

According to the latest Federal Reserve’s Triennial Consumer Finance Survey available, the average net worth for the following ages are:

Under 35: $76,200

35–44: $288,700

45–54: $727,500

55–64: $1,167,400

65–74: $1,066,000

75+: $1,067,000

I wouldn’t say these are bad, but considering the average debt load an American carries of roughly $70k, this is not a lot to get by in America.

When it comes to retirement, living off of $10k is tough. The ideal retirement net worth would be $10m.

But it’s also important to note that these average net worth numbers are skewed by the super rich who have generated an enormous amount of wealth since the financial crisis so they are actually lower.

Remember, this is an average, a 35 year old living in NYC would live very uncomfortably on this budget.

Building your nest egg early on focusing on tangible diversified assets from real estate to stocks are crucial to building financial independence, freedom and not be beholden to debt, liabilities, the bank or worst of all, the government through the IRA.

Feeling rich is a sense of freedom. Anyone can achieve it with a goal and diligent plan.