Never thought that not having enough hours to work would be a problem but here we are!

Although 4 hour work weeks seem nice, they can get boring quick if you’re unwilling to become uncomfortable and grow additional passive income streams.

My fellow colleagues in college are facing a good problem. They have too many options to live a comfortable life and are having trouble with splitting their time. But in all honesty, it is a true hassle since no one wants to get hired to not work. We all want a meaning and drive in life and this includes having something to do!

Luckily in this gig entrepreneurial hustle economy, Millennials and Gen Zers have it their way. Since the pandemic began, over 400k more Americans became self-employed to a total of 10 million+.

We are living through the hottest and tightest labor market on record where our time is back in our hands. The job market just added close to 690k jobs in January, employers are offering pumped-up cash bonuses, performance pay salaries, stock options, vacations, and hybrid lifestyles. You name it, it’s coming for ya. We’re in demand and considered top talent!

We have more freedom and flexibility than ever before and as a result, we are in the driver’s seat in deciding our lifestyles. It’s empowering to know fresh graduates have a say in how much they are worth.

Millennials have experienced a variety of pivotal moments such as 9/11, the 08 Housing Crisis, the Great Recession in 2020, and the brief recession at the start of the pandemic from Feb-March 2020. These events made them vulnerable to financial insecurity and more indebted than any other generation. Luckily, the stock market roared past March 2020 on pent-up demand and optimism and it was hard to lose money the past 2 years. Yet it’s important to never get too complacent with the markets, believe you are smarter than it, or conflate brains with a bull market. History teaches helpful lessons for the future but isn’t guaranteed to repeat in the same way.

Yet with too many choices on the table, comes regret and now the contemplation of quitting. It is contagious and people cannot make up their minds. This is certainly harmful since nothing will ever feel perfect since we are always comparing each position to the last position or the next. This will cause regret forever.

No matter what projects, side-hustles, jobs, ventures, hobbies you chose to tackle, what must always be considered is diversification. Not putting your eggs in 1 basket is a lifesaver.

Diversification is key for stability, capital preservation, maturity, mental sanity, freedom, and flexibility.

After all, wealth is a function not of what you earn but what you save.

Keep It Grounded

If everything hits the fan, at least we have our emergency savings (equiv to 6–12 months of living expenses), investments, and passive income sources to keep us afloat. Our investments are here for us in times of need and above all, they should be top of mind when it comes to diversification and safety. The average millionaire has 5–10 passive income sources for this reason and knows how to plan for the worst, hope for the best.

With growing fears of a possible recession, ~20% chance according to BofA on the horizon due to the oil price shocks and rising rates, hopefully, the Fed will be able to cool inflation and alleviate the supply chain without causing a wrong turn. National savings rates are already plummeting after a 40% high in 2020.

With a job, stick to the facts, not the title or image because it can make or break your chances when it comes to your finances, particularly when securing the largest financial decision of your life: buying a home. Building equity in a home requires you to not only allocate the suggested ~20% cash downpayment but if you’re like most Americans who cut that number in half and don’t officially own their home until 30 years later tied to a 30 yr fixed-rate mortgage, it’s important to remember how your career will be viewed by lenders.

The surprising observation is that they don’t care how well-off you may be at the moment. They focus on your recurring future cash flows and stable income streams to confirm you won’t default later on.

Although working for oneself is probably ideal by most for obvious reasons such as work-life balance, leverage over earnings potential, control over time, no commute, hierarchy, office politics, etc., it can make your life much harder.

For example, those who are self-employed don’t receive the prized benefits of PTO, health or dental insurance, parental/maternal leave, an HSA plan, employer qualified tax-deferred 401(k), 503(b), or any tax-advantaged retirement plan, various perks such as free food, housing, travel, community, or commuting reimbursements and more from working for a company that can be true deal breakers in the long-run.

The mortgage lending industry views self-employed borrowers as less successful and not stable despite having control over their earnings. Even if you’ve been a successful YouTuber making a top 1% income above $1m each year for the past decade and dabble in various other ventures such as advertisements, social media endorsements, and promotions, e-commerce, or possible crypto campaigns, you are still seen as less reliable to banks and loan officers since you aren’t working at a stable company.

To me the rules sound a bit off considering one has more leverage over their earnings working on their own (more hours = more earnings) and with an impressive annual salary of $1m, that can take a few decades to reach at a company. Yet to issuers (investors), they aren’t fooled by the lump sum since it won’t guarantee stability in the future, something Gen Zers must consider before dreaming of becoming the next David Dobrik.

In terms of your portfolio, while you only have so much control since what’s certain is uncertainty in the volatile world of markets, you can evaluate how much exposure you have to riskier and less Western countries. While exposure to emerging markets, specifically with Russia and China may be hurting our portfolios and we may not even know it, at least we have our home country bias as investors to keep us safe. The U.S. has the strongest economy in the world and although inflation is hurting margins, for many businesses, it is benefitting them, especially those that aren’t reliant on production and operation through manufacturing and facilities.

The U.S. believes in itself so much that investors here have a 75% domestic equity allocation of total equity. After all, being biased is good in this case as the U.S. has the most defensible and strongest military plus with the strength of our currency and economy, it’s okay to have a large leaning on domestic equities. I wouldn’t be able to sleep at night having my ruble currency depreciate by 40% as the Mosco Stock Market closed for weeks. Russia is headed into a depression in no time with the U.S. pulling the plug, freezing assets, retailers pausing and suspending operations, oligarchs fleeing, selling their assets and sports teams, cutting off crypto transactions, and Big Tech blocking Russia propaganda and state media.

Despite Russia controlling an enormous amount of land and having one of the world’s largest populations, they cannot seem to function on their own even as the largest producer and exporter of oil, natural gas, and commodities. Their economic output is relatively small as GDP is below average and exports take up 50% of its GDP in aggregate. Since the onset of the invasion, traders have been reluctant to trade Russian commodities despite the surge and there have been lower levels of liquidity citing emerging markets pose an equity risk premium concern.

During times of crisis, although the adage what’s certain is uncertainty is at the extreme and negative interest rates are still around, cash will always be king. It’s better to be safe than sorry. Are you willing to risk everything for a higher return or more guaranteed lower return? I always go with the latter.

Speaking of guaranteed return, I Savings Bonds issued by the Treasury Dept, currently pay 7.12% interest. That’s not a typo. Similar to TIPS (Treasury Inflation-Protected Securities), the principle value adjusts with inflation so your liquid investments aren’t totally bust. In addition to these, safe-haven assets such as currency-USD, gold-a counter-cyclical asset, money-market funds, and riskless Treasury bonds are bullet-proof. This is the least you can do to save your wallet and mind.

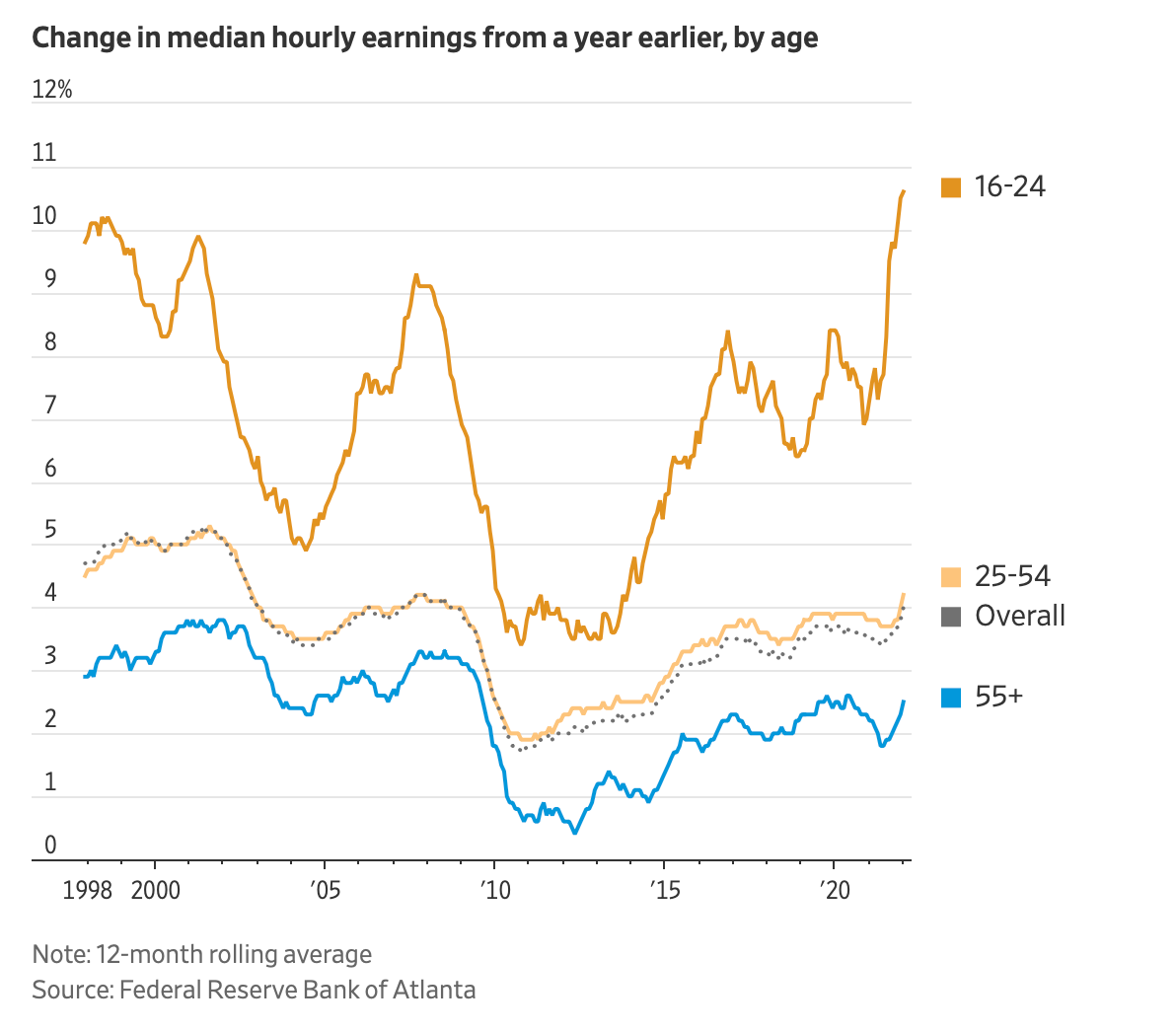

While we hope most businesses are engaged in the wage-price spiral as prices increase and wages follow, it is always advised to never be dependant on anyone except yourself. The share of young adults ages 16–24 looking for a job fell to a two-decade low while employers have also added incentives such as college tuition in signing bonuses. Thinking about the long-term may seem daunting especially when it comes to securing a job but it is part of an investor’s outlook that never falters that will keep you most secure which ends up paying the most later on.