With Biden’s plan to pump $1.9 trillion into the economy for the road to recovery, there are a plethora of reasons America is in desperate need for this help, a second time around.

From education to small business relief, help is finally on the way after the previous administration wasn’t able to focus its attention on boosting the vaccine rollout or the stimulus package to help those truly desperate.

Yet, as with the last package that was passed at the start of 2020, there were millions of Americans who received their checks that didn’t really need them!

Nearly 6 out of 10 Americans, or 59% stated that as soon as they received their stimulus checks in the mail last year, they used their money to pay household bills, pay off toxic debt such as credit card debt and student loans and of course, with the lead up to the trading frenzy at the start of this year, a record number of brokerage accounts have been opened as well.

If you guessed how Americans spent their $1200 stimulus checks last year, your answer probably would’ve looked like this: food, utilities, personal care, housing, debt a.k.a necessities which did actually happen yet according to the NY Federal Reserve, only 29% of Americans spent their stimulus checks on consumption.

Here are the results:

Consumption: 29%

Savings: 36%

Debt Repayment: 35%

This entails good and bad news.

Bad News:

-Wealth isn’t evenly distributed

-People relied on their stimulus to get a boost in income instead of supplying their skills towards the economy

-Wealth gap has only divided

Good News:

-Promoting ‘cash is king’ sentiment

-Boost in discretionary good spending and supplemental income

-Emergency savings attention

Compared to those who were unemployed, they spent their 2020 stimulus checks as the following:

Consumption: 29%

Savings: 23%

Debt Repayment: 48%

Compared to the employed, consumption on goods and services didn’t change, savings went down and debt repayment only went up!

So why are checks going out to those who don’t need them?

The richer you are, the more opportunities you have to contact lawyers, accountants and let’s just say, get your way with things a bit easier.

You have more opportunities to deduct your expenses towards your business and quality them as losses.

Also, many businesses have tax shelters/haves and money launder (hide their money) in the Bahamas where they pay 0% corporate tax on billions of dollars leading them to qualify.

Second Wave

Since the second stimulus package of $1.9 trillion was passed on March 10th by the House for one final vote, checks should hit Americans’ bank accounts (those who need it) by next Tuesday, March 16th.

Here’s the breakdown of how Americans, unemployed and employed plan on spending their money this time:

Consumption: 24%

Saving: 45%

Debt Repayment: 31%

Savings is up as spending has decreased.

This could be for several reasons including:

-People are finally learning the importance of having a cash cushion, preferably roughly 20% of one’s net worth in case of emergencies

-Paying off debt (principle and rising interest is key) to becoming financially free

-The importance of financial literacy and investing in one self pays dividends for a lifetime-having patience is key, it won’t come right away

Breakdown of Second Stimulus

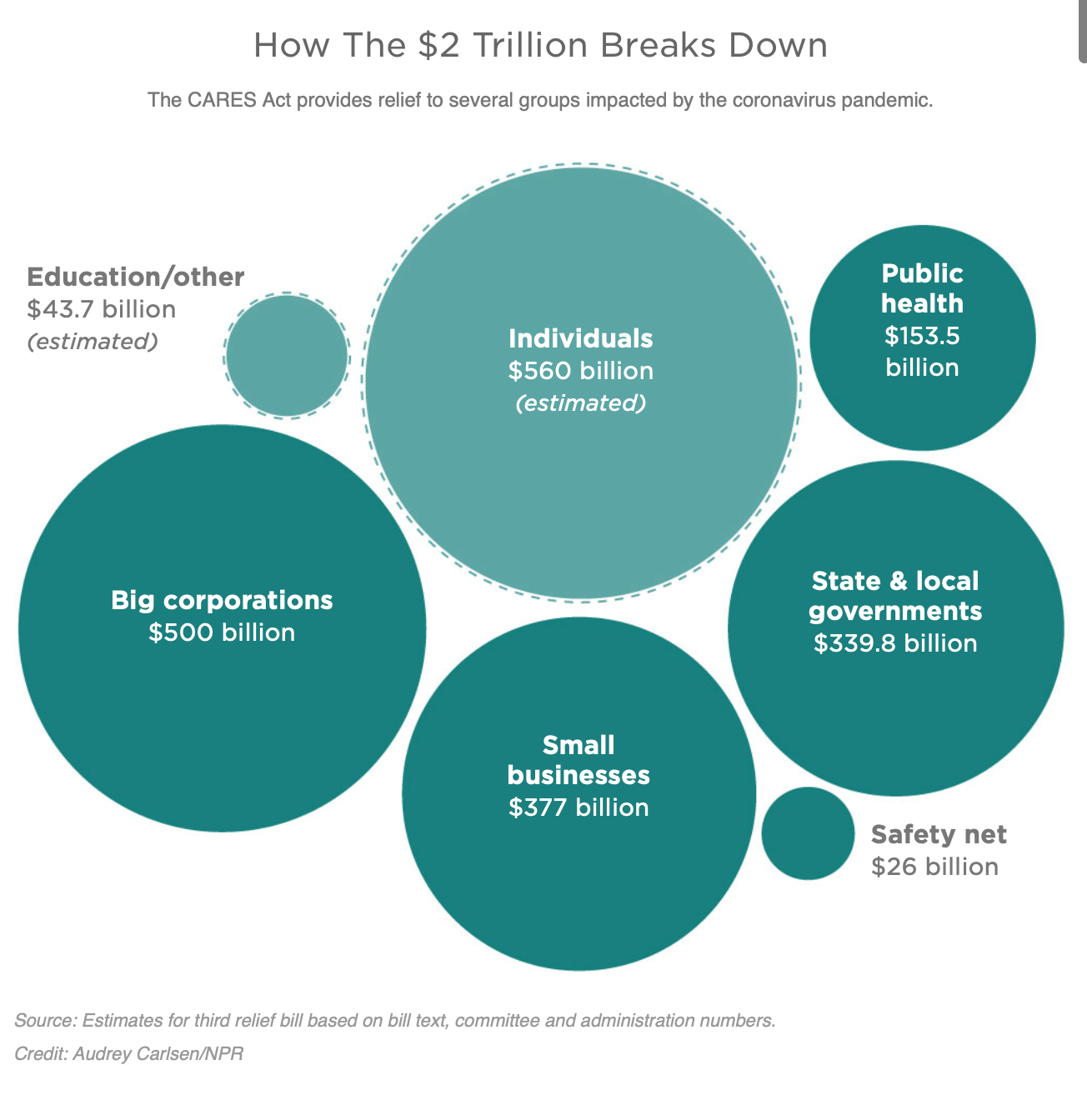

Strangely, big corporations and mega cap companies (market cap> $200 billion) take up a larger share of the relief than smaller businesses on Main Street, even though they need less help.

There are roughly 300 million small businesses in this country and 1 out of 9 have closed permanently due to the pandemic while only 5% of big C-suites have shut down.

This is all related to the stark difference of Wall Street vs Main Street as the wealth gap has surged as the richest 1% have amassed over $1.5 trillion in net worth as 10m+ are unemployed without work for 6+ months.

Although small businesses are still struggling and inflation fears are rising which leads owners to become fearful of laying off workers due to an increase in minimum wage, I believe there will be a true comeback for the hardest hit industries of leisure, hospitality and tourism as people will be flocking to them due to the their massive cabin fever ache through the pandemic.

Although I believe companies will price gauge due to a loss of revenue from the past year, people are willing to pay the price to support businesses and live life again.

So What’s In It For You?

Whether you are a college student or a family earning the base amount to become qualified to receive stimulus, understanding and having a game plan is crucial whenever expecting a large sum of money to hit the account.

Just like winning the lottery or signing a sports/endorsement deal, there’s a reason why 90%+ of those who earn lump sums right away go bankrupt within a year.

They don’t know how to handle that extoradirnary amount of money!

Just as your net worth increases with age (read here), so does your spending.

You fall into the trap of an inflationary lifestyle. I don’t blame you, earning more feels enticing and you should congratulate yourself by spending to have a better existence yet that is a dangerous trap to fall into especially after you realize down the road how many opportunities you missed out on in the markets to real estate by purchasing depreciating goods that take up dust and loose value instead.

Yet positive anticipation from surveys indicate that Americans plan on spending less with these checks and saving more building up their cash cushion.

These are hopeful signs that Americans are willing to become more financial literate and responsible.

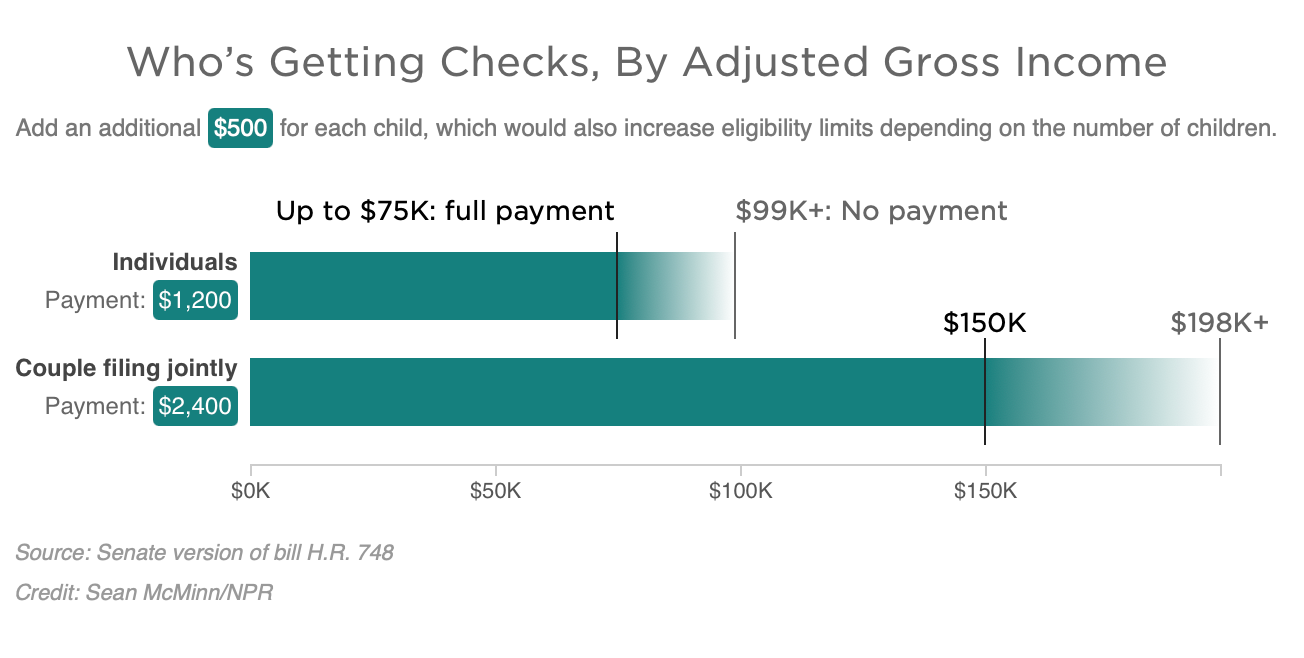

Cash Payments By the Books

The total payment to all Americans is roughly $300 billion.

Most individuals earning less than $75,000 can expect a one-time cash payment of $1,200.

Married couples would each receive a check and families would get $500 per child.

That means a family of four earning less than $150,000 can expect $3,400.

The checks start to phase down after that and disappear completely for people making more than $99,000 and couples making more than $198,000.

Freelancers or Gig Workers (Entrepreneur/Self-Employed)

Typically, they people cannot apply for unemployment. This bill creates a new, temporary Pandemic Unemployment Assistance program through the end of this year to help people who lose work as a direct result of the public health emergency.

Students + Debt

If you’re working as a student and earning a salary, employers can provide up to $5,250 in tax-free student loan repayment benefits.

College Drop Out Due To Covid

Students who dropped out of school as a result of the coronavirus wouldn’t have that time away from school deducted from their lifetime limits on subsidized loan and Pell Grant eligibility. Those students would also not be asked to pay back any grants or other aid they’ve already received.

By Age

People 25–34 plan on investing half of their stimulus checks in stocks according to a survey form Deutsche Bank. This is reassuring as 80%+ Americans are financially illiterate and there’s no better time to start building your wealth than in your 20’s.

Time is your most precious asset and on your side!

As we’ve seen at the start of the 2021 with the trading frenzy between Robinhood and hedge funds, most notably Melvin Capital who lost more than 50% in January down $4.5 billion after the surge in unprofitable stocks most notably, GameStop, AMC and BlackBerry, expected to flop are now worth a couple billion for no apparent reason, having a diversified portfolio and at least 40% of your holdings passively traded is always a must.

Currently 20% of the activity in the stock market is directed by retail traders, most notably due to the stimulus surge.

By Market Sector

Young people are planning to put half of any forth coming stimulus checks directly into equities and for 18–24 year olds it was slightly lower at 40% as they are relatively young to become part of this gambling world just yet!

At age 20, trading becomes a hit and the most popular time to invest.

My Plan + Recommendation For You

Through my brief experience as a day trader when I first started out in economic’s class in middle school, I soon got out.

It was too risky, waste of my time, caused headaches and I’ve always lost more than I’ve gained. Plus, investing FOMO is the worst kind of feeling. You always feel you’ve never gotten in or out at the right time. And don’t even get me started on options or derivates.

Who can predict that a movie theatre on the brink of its 5th bankruptcy will surge 400%?

No one can justify active investing and this is all “GAMESTOPPABLE”.

No matter how much experience you have, it’s unpredictable.

But what is predictable is passive investing (read here). Historically, it consistently beats out active investing and provides a guaranteed return since the stock market always goes up.

Let’s say, if you invest in a low cost ETF from Vanguard or Fidelity that tracks the S&P 500, you will make roughly 6% each year.

Not bad considering there was little to no work not having to deal with intraday volatility as a day trader.

For the first time, college students classed as adult dependents will now be eligible for stimulus checks.

Yet, since I’m earning more than $75k after tax per year through my investments, real estate portfolio and intellectual property, I’m not eligible for the full $1,400.

My Recommendation

If I were you, I would firstly plan to pay off all liabilities then invest into the market. Yet just because you invest into the market, doesn’t mean it will go up or be a RoaringKitty hit.

No matter if you are 20 or 70, having an appropriate split between passive and active investments is crucial. As a rule of thumb, the younger you are, the more risk you can take because you have a longer time horizon to make up for the losses.

As a result, I currently have a split in my portfolio of 60% passive (index funds, ETFs, bonds, CDs etc.), 40% active investments (mutual funds, single name stocks) with most in growth and dividend stocks.

As I get older, I will readjust to 80% passive, 20% active as safe haven assets such as bonds will keep me more stable than high flying equities like stocks.

I would also suggest looking towards value stocks in small caps for growth.

Overall Sentiment

When it comes to Americans’ predictions, about 12% say it will take less than three months for their financial health to return to pre-pandemic levels.

On the other hand, 41% estimate it will take over a year.

“It is very encouraging to see that nearly all U.S. consumers believe that the government’s latest round of stimulus checks will help them improve their own financial health in the coming year,” Kreyenhagen, Doxo’s Vice president of marketing and consumer services says.

I’m very hopeful that this stimulus rollout will lead the American economy close to its pre-pandemic levels and allow it to recover smoothly.

Of course, it will take a few more years until hard hit industries will recover, yet with the strong American economy and faith, I believe this will be easier than expected.

In the meantime, set up a game plan, make sure to file for unemployment here and stay safe.

The light is at the end of the tunnel.