My rule of thumb is to never have more than 20% of your capital or net worth in 1 investment or asset class. If you do, expect to become toast. Eventually.

Just like there should never be a need for someone to pressure you to spend money, there should be absolutely no reason, no matter how young and lucky you may be to have too much exposure into 1 thing.

Diversification is essential in life because, at the end of the day, we cannot be reliant on anyone except for ourselves.

Every recession, downturn, and ounce of volatility reminds us of how important it is to only be dependent on ourselves, not only the markets, teachers, primary income source, or partners.

As easy as it may be to be cruising and living lifestyle inflation creep with a high-paying six-figure salary, nothing lasts forever. Or although it may be convenient for you to rely on your partner to pay the bills and keep 4 humans alive, it isn’t safe nor prudent.

Don’t gamble with your life. You only have 1 so provide yourself the backup it needs.

That’s my little pep talk before I get into the speculative, volatile, non-regulated, non-asset class world of crypto. I’m not here to bash crypto since I believe OpenSea within the NFT art world and Masterworks which is a public company that offers publicly traded artwork that the SEC qualifies is a store of value in itself as it represents value, scarcity, and ownership yet when it comes to crypto on its own, it’s simply too risky to just hold onto. As a $2T asset class, it isn’t nearly as safe as other asset classes.

At least NFTs (non-fungible tokens) cannot be replaced or replicated as digitalized artwork associated with a piece of code. They come from something we know: art. No matter if its Bored Ape Club or a $69m Beeple collage, there’s always a price to be paid for art since it is a store of value, preservation strategy, offers utility, and someone is always willing to get their sticky fingers on it and pay double than what it is really worth.

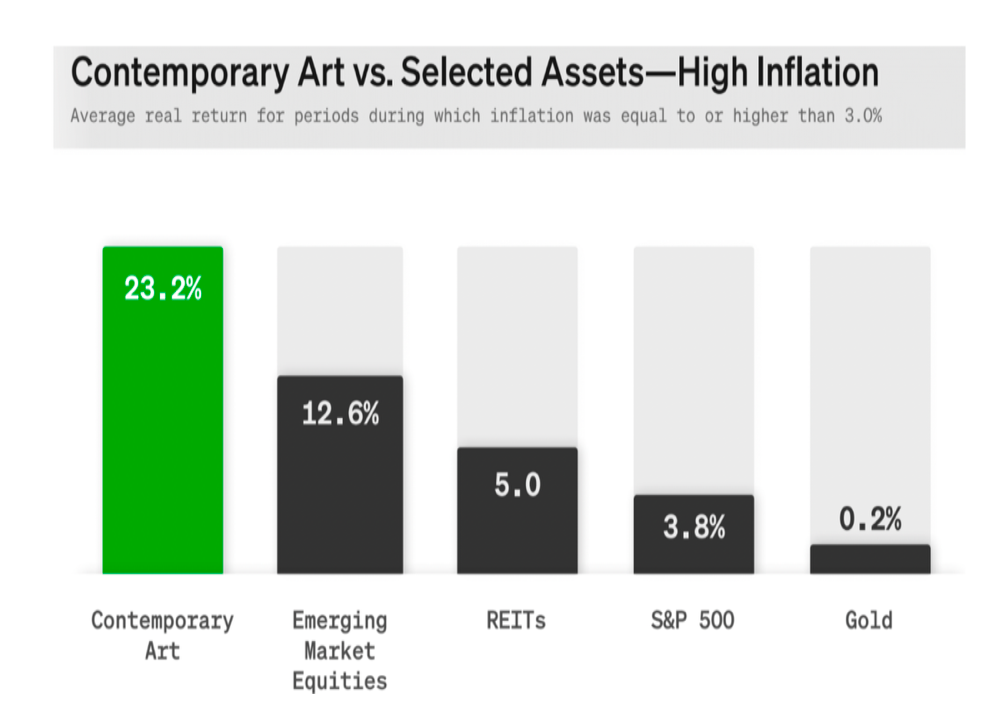

If you want a real store of value and inflation hedge alongside my favorite asset class, real estate, alternative assets and artwork are favorable.

From 1995 till 2021, digitalized and physical contemporary artwork has balooned while still seen as a secure store of value:

On the other hand although crypto has been around since 2009, it is advised by wealth managers to have no more than 2–5% of crypto in your investment accounts since it isn’t something you can live off of. It is unstable, not considered an asset class by many, speculative, volatile, and not regulated. All that might change once regulations and the U.S. central bank establishes a digital currency yet the implications on consumer spending, financial stability, and national security may pose a risk but that’s a story for another day.

In order to create the future, we must create it but we also have to sleep tonight.

Don’t go over your head or conflate brains with a bull market. Many outperformed last year in the markets. It wasn’t really due to skill or expertise, rather luck and timing transitioning past March 2020 lows. Now we must buckle down and be serious about how our money is being put to work.

Why Crypto Isn’t A Hedge

Luckily, if you follow my capital preservation rule and believe cash is king, this is a great time to use your cash on the sidelines and buy into the speculative expensive at-home pandemic accelerated trades and Big Tech that have fallen 50–80% in the last year!

Deep discounts are rare. Always have cash on hand to buy into opportunities that you know have a better chance of going up later on. If you’re planning on retiring, now may be the worst time at the top of a bear market with stagflation worries along with a possible recession next year. Luckily if you lower your withdrawal rate and pick up supplemental income streams, you will be able to eliminate the loss of your capital in the market and it won’t hurt so bad any more. Through dollar-cost-averaging every time there’s a 2–5, 10–12% drop if your brokerage doesn’t charge any commissions, go ahead and buy a few shares before the momentum picks up again.

Back to crypto, nowadays with the the 10 yr Treasury yield retreating to lower levels below 2% with investors retreating to safe haven assets such as money-market funds, U.S government bonds, Treasury securities, and liquid and cash equivalents, shouldn’t crypto be rising to fame?

Wasn’t 2022 made for crypto as equities get hammered? Instead of acting as a store of value and following its non-correlated ways, it acts like every other asset class in the market right now, plummeting in value. Since more cyclical stock such as tech and biopharma tend have an overreliance on short-term borrowing rates to project future cash flows, with rising interest rates set to be enforced today, March 16th 2022, the market is pricing in a tougher time for riskier assets, including cryptocurrency.

Crypto has been in the spotlight for plummeting since it isn’t used for necessary and everyday transactions yet. Plus the fact that it is falling typically makes it fall further. In Ukraine, they are asking for donations in Bitcoin which is one way to help the world inside of mining and wasting energy through the digital coin. Yet cryptocurrency isn’t a hedge against inflation since it doesn’t replace the dollar’s purchasing power. Though that may soon change as the Biden administration plans on taking a wider stance on crypto looking to develop its own digital currency for the central bank along with adding regulations to it which can in fact help spread its use to democratize it even further so it won’t just be for those willing to spend ~$40k a coin. It acts as a volatile asset as any other security, not proving its worth in times of need.

Crypto Craze

If you are still crazy about crypto despite all I said above, realize you are not alone. The exposure effect makes us humans want something even more so lets get straight into it before you start buying coins and blaming me.

If you are audacious enough and want exposure into crypto while still staying sane and stable, you’re in luck.

Here are some advantageous ways to gain exposure without soaring and flying back down from the moon:

-Invest in companies that hold bitcoin in their balance sheets-Tesla, MicroStrategy-BTC owned: $3.4bn

-Grayscale-Asset Mgmt specializes in digital currencies

-eToro platform-decrypters of crypto and digital assets

-Invest in crypto trading platforms not necessarily use them-as crypto prominence grows, volume benefits brokerages = tick in stock price and Q earnings

-Blockchain ETFs-offer exposure to bitcoins snd other blockchain companies

Blockchain ETF-track performance of companies developing or stand to benefit from blockchain technology

-Earn bitcoin as a payback-reward as you shop e.g. at Shake Shack

-Crypto credit cards e.g. SoFi crypto card crypto cash back

If it seems too good to be true, it usually is. Although crypto is credible, it is extremely popular with no IRR and based on speculation which makes it susceptible to downturns.

As a result, it is even more unpredictable as a source of entertainment and kind of social movement promoted by retail trades and billionaires.

As with everything, if you don’t understand its use or firmly believe in it, it’s worth the wait but doesn’t mean you can’t try it to fit your level of comfort.