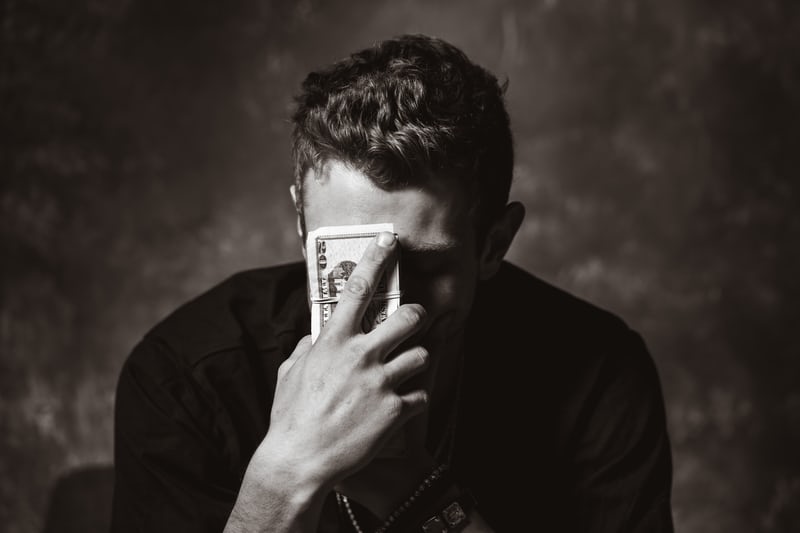

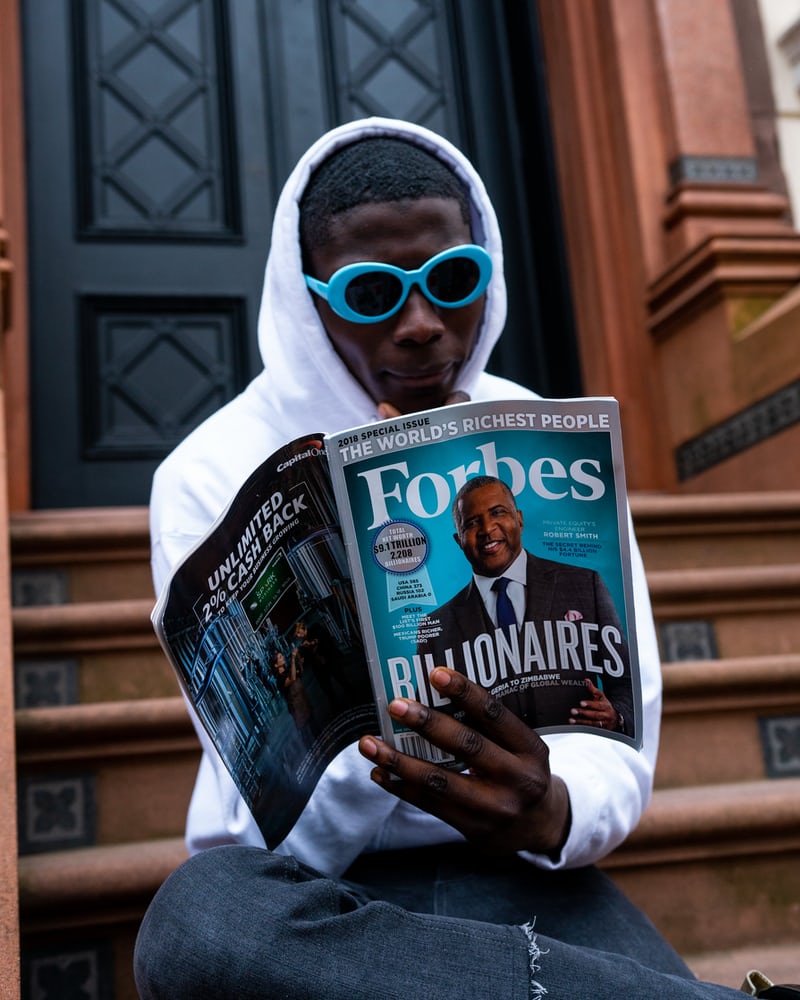

👘Why People Obsess Over Luxury Especially During Crises

Exclusivity and scarcity will forever be in demand. We are allured by prestige, image, and praise. We want more of it and it can never be enough. The problem is there’s always something we don’t have. Since birth, we craved attention from everyone. We want to be told we are the cutest baby in the […]

👘Why People Obsess Over Luxury Especially During Crises Read More »