I hadn’t heard of the concept of financialization prior to last semester when I enrolled in the course, “The Political Economy of Financialized Life”. To be frank, crypto, stable coins, dogecoin, meme stocks, GameStop, Black Berry, yes, Musk, and NFTs weren’t part of my lexicon either since last year. The sign of the times in itself is a free Masterclass!

The pandemic slipped in some extra time to become well-versed within the markets and Reddit. As a result, brokerages saw a record number of accounts opened and recorded quarterly record profits! At the moment, inflation, geopolitical concerns, and rising interest rates are top of mind.

Payment for order flow blew it out of the water while on the flip-slide, hedge funds, most notably Melvin Capital got bruised due to their inaccurate shorts against retail traders.

Yet, with a ~29% gain with dividends, individual investors won! I wouldn’t feel bad for hedgies either. Gabe Plotkin, the founder of Melvin still bought himself a nice $44 million Miami home while his fund was down more than ~50% last year. Although 2022 is down in the dumps with high-flying tech, at-home stocks, crypto currency, and meme stocks at their all-time lows, luckily with a capital preservation strategy and diversification throughout, nothing will stop you long-term.

Luckily, this course about financialization, yes it’s an actual word, was one of few that related to the real world and I was able to easily apply my knowledge directly to the new dawn of the internet, Web 3.0, the decentralized version of the internet where Big Apps, Tech and all things Silicon Valley are finally NOT in control anymore. Meta, a.k.a Facebook is feeling the heat already, the first company that recorded its largest one day drop last week ever. Web 2.0 put monopolies on a pedestal, Web 3.0 is wiping it.

In this day in age, although Big Tech (F(M)AANGs) portfolio is still intense and houses the new oil, a.k.a data that powers the world and kills us with ads, the internet is in for a remodel. It will witness a transformation all powered by blockchain.

Web 3.0 1.0 2.0

If 2021 had a name, I would call it the heaviest jargon year. Most investors and curious creatures including myself had not heard of half of what are now deemed the most powerful tools, assets, investments, and tangibles of all time.

Ring a bell?

I’m referring to crypto, blockchain, DeFi, NFTs, digital wallet, metaverse, Oculus, etc. etc. etc.

Lost yet? SNL’s skit on NFTs just made me more confused.

Not to worry though! If you don’t know WTF NFTs are, you can read here. All things volatility are changing by the day so don’t quote me on anything for that sake. Quote Elon instead. He probably caused the cataclysmic shift.

When I think of an Oculus, a.k.a digital headband, I immediately feel lethargic. Anyone else? Honestly though, the last I want to do is exercise with my digital avatar friends and release fake sweat. If I want to go bike riding, I will do it myself, not with Olympic avatars beating me in my living room. I’m concerned too much is moving online.

Anyone else with me? What should stay and what should be in-person? Right away, any form of natural movement.

Sometimes Big Tech goes too far. No kidding. It’s big after all.

Too Far?

Although future predictions for today’s world are nowhere close to where the Jetson’s believed we would be at this point, they tend to be way off like financial predictions. Making predictions is hard and it doesn’t have a great track record in itself. If there’s one thing to remember about the markets, it’s that what’s certain is uncertainty. If news, hopes, media moguls, or virtually anything relates back to a company, it WILL move regardless. It’s guaranteed. Thanks to capitalism, if investors don’t like what a company is up to, shareholders have the most power and will forcefully plummet the stock themselves. No wonder shareholder value is so strong. Look at what’s happening with Spotify as a relevant example. The CEO isn’t doing enough to censor the content so investors back out alongside creators.

Back to the metaverse, or forward? Who knows! Anyways, it’s worth a shot to better understand these technologies so we seem somewhat knowledgeable on this nascent universe the next time we strike up a conversation at a brunch in the metaverse with our avatar friends. Silence is awkward even there.

As mentioned earlier, Web 3.0 is a decentralized version of the internet built upon blockchain. It involves, well, decentralization, commodification, gamification, speculation and various business models that are built upon the core concept of crypto and an open-ledger, an open database where all financial deals and transactions are accessible by the public.

It is based on the model of openness. Since we were stuck at home for two years, maybe Web 3.0 drew inspiration from this!

It is powered by encryption on open ledgers and within all of this the creator economy comes alive, not ruled by big apps or as China calls them, super apps. Instead, creators have more of a say, power, and earnings potential. Built upon AI/VR and crypto, as a centralized entity, these apps are built and owned by their users.

NFTs a.k.a non-fungible tokens have become popularized in this world. Non-fungible means something cannot be replicated. An example includes a specific property and something fungible are dollar bills or shares of a company.

There Yet?

Within this idealized Wild West version of the internet, NFTs, crypto tokens and blockchain RULE. Digging deeper, DAOs also emerge. Have I lost you yet?

If you’re wondering if this universe has been created yet or in fruition, it’s a mix. This is a slow process considering no one as heard of crypto until 13 years later.

To become even more confused, DAOs are decentralized autonomous organizations. They are built with the intention to democratize corporate governance.

Why is this important?

Web 3.0 prioritizes solid databases on a decentralized network not static websites with too much control.

Big Tech is replaced by a decentralized ledger and all participation, organization, and transaction requires a wallet and participation to be a part of DAO organizations and vote. Nothing to be envious of yet.

Web 3.0 emphasizes scarcity instead of abundance or socialization with Web 2.0, the age of apps, Big Tech, and ads, too many ads.

Decentralization Nonsense

You may be asking yourself, why the heck is this important or relevant? I’ll be on Twitter for as long as it takes.

Decentralization in laymen terms entails revenge of power.

Centralization sounds bureaucratic. We are gearing for a meritocracy by gaining back power and control of our effort + value.

Although blockchain and crypto are known as the Wild West, they aren’t an entirely bad thing in this gig economy self-help side hustle entrepreneurial world. With millions venturing off on their own with the freedom and confidence to forge their own path, decentralization promises to get rid of the middle-man, brokerage, government, regulator i.e. SECC or bank to protect blockchain technology.

Side Kick

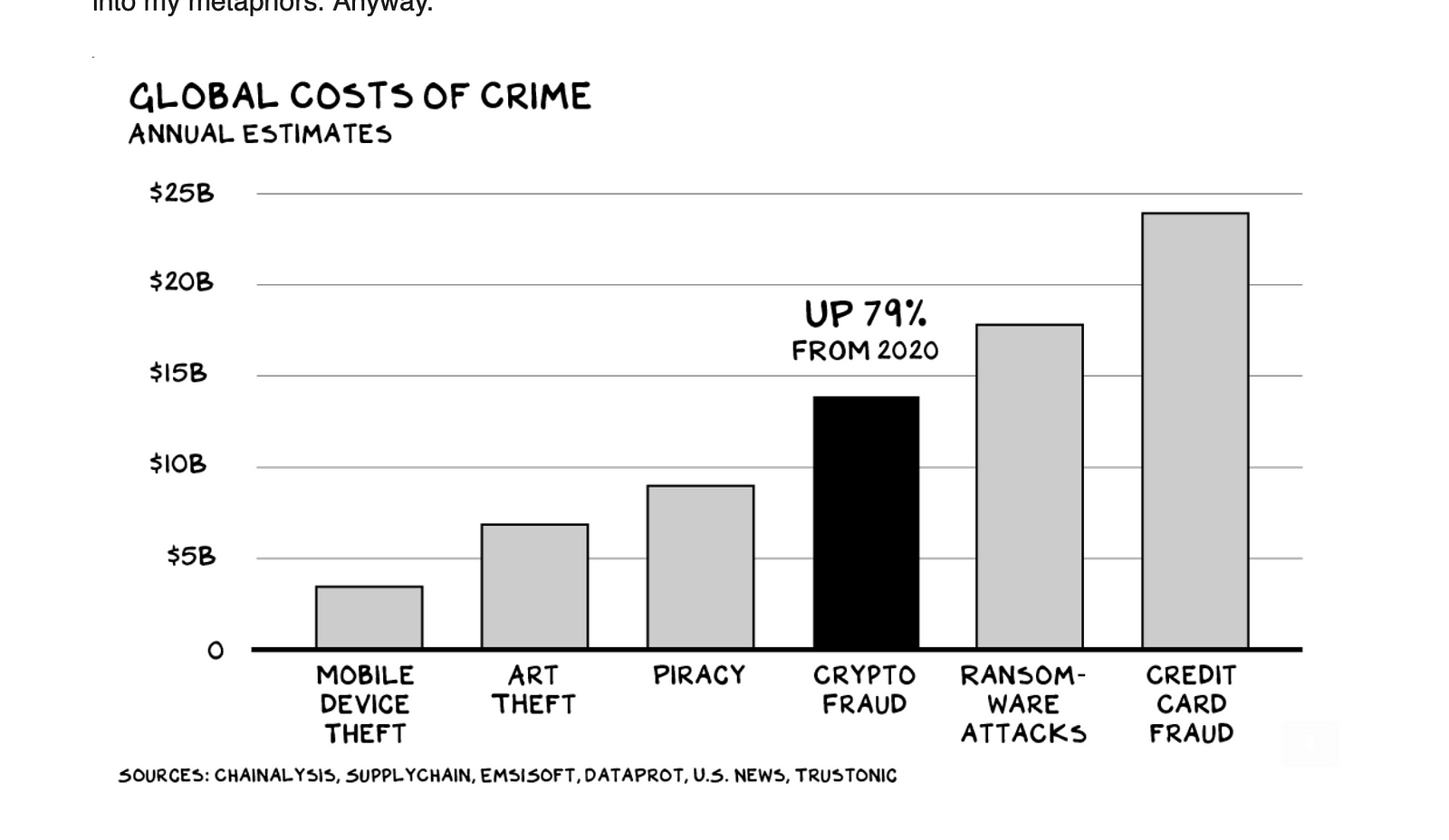

Yet no oversight or accountability creates a massive dilemma. Theft runs rampant on Web 3.0. Last year losses from crypto scam and thefts totaled $14 billion alone.

No more fetishizing big tech and media moguls that steal our data, but here’s a question: do they make our lives easier as a control person regulating conversations and blocking those who spread misinformation? Should other artists let their music go from Spotify? If anyone uses Parlor the social media app, I’m curious how it survives. An intermediary is usually necessary for a flourishing stable economy to thrive. Is China successful in this way? They sure are with covid but not with human rights. It’s moderation that counts.

Theft is the most pressing issue with crypto, ahead of piracy and art and mobile device theft leaving hefty damage nearing $25 billion expected in 2023.

Cryptocurrency alongside high-flying tech stocks and meme stocks have been ravaged this year, down ~50%+. Although cryptocurrency fame and usage is growing faster than ever as total transaction volume has surged to more than $15.8 trillion, up 560% from 2020’ totals yet with more volume causes more usage and opportunity for theft and scams.

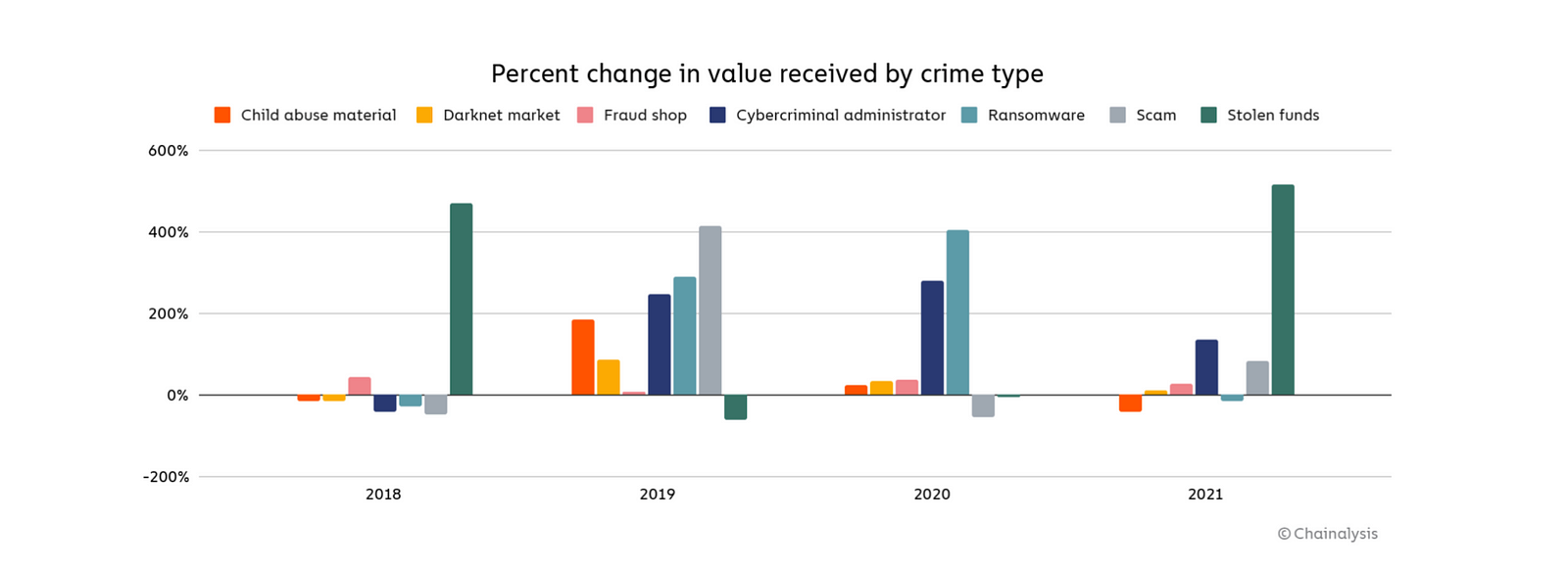

The two categories that stand out for crypto are stolen funds and scams that are most prominent in DeFi as well.

Crypto’s main concerns at the start of 2021 when it was touted as a game and get rich quick scheme opportunity was still of concern.

According to a Chainalaysis survey,

-67% of participants said price volatility

-56% who cited market cap

– 49% who said the regulatory environment

– 12% included the carbon footprint from Bitcoin and other cryptocurrencies for taking up heavy usage with mining with limited supply running out.

DeFi Now?

Whether or not you believe crypto is an asset class and by many financial institution’s standards it isn’t due to its painful price swings and unstable track record, it has still paved a new revolution in banking, DeFi, DECENTRALIZED FINANCE.

In simple terms it is turning traditional brokerage services such as trading, sales, and lending and automating them with software to be used as an open platform with the blockchain.

Built on the blockchain, this is a way to digitalize banking systems. This isn’t a product, service or part of a bank, in fact it is modernizing the way banking is done via the cloud and through public ledger with no intermediary or bank/central government gatekeeper involved, one of the main reasons crypto fanatics flock to the blockchain to be able to transact and trade crypto in real-time in seconds. There’s no intermediary controlling lending or exchange practices.

As opposed to a brokerage where you want to buy shares of a company with your advisor, they have their own private ledger that’s not open, similar to a dark pool.

DeFi transaction volume has grown 912% in 2021 returning stellar returns for decentralized tokens such as stablecoin, a digital coin pegged to the USD. Yet, beneath this leverage, rug pools, a scam where fake cryptocurrencies are made have become more prevalent and in 2020, over $162 million worth fo crypto was stolen from DeFi platforms and money laundering rose at 1,964% in the last year.

Blockchain and Web 3.0 are certainly burgeoning parts of DeFi.

Fight Against Crypto

Crypto-based criminal transactions hit a record $14 billion last year, up 79% from the year before, according to Chainalysis. Still, illicit transactions accounted for only 0.15% of all cryptocurrency transaction volume in 2021.

At the moment, Web 3.0, is the future of the web. More data means more security measures must be in place. Web 2.0 has lasted for roughly two decades but it is time to pivot. The creator and gig economy is here. FinTech is ready more than ever.

Although the name suggests the Web, version 3.0 is more stylish. It embodies the spirit of a new wave of security, tech, and meaning. Although resolving and taking down Big Tech is too big of a challenge right away, only time will tell how sensitive it really is. With higher interest rates expected, cyclical stocks are already shaking. As of now, Meta and the rest of the Big Tech gang seems troubled.